“The four most dangerous words in investing are ‘this time it’s different.’” Said Sir John Templeton, indicating the historical trend that investors often identify “unprecedented opportunities” to invest in, only to find that history repeats itself often when said opportunities crash or end up mediocre. After all, since the most valuable company on earth, Apple, had an initial public offering …

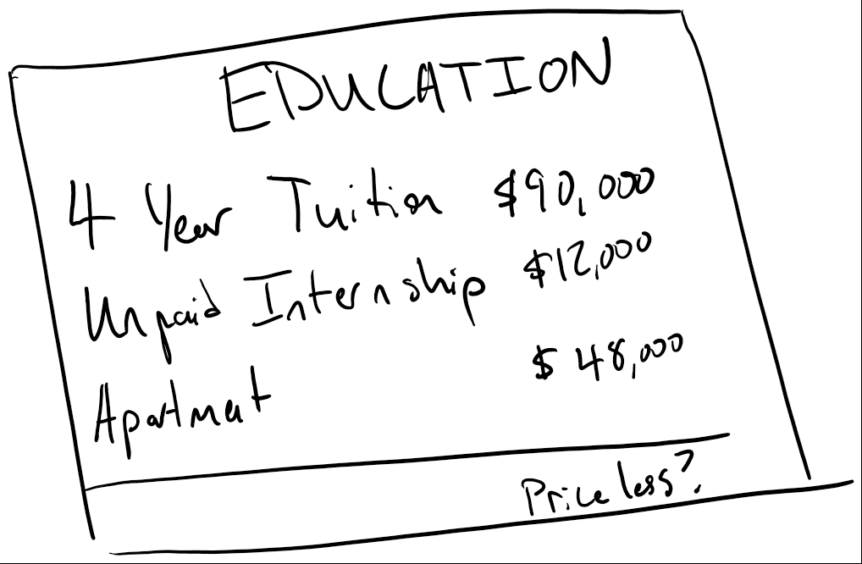

The Cost of Education

If there’s one thing Americans can bemoan, it’s the cost of higher education. Whether it’s lower tuition at a community college or tuition in excess of hundreds of thousands of dollars, Americans largely can agree that a good education is too expensive. Yet, a common financial planning challenge that comes up for families is not only how to pay for …

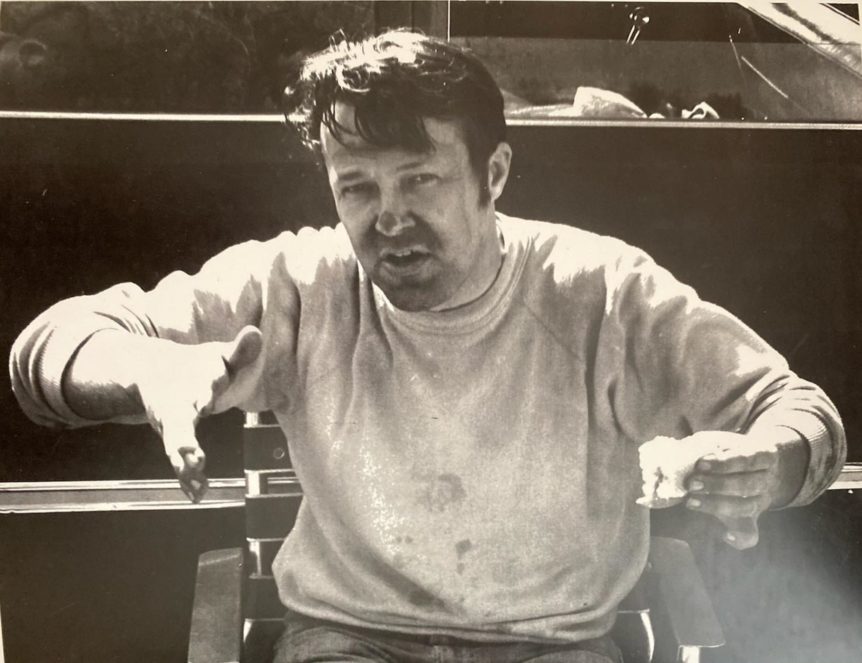

Plan Ahead – Financial Lessons from the Life of a Good Man

Financial Lessons from the Life of a Good Man My grandfather, Chester Persons, passed away on March 5th. While his passing is sad, he has left behind an incredible legacy, one part of which I want to share with you: financial lessons. While Chet didn’t die a rich man, he overcame enormous uphill battles to support his family and create …

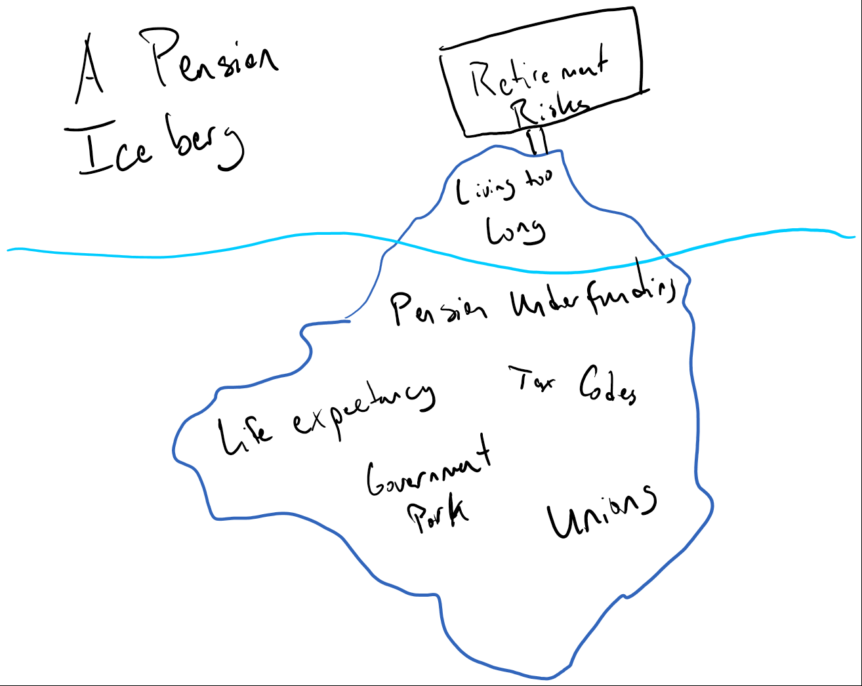

Some Retirement Plans are More Equal Than Others

In the United States, we have a national pension and disability insurance system called Social Security; you may have heard of it. Originally established in 1935, social security started as a safety net to provide the elderly, widows, and orphans with some form of supplemental income. At the time and since that time as the program has developed, the concern …

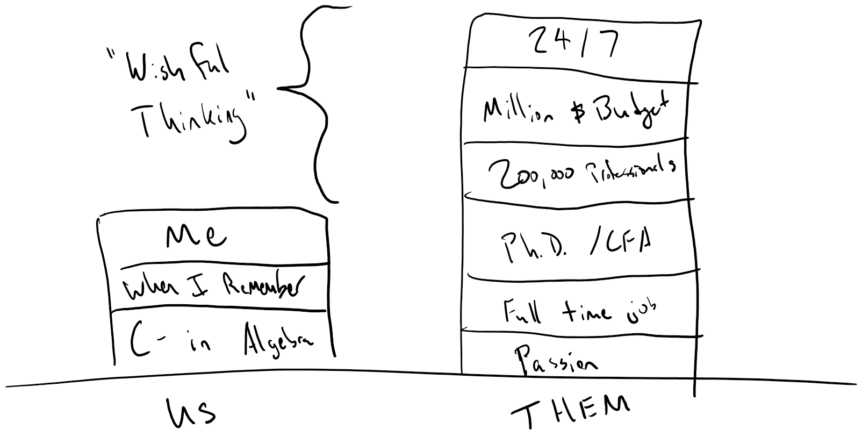

This Time It’s Different – Why I’m a Boring Investor

It was exactly one year ago when my phone rang. It was a client out in California, and the S&P 500 index had just shown a slide of over 11% in the proceeding five days. “Dan, don’t you think we should get out now? It’s getting kinda scary.” He said. “No; this is what asset allocation is for. We have …

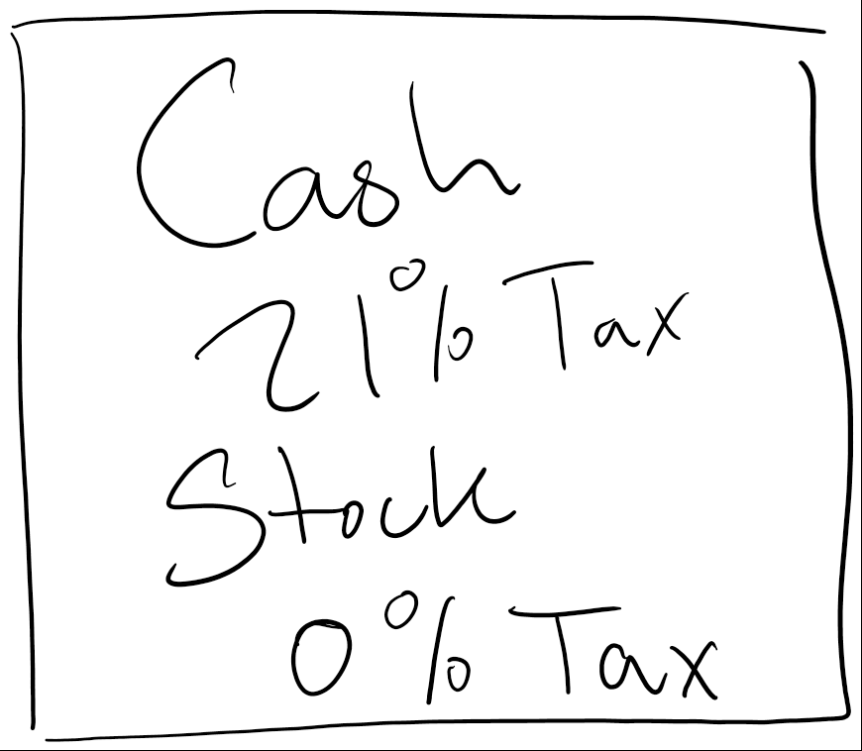

Death and Taxes

There’s an old saying from Benjamin Franklin: “…nothing is certain but death and taxes.” Charmingly dour as the sentiment is, he’s not wrong about that when it comes to your financial affairs and the handling of your assets when it comes to moving on from this life. As a nation, we’ve experienced a disproportionate amount of loss in the past …

Becoming a Millionaire Next Door

According to a fair bit of research and just plain anecdotal evidence, there are three controllable paths to becoming a millionaire in the United States: work in a high-paying profession, save and invest consistently over time, and own a successful business. While some smart aleck is likely to come along at this point and say “be born with rich parents”, …

The Making of a Ponzi Scheme

On February 4th, the SEC charged three individuals and their investment firm, GPB Capital, with running a Ponzi scheme in the amount of $1.7 billion dollars. For scale, the Bernie Madoff Ponzi scheme was $64.8 billion, so while this scheme did not reach such a significant size, it is still the largest Ponzi scheme accusation made since Madoff’s conviction in …

The Games Won’t Stop

If your experience with the markets lately has been an entertaining, if confusing one, you’re not alone. Last week, the market had another “never before seen” event, after members of the website Reddit banded together to buy as much Gamestop stock as they could afford. Reporting has been mixed regarding this, but there have been several constants. Most importantly, if …

On the Morality of Stock Buybacks

In 2020 stock buybacks came under attack, and it was no surprise. The public was outraged to learn that airlines had collectively engaged in over $25 billion dollars in stock buybacks over the past decade. “How can companies making that much money suddenly not have the cash to operate?!” Was the question of the day, and a fair one at …