As you know, we were on hiatus for two weeks earlier this month, as I was in Manhattan, Kansas, at Kansas State University (which, for those who don’t know, is Harvard for Financial Planners). It seems only fair that with the interruption to your regularly scheduled educational content, that I should share some of the research we did while we were in Manhattan. Specifically, my research project was looking at the determinant relationships between those who use financial planners and those who don’t, as well as then what other sources of professional information people seeking advice around credit and investing use. To examine that research question, we used the Survey of Consumer Finances, a tri-annual study conducted by the Federal Reserve on several thousand households across the United States, which are representative of the general population.

The Trend that Led to our Research Question

Prior to the advent of the internet, financial advice was an almost entirely transactional business, largely staffed by the infamous “stockbrokers”, who were required to both execute purchases and sales of securities, but who also was the predominant source of advice around those transactions. This was compounded by the difficulty of achieving “asset management” pre-internet, as something as simple as rebalancing a portfolio could require dozens of pages of paperwork, client signatures, and weeks of work to mail the appropriate documentation place to place. This ultimately meant that only the ultra-affluent with “family offices”, full-time staff who managed their funds, could afford investment advice separated from the transactional business model. With the opening of the internet, more and more self-directed investment platforms opened the door for the public to circumvent these gatekeepers, and ultimately the business model for financial advice shifted to a service-based model, with a growing population of “asset under management” service providers managing both investments and giving general financial advice. However, this model still largely serves a population with a million-plus in liquid investable assets, and so over the last decade, there has been a growing proliferation of service models including hourly, subscriptions, project-based, and retainers, which all purport to help serve a population with less liquid assets, including younger people or those with higher incomes who hadn’t accumulated significant wealth yet.

What We Were Expecting to Find

Going into any scientific research project, you develop hypotheses that inform the assumptions you’re making about what you expect from the data. In the case of my project we used age, race, and sex as immutable characteristic demographic controls, and then looked at educational attainment, self-reported financial knowledge, financial stress, and financial characteristics such as financial and non-financial assets, income, homeownership, and debt, to analyze financial behaviors. To analyze the research question, we were working through the lens of “Financial Help-Seeking Theory”, which posits that age, financial behaviors, and homeownership will increase the likelihood of help-seeking while financial stress decreases the likelihood of help-seeking. Because we wanted to examine whether the growing proliferation of alternate service models was changing the math on whether younger and less affluent people were entering into financial advice arrangements, we thought we’d see that both the traditional metrics of financial advisor use (age and liquid assets) would be statistically significant, but that we’d likely see that age was becoming more of a net neutral and that other factors such as non-financial assets (e.g., real estate, business ownership, etc.) and income would be becoming more statistically significant over time.

How we performed the study

This is usually the part where a lot of people start skimming academic papers, and for good reason: There’s not much to be learned in how a study was conducted when you’re ultimately just looking for the summary of things. So we’ll keep things really simple here: We developed a statistical model that had two output results: Whether someone in the sample group used a financial planner and what factors were consistently found in those who did, and from that, how many other sources of professional advice (lawyers, accountants, etc.) they were using for the same types of credit and investing questions. If you want more information than that and want to read nerdy terminology like “Binary Probit Model Analysis” and “Ordered Logistic Model”, you’ll probably have to wait for the study to be published in a year or two!

What did we find?

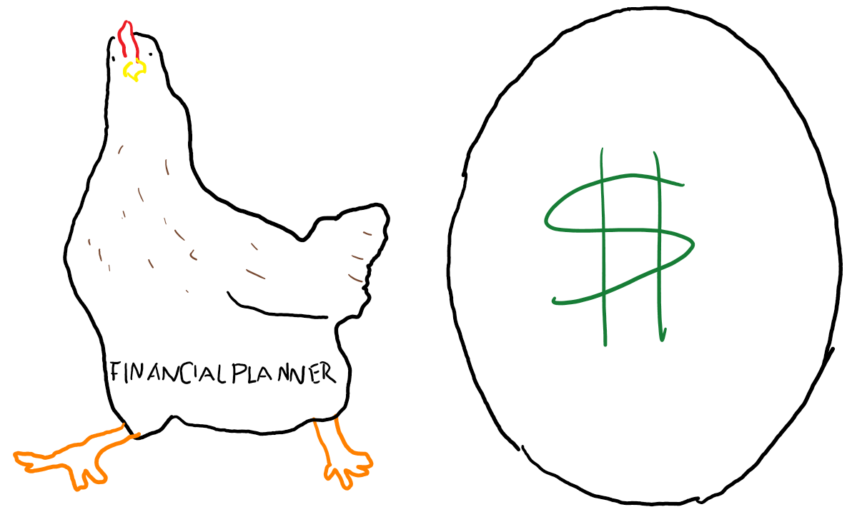

More than a few things were surprising in our study. First, we found that age had no significant relationship with the use of financial planners when compared with the variable of age and financial asset’s interactions with each other, which would suggest that it’s not “getting older” that encourages people to seek financial advice, but that with the accumulation of wealth comes a greater need for financial advice. Of course, you can have a chicken and egg problem with that finding: Is it having more financial assets that leads someone to use financial planners, or is having a financial planner the cause of having more financial assets? We further found that racial demographics had little to do with the adoption of financial planners, although Asian respondents were statistically significantly less likely to use financial planners than Black or Hispanic identified respondents. The most interesting demographic control was the statistical significance of formal education. We found that every gradient of education, including high school graduation, some college completion, a bachelor’s degree, and an advanced degree, all had an increasing likelihood of using a financial planner. Further, even those with a high self-perceived financial knowledge were more likely to use a financial planner, undermining the idea that only people who admit “they know nothing about money” use planners, and that relationship would indicate that those with higher levels of formal education and those who believe they know more about money, know that they need financial planning help! Finally, we found that income, financial assets, and debt all had statistically significant relationships with the use of financial planners, though surprisingly non-financial assets were not statistically significant.

What about other professionals?

We hypothesized that people using financial planners would be using them as a one-stop shop for their financial questions, but were surprised to find that using a financial planner significantly increased the use of other professionals (lawyers, accountants, and so on) for financial advice. A limitation of the Survey of Consumer Finances is that it only asks if respondents use these professionals for questions about credit and investing, not if they’re used for their core professional role (i.e., lawyers for legal advice). Thus, it can be a bit difficult to discern whether the people using financial planners are taking a “shotgun” approach to ask lots of professionals for advice about credit and investing, or if there’s more of a referral-based relationship. That said, with the finding that financial planner use significantly increased the likelihood of people seeking help from other professionals, we saw some interesting changes in the statistically significant relationships. First, we saw that age became statistically significant and that as age increased, the odds that someone had a different type of professional actually were lower by about 3.1% per increment of age. We also saw that black respondents were 17.6% less likely to use other types of professionals. Meanwhile, financial stress became statistically significant and showed that the odds of using other professionals were 15.9% greater. Most surprisingly, it came up that financial assets stopped being statistically significant while non-financial assets became statistically significant. This suggests that people view non-financial planning professionals as good sources of advice when their assets are non-financial, but that financial planners are still viewed as a strong source of professional advice when there’s a significant level of financial assets.

The Relationships Between Planning & Wealth

The question should arise: What can we do with this information about the relationships between planning & wealth? To be frank, not much. It took two weeks for us to build the models we used during our study to get to this point in our findings. Expanded research into this research question might go a couple of different directions: we could look at previous iterations of the Survey of Consumer Finances to examine the trend and whether our findings are growing in significance or represent a change over time. We could also deepen the model analysis to get at the causal relationship between the variables (again, the chicken and egg problem is prevalent here). For now, what we do know is that the odds are significantly greater that people with high education, high financial knowledge, and both high incomes and financial assets are more likely to use financial planners than those without. The question remains to be seen whether one causes the other, but that’s the fun of research!

Dr. Daniel M. Yerger is the President of MY Wealth Planners®, a fee-only financial planning firm serving Longmont, CO’s accomplished professionals.

Comments 2

Interesting! When our savings hit 100K we looked for financial planning help via classes and actual planners. However, I did try to invest as a new grad, a bit of money I had at the time, about $500 in savings. The broker I spoke with wasn’t interested in helping with such a paltry sum. Reading the summary of your project, I get the chicken or egg question but from my perspective, it is that actual money (not owning a house or whatever) is the spur to seeking advice. Or, have I missed the point?

The relationship between planning and wealth is an important and interesting topic.

But something that we should not overlook is to keep track on our assets.

In most of the cases, people think that they don’t posses any wealth, but short after they start to catalog and keep track on their financial and digital assets, it turns out that they have collected more than they have ever thought.