Primerica Fee Type Annual Fee Program Fee 2.24% Up Front Revenue Sharing 0.25% Quarterly Revenue Sharing 0.0175% Annual Cost to Clients in the First Year 2.56% Disclosure of Revenue Sharing Regulatory Filings for Advisory Services Merrill Fee Type Annual Fee Merrill Lynch Fee Rate 2.00% Style Manager Rate 0.65% Revenue Sharing ? Annual Cost to Clients in the First …

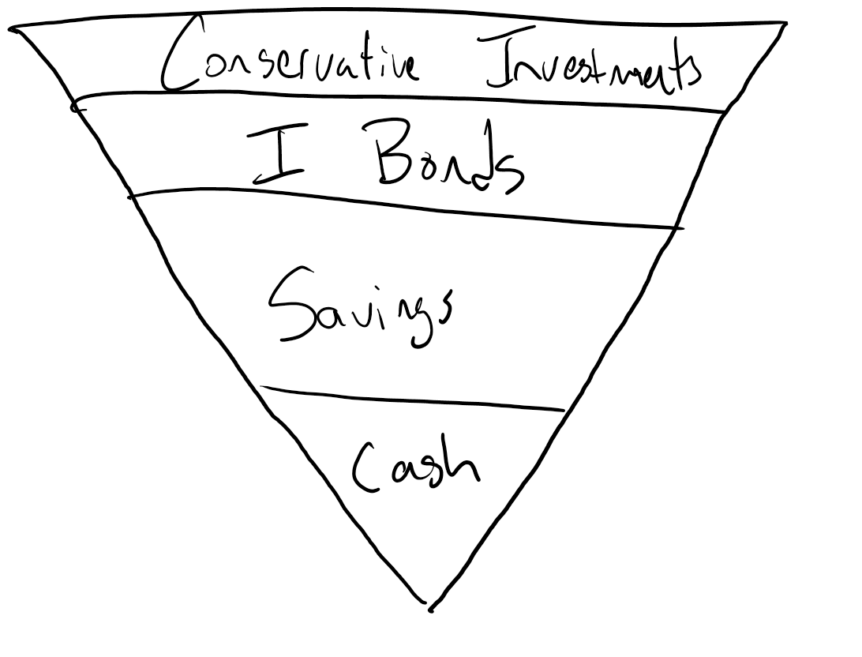

The Safe Harbors of Capital

If you hadn’t noticed over the past decade, interest rates have been low. Really low. Historically low, in fact. This has been an enormous economic boon for small businesses, home buyers, and other borrowers of just about any sort. While the Federal Reserve’s monetary policy is to keep the reserve rate low, competition for low rates on every form of …

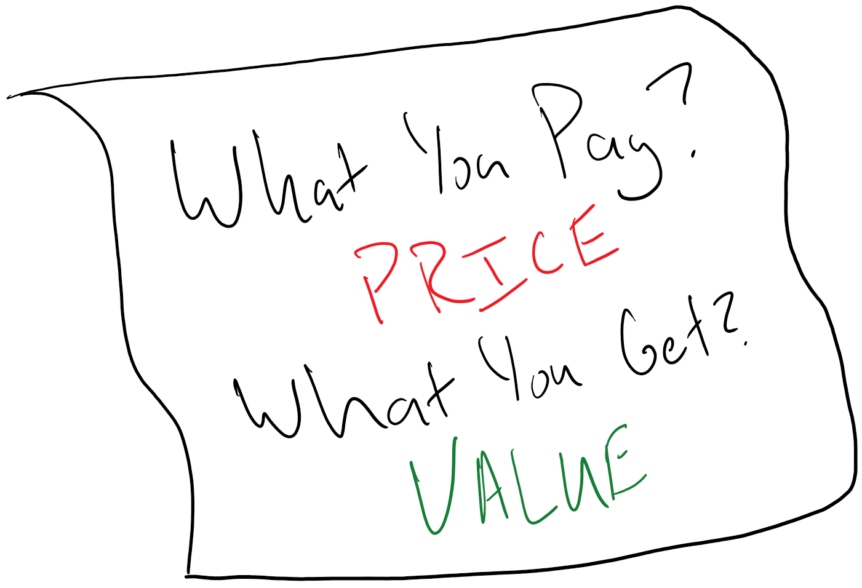

The Value Proposition of Financial Planning

In business school, you’re taught a lot of things: business plans, marketing, managerial accounting, and so on. One of the most important things that does not get enough attention is the “value proposition” of a business. Simply put, the value proposition is the core reason someone would do business with you rather than doing business with someone else. Sometimes that …

Inflation and You

In case you’ve forgotten, inflation is the simple principle that over time, the value of existing currency declines as the perception of the public is generally that things get more expensive with time, and that as the population grows, there is a natural growing demand-side pressure on the supply-side of the economy. Inflation has been all but absent for the …

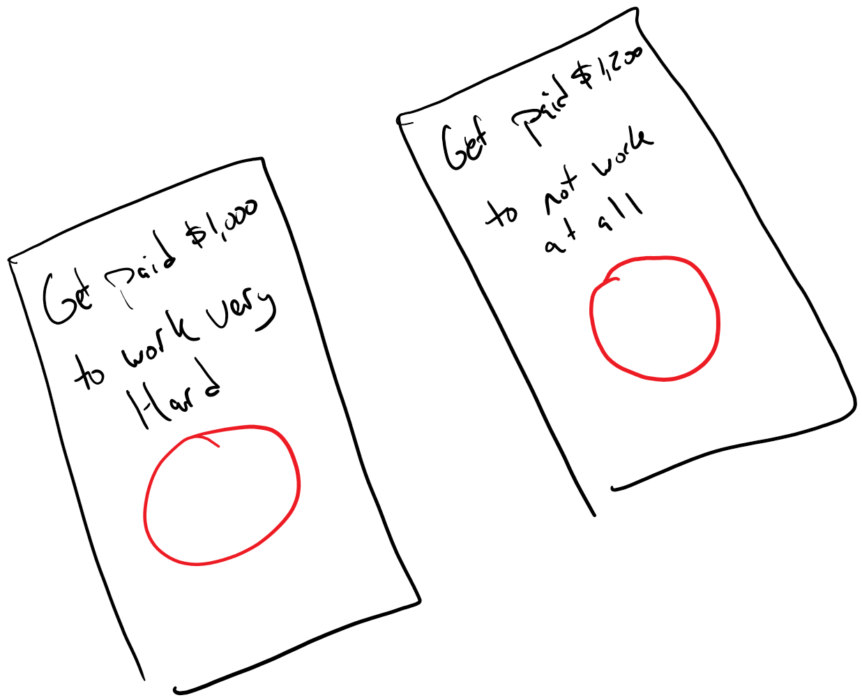

Underwhelming Wages in the Free Labor Market

“It is not from the benevolence of the butcher, the brewer, or the baker that we expect our dinner, but from regard to their own interest.” Wrote Adam Smith in “The Wealth of Nations”, a classic treatise on what we now know as capitalism. As of late, a great deal of news and memes have been made up of the …

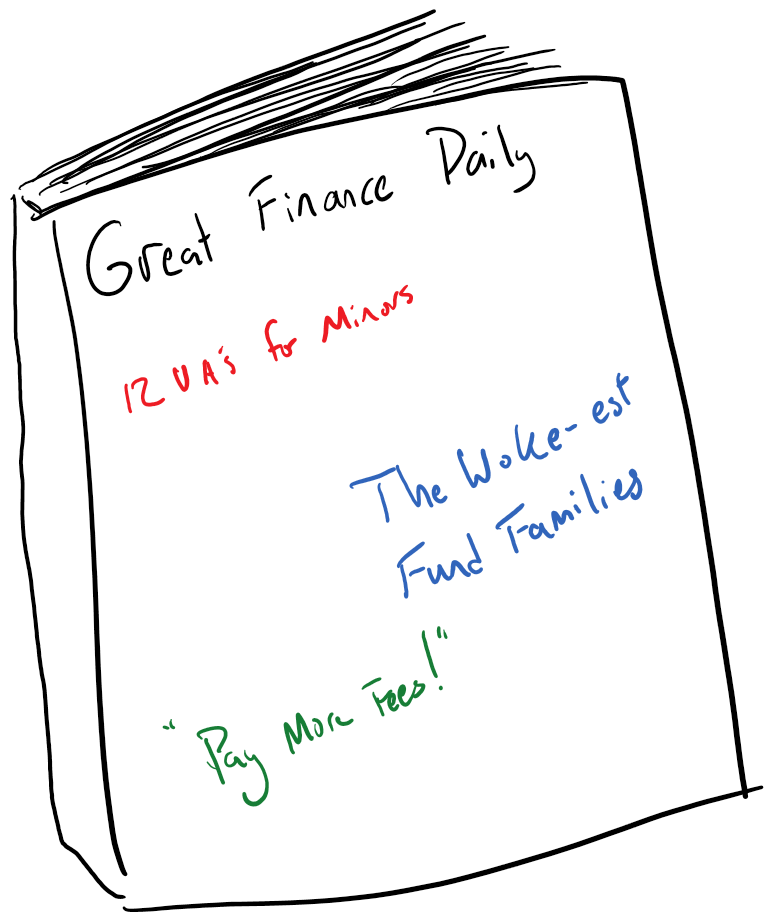

The Influencer Age of Finance

Last year, the SEC released marketing rules that came into effect today. Now I know what you’re thinking: Dan, rules, from the SEC, about marketing, sounds like the most boring thing ever, of all time. Oh contraire! You see my friend, these rules are about to have a major effect on how you are targeted and marketed to by a …

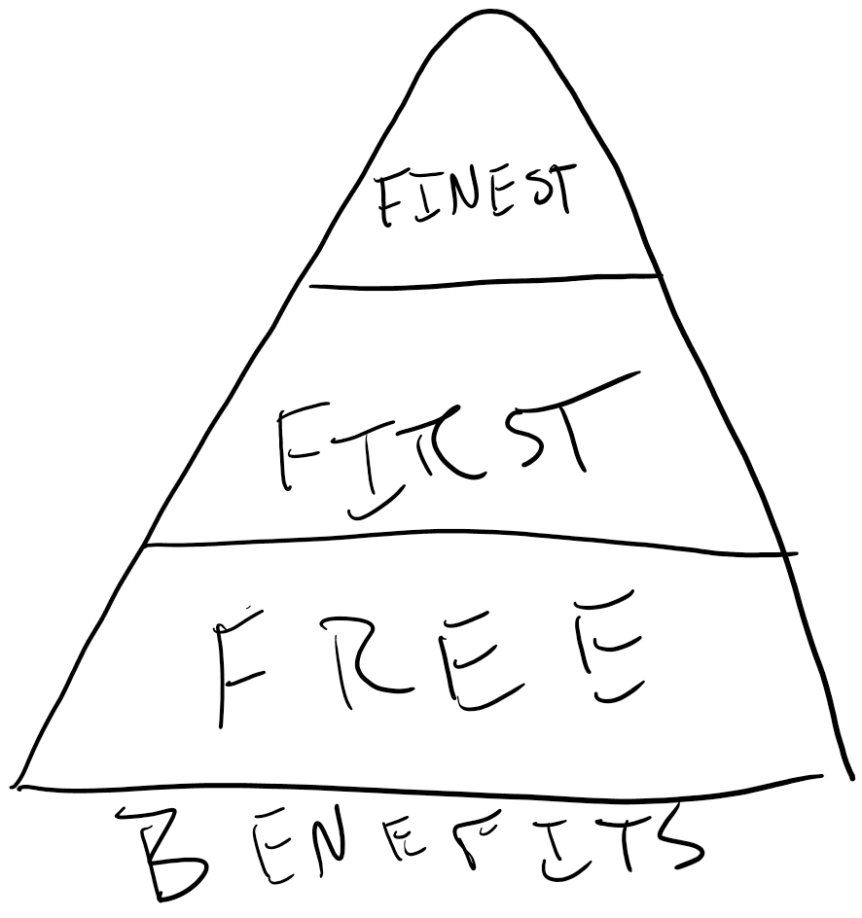

The Free, The First, and the Finest

Whether you’re a startup founder, accidental entrepreneur, or simply looking for help in deciding what job offers to accept, the benefits package is a big deal. People work within organizations (public, private, or non-profit) for a handful of reasons: They believe in the mission, they love the work, or the compensation is right. In a perfect world, it’s all three. …

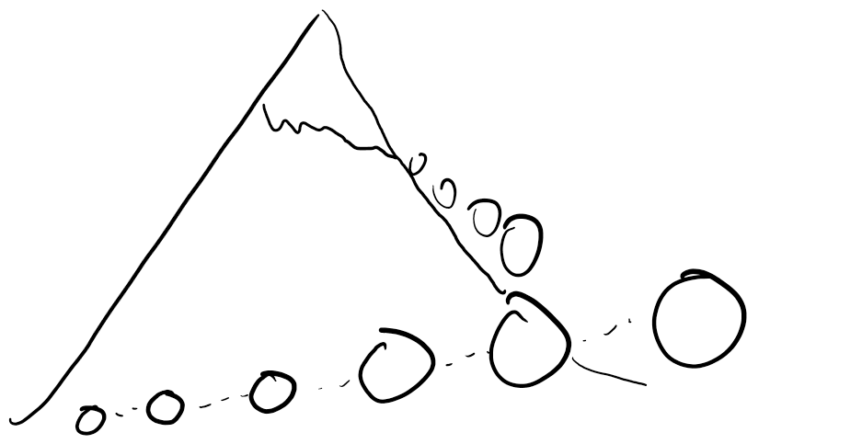

Snowballs and Avalanches

With a national debt of $23.3 trillion dollars, you could say that debt is American as “baseball, mom, and apple pie.” Yet debt is a major source of existential and cultural angst, with multiple studies linking stress and both physical and mental health issues to the levels of debt carried by Americans. In 2015, the Federal Reserve even found that …

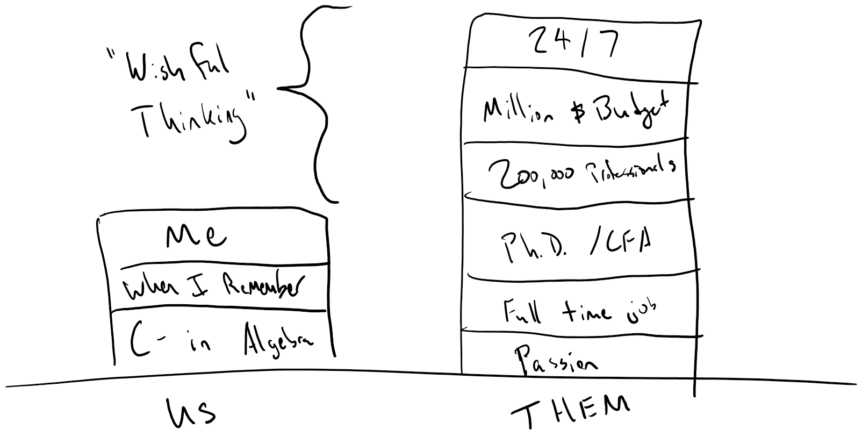

Don’t Judge a Book by its Cover

The admonishment to not “judge a book by its cover” is usually one encouraging us to be better people. “Look past a person on their worst day or who presents poorly to see that they’re a human being just having a hard day. See the merit in every individual and get to know them better than they appear;” or some …

This Time I’m Different

“The four most dangerous words in investing are ‘this time it’s different.’” Said Sir John Templeton, indicating the historical trend that investors often identify “unprecedented opportunities” to invest in, only to find that history repeats itself often when said opportunities crash or end up mediocre. After all, since the most valuable company on earth, Apple, had an initial public offering …