If you weren’t aware, there are not many financial planners. In Longmont, of 132 securities licensed professionals, only 89 are licensed to give advice, and of those 89, 22 are CFP® Professionals, and of those 22, only 4 are practicing financial planners. In Longmont, MY Wealth Planners® is the only practicing fee-only financial planning firm with a CFP® Professional working …

Money Scripts – Knowing Your Lines

Believe it or not, you have some lines of a drama or comedy memorized. Sure, we all know quotes from our favorite movies and shows, but that’s not what we’re talking about today. Rather, you have a script that you follow day to day in your financial life. It’s a pre-written set of lines that you lean on in times …

The Good of Disruption and Differentiation

Today we’re going to spin a yarn about three seemingly unrelated events: The steady shift of investment money from active investment products to passive investment products, sales practices in Canadian banks, and the recent anti-trust settlement regarding realtor commissions. You might look at this with bemusement. “What does this have to do with me?” And fair enough for our non-Canadian, …

This Doesn’t Look Like Anything to Me (IULs Part 2)

It’s rare that writing on finance that I get to do a “part 2”. So many topics are recurring topics that, while bearing repetition, fail to be meaningful to write about. Yet, as the old saying goes “History doesn’t repeat itself, but it rhymes.” This week, we’re reflecting on a year’s worth of improvements to a specific financial product’s market, …

Applying to become a B Corp

Last week, MY Wealth Planners filed its first assessment and request for review to become a certified B Corporation. Unlike an S Corporation or C Corporation, B Corporation status is not a business structure or tax election. Rather, “B Corp” is a voluntary designation to make not just profit the purpose of the company, but to address governance, workers, community …

Surrendering the CDFA

In 2019, I completed the Certified Divorce Financial Analyst designation. The designation was created to help qualified financial planners better assist their clients in the divorce process, whether complementing a collaborative divorce or helping clients keep as much on their side of the scale as possible in the division of assets on an adversarial basis. The designation included four courses …

Reducing Access to Retirement Advice is… Good?

It may surprise you to know that the vast majority of financial professionals and companies are not required to provide you with products or services that are in your best interest. We’ve written many times before about these conflicts, but for those who haven’t been long readers, it is essentially the exception and not the rule, that financial professionals must …

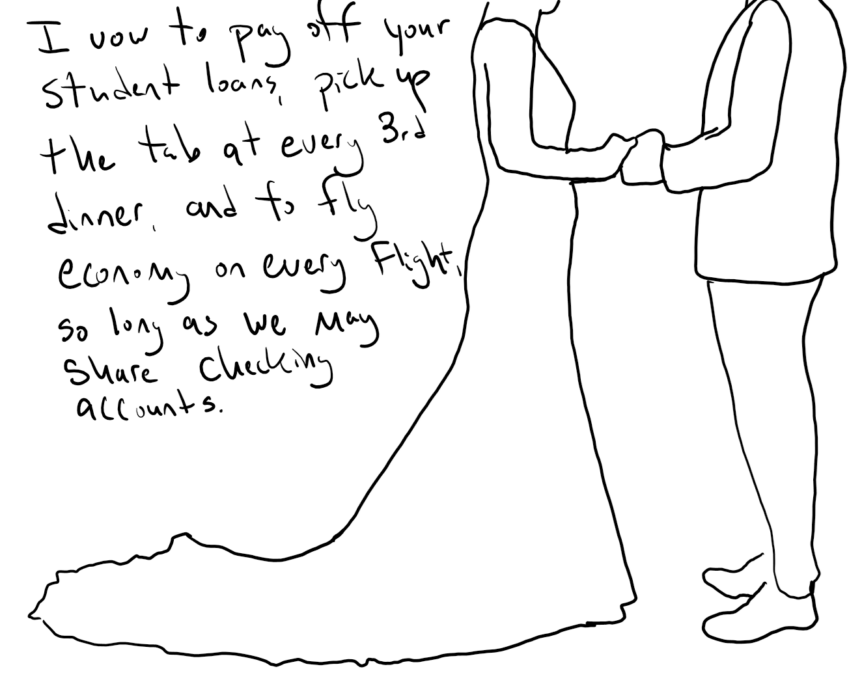

Cash Management for Couples

If I tried to build a rocket ship, only one of two things would happen. At best, I’d go nowhere, and at worst, I’d explode. This seems fairly self-evident, given that I’m not a rocket scientist, and the highest grade I ever got in a physics class was a C+ in high school. The simple fact is that even though …

The Most Common Mistakes a Business Owner Makes

At MY Wealth Planners, we advise business owners and managers at all stages of a business, from startup to the sale of the enterprise. Understandably, then, we’ve also seen mistakes. A lot of common mistakes. We’ve even made some ourselves! This week, we’re talking about the three most common stages we see by business owners in the startup phase, the …

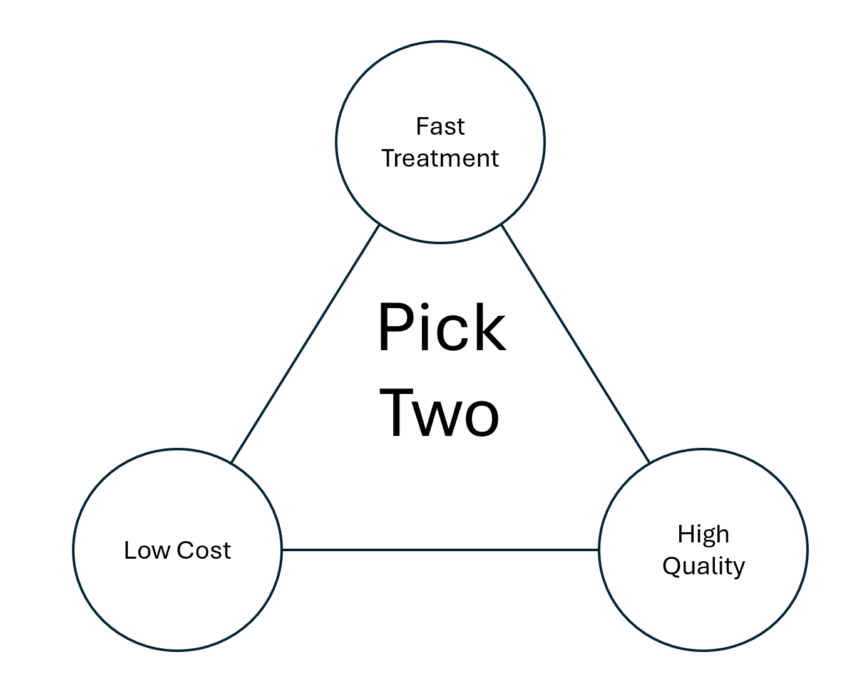

Colorado Legislative Session 2024

Last week marked the beginning of the Colorado legislative session, and over 160 bills are already being proposed to amend everything from tax treatment to studying healthcare. This week we’re taking a few minutes to highlight some more salient and relevant bills in the legislative session that may come to impact you at a personal or work level. None of …