Last week marked the beginning of the Colorado legislative session, and over 160 bills are already being proposed to amend everything from tax treatment to studying healthcare. This week we’re taking a few minutes to highlight some more salient and relevant bills in the legislative session that may come to impact you at a personal or work level. None of these bills have passed as of yet, and many may not come to pass, but being an effective manager of your financial future sometimes requires an understanding not only of what’s going on right now but also of what may come to pass.

HB24-1005 – Health Insurers Contract with Qualified Providers

This bill attempts to solve a common problem: You have health insurance through work, and perhaps you have a serious medical condition that requires seeing a particular doctor or specialist over time. Suddenly, at the open enrollment period, your employer says they’ve switched insurance networks and are now offering a different medical insurance package. Consequently, suddenly you’re out of network for your specialty provider and potentially out of pocket for significantly increased healthcare costs.

What the bill proposes is that employees who experience a situation like the one described above can continue to see their old healthcare provider, and require that their employer cover the additional costs. While that might seem reasonable at face value, there are, of course, some serious issues that come with the bill as proposed. First and foremost, there is no cap on this obligation. This means that even a small business could be on the hook for tens of thousands or hundreds of thousands of dollars, even millions of dollars, in employee-incurred medical expenses. Even on a larger scale, this issue only magnifies. Imagine a company like Walmart attempting to change their healthcare for their tens of thousands of employees in Colorado; there’s little to no chance that such a change would not only expose the business to an enormous potential medical liability but that it would effectively cripple the ability of any business to make healthcare coverage changes for their employees.

Ultimately, while there is a problem to be solved here, the mechanism of shifting uncapped financial liability at scale to employers is unlikely to end up passing. However, if it does, expect some serious changes to healthcare coverage at your employer or within your business before any effective date takes place.

HB24-1008 – Wage Claims Construction Industry Contractors

This bill is also attempting to solve a common problem. Often when you or a business hires a general contractor to complete a construction contract, that general contractor then hires numerous subcontractors to complete the work. The subtractor companies are then paid by the general contractor. However, subcontractors in the construction industry are at the top of the list for businesses that often engage in wage theft, e.g., not paying their employees for the work they complete on projects or simply going out of business during the scope of a project, and being unable to pay their employees.

This bill presents that the general contractor should be liable for the wage claims of employees of subcontractors in the event that their subcontract employer doesn’t pay them. This seems reasonable at face value, right? These folks did the work and aren’t getting paid! Unfortunately, this proposal presents a solution in search of a problem. There are already numerous state and federal laws regarding wage theft that present remedies to employees who need to take their employer to court. Yet, the proposal here suggests shortcutting those measures and simply asking the general contractor, and by extension the customer, to pay for the same labor twice.

HB24-1075 – Analysis of Universal Health-Care Payment System

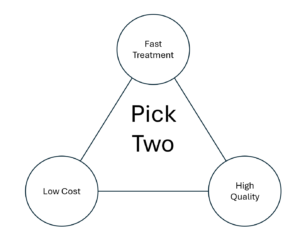

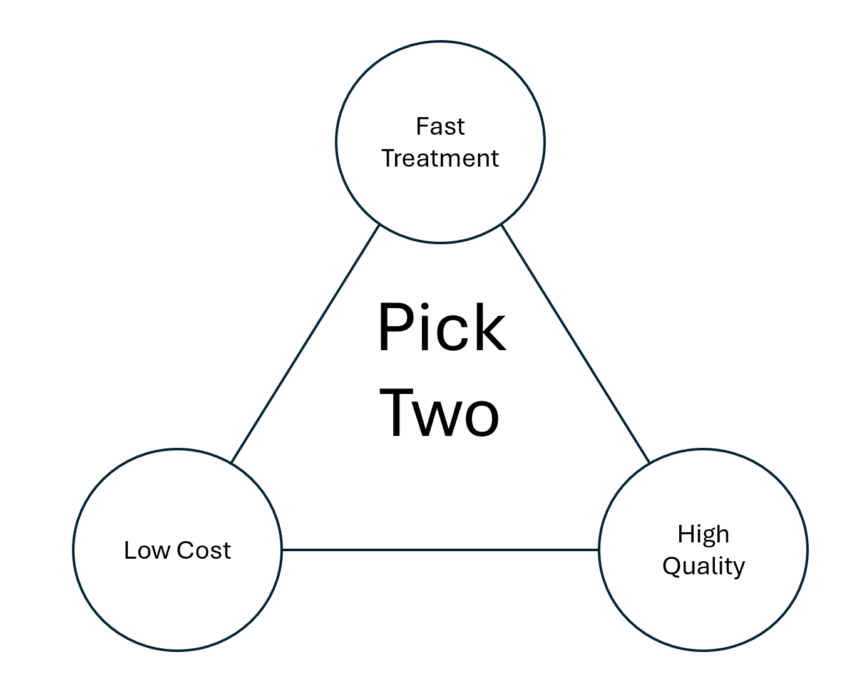

Presented by our very own Longmont representatives McCormick and Jaquez Lewis, this bill proposes to resurrect the long road toward a single-payer healthcare system in Colorado. Every legislative session for the past several years has presented a proposal to move Colorado to a single-payer system, and every year, it has been defeated or pushed back. This iteration proposes conducting a study on the topic, which can then presumably be used to present a single-payer bill with the data generated from that study in a future term. While this has no immediate impact on you, whether you’re an individual or a business, a shift to single-payer will have natural consequences. The policy around healthcare providing simply dictates that you get a “pick two” problem:

If the bill passes during this legislative session, we can expect to see a proposal for its adoption in the upcoming 2025 legislative session. This may be more or less preferable to you, depending on exactly how it’s proposed and in particular, how they anticipate funding a single-payer system.

SB24-033 – Lodging Property Tax Treatment

This bill proposes that residences used as short-term rentals (< 30-day average duration) for 90 or more days per year should be classified as lodging property, which means that the properties would no longer be classified as residential properties but commercial properties, which incur a 29% tax rate. Functionally, this has been proposed to even the playing field between conventional hotels and investment properties, and if it passes, will naturally increase the amount that needs to be charged for stays in such VRBO and AirBnB properties, along with condo associations and other housing that are popular in ski towns such as Vail and Breckenridge. This naturally impacts you both if you are an investment property owner with short-term rentals but also those of us who like to take trips up into the high country. Keep an eye on this, and plan your vacation budgets accordingly!

HB24-2030 – Railroad Safety Requirements

This bill has little to no impact on your finances, but if you’re a resident of Longmont, it may dramatically improve your quality of life. The bill proposes capping trains passing through Colorado’s residential areas at no greater than 8,500 feet (1.6 miles) and making it illegal for trains to block a crossing for any longer than ten minutes. While I’m certain this bill will be fought against hard by the railroad lobbyists, I would happily spend a lot less time waiting for trains in Longmont!

Comments 1

What would I do without you to keep me apprised of such as this?

Regarding a “One Payer” healthcare system it seems dangerously close to socialized medicine. They may not actually own the hospitals but they effectively call the shots. Admittedly our medical system needs help but I question whether having a one-payer system would be an improvement.

The other “fixes” for construction contractors and health insurance provided by businesses seem, as you pointed out, to only add another layer of difficulty instead of actually fixing anything.

I love hearing about this sort of thing. Thanks