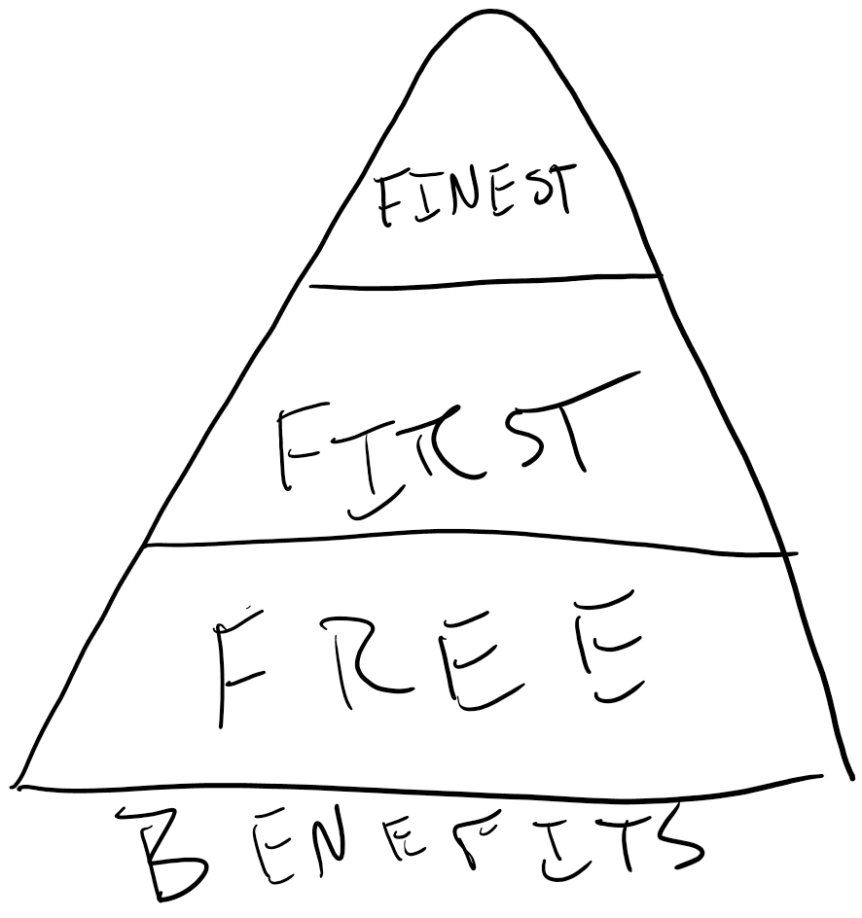

Whether you’re a startup founder, accidental entrepreneur, or simply looking for help in deciding what job offers to accept, the benefits package is a big deal. People work within organizations (public, private, or non-profit) for a handful of reasons: They believe in the mission, they love the work, or the compensation is right. In a perfect world, it’s all three. While as a financial planner I can’t really tell you what the mission should be and everyone has a different type of work they enjoy, I can help you figure out the compensation part. Today we’re going through the benefits an organization can offer, in order of “free in all but administration”, “first you should offer that cost money”, and “the good stuff” a company can offer when it has the resources and culture to take its employee’s financial welfare seriously. For those who need some inspiration, we’ve included a one-page benefits summary, and if you’d like a copy of our current employee benefits guide, you can sign up for our newsletter here and download a copy.

The Free

In America, we love the word “free”, but there’s often a catch that comes with “free”. In this example, the biggest catch for free is going to be “administration time”. There are a number of choices that technology can possibly automate here, but if the business or organization can’t afford to offer even a penny of benefits because of budget limitations, these benefits will only cost time.

Payroll Deferral Plans: This is the simple facilitation of pre-tax savings and deferrals for various plans an employee might want to make. By agreeing to facilitate pre-tax deferrals into a traditional IRA, 529 College Savings Plan, and Health Savings Accounts and Flex Spending Accounts, an employer can help an employee keep more money per paycheck in their pocket at no cost of capital, only the time it takes to make an electronic bank transfer of the contribution or to set up the rules in payroll software.

Flex-Pay Options: For those companies using payroll software such as Gusto and others, many have established cost-free paycheck flexibility accounts. In short, the payroll company will lend money at no interest to an employee early in their payroll cycle (i.e., 3 days into a two weeks cycle) and will pay themselves back with the payroll paid at the end of the cycle. This flexibility can help employees meet emergency and unexpected expenses such as a car repair or trip to visit a sick family member without placing an undue financial burden on the employer or costing the employee the outrageous rates charged by payday loan companies.

Student Loan Repayments: This is a temporary benefit that may only last until 2025 under the American Recovery Act, but by law, from 2021 through the end of 2025, employers can pay up to $5,250 of employee wages as student loan reimbursements on a tax-free basis, saving the employee extra payroll taxes and helping stretch the employee’s wages just a bit further. This one is a bit more complicated to administer because of its time-limited nature, but anyone with student loans should be talking to their employer about getting whatever their monthly payment is turned into student loan reimbursement to save on payroll taxes.

The First

A time finally comes when a company knows it has to make investments in benefits to be a competitive employer in today’s job market. This section covers those most critical benefits options for employers to utilize and should be the first priority for benefits that do cost the company money.

QSHERA: For a still cost-conscious company, health insurance can be a tough pill to swallow. For those who don’t know, group health insurance premiums are calculated based on the “aggregate” person in a company, i.e. the average of everyone’s genders, ages, and the genders and ages of their spouses and dependents. If you have a “young company”, this means health insurance could be cheaper. If you have a “veteran company”, you will have higher health costs. Ultimately, these premiums can amount to hundreds or even thousands of dollars a month per employee, so it’s a natural area of concern for employers to consider limiting the costs. Enter in the “Qualified Small Employer Health Reimbursement Arrangement”, or QSEHRA. A QSEHRA is only available for companies with less than 50 employees and allows an employer to levelize their health insurance expenses. Rather than quoting a group health plan and paying a percentage of the premiums for their employees, a QSEHRA allows the employer to specify a monthly dollar amount paid to employees tax-free to be used to pay for premiums, i.e. $200/month per employee. If the employee wants a lower-tier health insurance plan or is younger, they’ll potentially pay little to nothing for the health insurance. If the employee is older or wants a higher-tier health insurance plan, then they bear more of the cost. This can be a cost-controlling intermediate step for a business in providing health insurance benefits to its employees.

Group Health Plan: Past the point of the QSEHRA is a traditional group health plan. As described above, you add up your employees and their families and get an “average employee” that premiums will be based upon. From there, as an employer, you decide what quality of plans to offer and what amount of the premiums you will pay for. In a company with an age-diverse employee group, this can be very important for older employees, as individual and family premiums for older workers can extend to the point of over a thousand or even two thousand dollars monthly. Conversely, it could be more expensive for younger employees, so deciding what percentage or ratio of premium you’ll cover is a balancing act. I personally recommend that employers cover the cost of an ACA Silver plan that qualifies as a high deductible health plan, so employees with little to no healthcare costs can utilize a healthcare savings account for additional tax savings, and then offer an ACA Gold or Platinum plan to keep costs lower for those with chronic conditions, which employees can opt into and pay for the additional premium. For context, at MY Wealth Planners®, we offer both a Silver and Platinum plan at no cost to employees.

A Retirement Plan: A common “to do” for business owners is a retirement plan. While companies with funding and financing (i.e., invested startups) often offer a retirement plan from day one as a form of security for employees (“hey, we might go public and you might be millionaires, or we might go out of business in a year, so here are some savings!”) many small businesses tend to place a retirement plan on the back burner for two reasons: First, employers often like to make the business poor on paper by simply spending money before the end of the year and thus converting taxable cash into untaxed inventory or assets. Second, employers tend to get weird about benefits that cost a percentage of income. “But however could we afford a 3% increase to payroll?” One might say. Well, if the government increases payroll taxes by 3% this year, guess what? You’re paying it. If I sound salty about this, it’s because the average employer would rather waste money on things their business doesn’t need than save money for their retirement and help their employees out too. Getting past my saltiness, the introduction to a retirement benefits plan for employees is a SIMPLE IRA. Many companies will have a SEP IRA first, but those are better used by solo owners and partnerships than companies with genuine employees. A SIMPLE IRA comes with no additional regulatory, tax, or administrative costs, and functionally offers a 100% match up to 3% of employee wages. The greatest drawback to SIMPLE IRA plans is that there isn’t much of a standardized provider market for them, so they tend to be a bit “hodge-podge” in nature from an employee’s point of view. When an employer is ready to take retirement saving more seriously or wants to provide the gold standard for retirement savings, they upgrade to a 401(k) plan. A 401(k) will cost an employer a minimum of $600 a year in administration costs, plus either a non-elective 3% of wages contribution to all employees or a safe harbor match of 100% of the first 3% of saved wages plus 50% of the next 2% (5% saved equals 4% match). A 401(k) can match and contribute much more or can do a lot less, but those formulas just mentioned are the safe harbor requirements for compliance testing.

Take Some Time Off: The viability of holidays and vacations is tricky. For a business like a financial planning firm, where revenue is functionally on subscription, giving employees a day off for holidays and giving them a generous vacation allotment is no trouble. For companies that work on larger long-term projects, the same is true so long as there’s a cultural work ethic that ensures the work gets done. But for businesses that require “coverage”, i.e., restaurants, retail, etc., or those that work in hourly allotments, i.e., law firms, accounting firms, and various forms of trades, there is an immediate and negative effect caused by vacation policies and potentially by holiday policies. Ultimately, the business model dictates what is most viable for a business to offer, but remember that if a company doesn’t offer holidays or vacations, it’s ultimately at a disadvantage against competitors that do.

The Finest

Benefits offered in this category are not, per se, the gold-plated best-in-class benefits a company can offer. Rather, many of them are tertiary but important benefits not because they cost more or less or are more or less beneficial, but because a company that goes the extra mile to offer these types of benefits is ultimately extending benefits beyond that which is required to be competitive in general. For those who have worked at large Fortune 500 companies, most of these won’t be surprising to see, but it’s important to remember that the majority of Americans work for small businesses which can make these less common.

Dental and Vision Insurance: Even the best-in-class dental and vision policies can cost 1/10th comparable quality health insurance, so it seems odd that Dental and Vision would come afterward. However, the critical difference between health insurance and these is that health insurance largely exists to mitigate the catastrophic cost of emergency services, surgery, and major chronic medical conditions. In other words, it is less about maintenance and more about genuine protection. In the case of Dental and Vision, the value is more akin to a Costco membership. The a la carte cost of Dental and Vision healthcare is not that much greater than the insured version, but if you intend to get regular checkups for dental care and vision checks or glasses, then the insurance makes sense to have. It’s also noteworthy that some carriers will not cover Dental and Vision policies without a healthcare policy in place.

Disability and Life Insurance: Much like Dental and Vision, disability and life insurance both are often cheaper than health insurance. However, the critical distinction here is the principle of group insurability. The value provided by a group policy is less than the benefit is being provided (though helping an employee’s family members with their sudden loss or providing lifetime income for an employee if they’re sick or injured is certainly valuable!) and more in the form of the ability to insure employees who couldn’t qualify on their own. Conditions like diabetes, pre-existing injuries, and other chronic health conditions can make individuals uninsurable without an employer plan in place. While it can seem like a small thing, access to disability and life insurance can be a major value add for employees who need group insurability.

Need Some Inspiration?

Take a gander at our one-page benefits summary, and if you’d like a copy of our current employee benefits guide, you can sign up for our newsletter here and download a copy.

Comments 2

Can I come work for you? LOL

Author

How’s your memory on Tukey-Kramer’s Honestly Least Difference test?