I’m an extremely passionate advocate for the value of financial planning. I’ve written a book on starting a career in financial planning, am halfway through a doctorate in financial planning, and serve on regional boards and national committees for multiple financial planning organizations. It might surprise you then to know that I had a terrible first interaction with a financial …

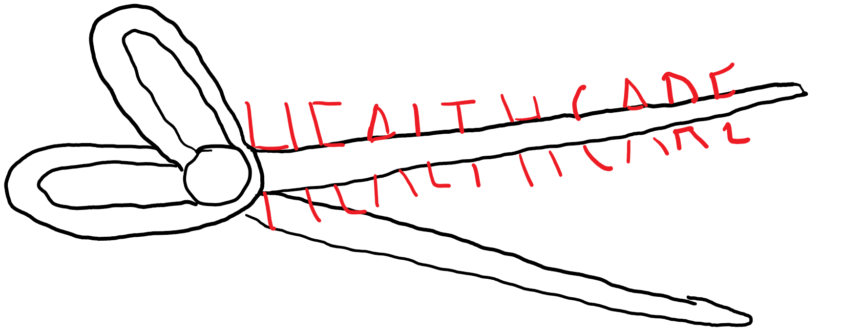

Reducing the Cost of YOUR Healthcare

Here’s a simple experiment: The next time you buy any good or service that isn’t clearly labeled with its price, ask what it costs. For example, if you go to a high-end restaurant and they list cocktails without prices, ask the server what it costs. They will likely know immediately or be able to check out the price quickly on …

When Courage Fails

“A day may come when the courage of men fails, when we forsake our friends and break all bonds of fellowship, but it is not this day.” -Aragorn at the Battle of the Black Gate I have written a lot about volatile markets and market downturns, yet without fail, the lessons of dozens of market crashes before seem to fall …

Pension Maximization

If you have worked for the government in Colorado, or worked anywhere in the United States for more than ten years, then congratulations, you have a pension! Pensions have been a staple of retirement planning and income for centuries, with the first corporate pension being established in 1875 by the company we now know as American Express. Even before American …

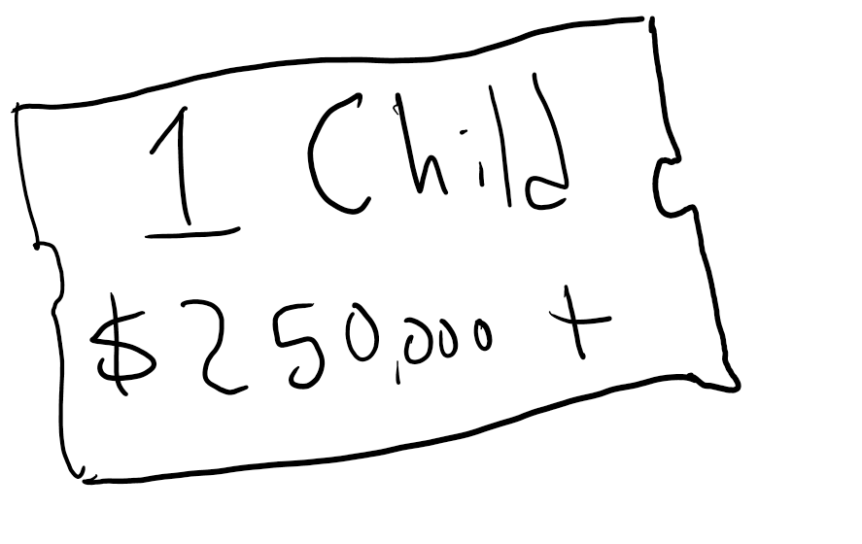

The Cost of Children

As I’m sure you’re aware, the Supreme Court overruled Roe v. Wade on Friday, overturning a 50-year precedent limiting the state’s ability to restrict access to abortion. Consequently, abortion has become outright illegal in 17 states, and is time-limited in 6 states, while a handful of others are undetermined. Regardless of the state you live in or your personal politics, …

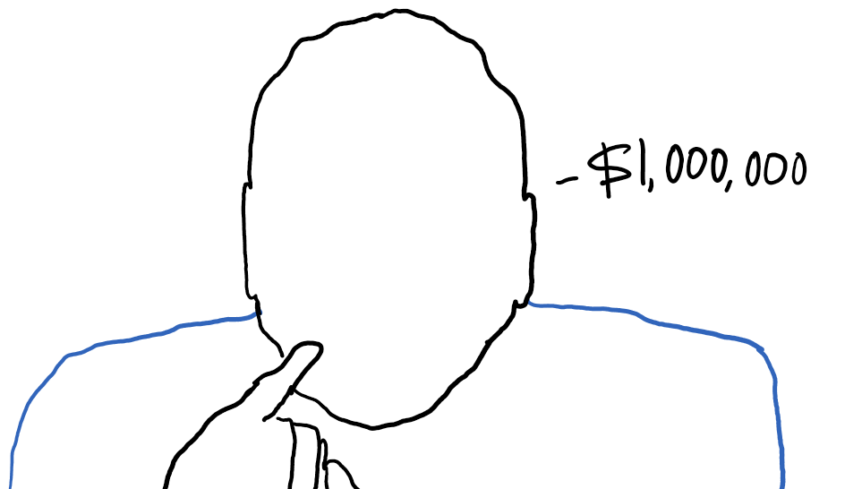

Becoming A Millionaire in Seven Years

Well, this is an awkward brag of sorts, but as of May 31st this year, it appears I’ve become a millionaire. I’ll get it out of the way and say that I don’t feel like a millionaire. I certainly don’t live like one, or at least, I don’t live like what I’d think of a millionaire as living like. I’m …

The Environmental Disaster of Crypto

Set up a camera in front of your home and start recording. Do this for two and a half months. When you’re done watch a sped-up time-lapse of the recording. Observe how often and for how long the lights are turned on at night. Watch the garage door roll up and down from time to time. See steam or smoke …

Paradoxical Financial Advice

When I was in the Army, I attended a leadership course that included a land navigation assessment. Land navigation is the old-fashioned practice of using an accurate topographical map, plotting points on the map using coordinates, and physically traveling to those points. These courses would typically take 3-5 hours and be spread over a ten to twenty square-kilometer area, where …

ESG Products are Mostly Marketing

In 2014 I was halfway through my graduate program in finance and I’d developed a habit that I think many of us can identify with: obsessively watching TED Talks. TED Talks started in the 80s but gained widespread attention as they started being shared online in 2006. Almost a decade later, I’d taken to the habit of getting a notification …

Man Versus Machine

A recent study by Vanguard researchers, Dr. Paulo Costa, Ph.D., and Jane Henshaw, has been conducted on the differences in value between human financial planners and the digital advice offerings of “Robo-advisors,” such as Betterment and Wealthfront. The results of this study of man versus machine are stunning to say the least, not only because of its explicit findings in …