Believe it or not, you have some lines of a drama or comedy memorized. Sure, we all know quotes from our favorite movies and shows, but that’s not what we’re talking about today. Rather, you have a script that you follow day to day in your financial life. It’s a pre-written set of lines that you lean on in times of financial decision-making and determination. These are called “money scripts.” Money scripts feed us certain knee-jerk and default heuristics that help us determine how we’ll deal with financial adversity or opportunity, sometimes for the better, sometimes for the worse. So today, we’re talking about money scripts and where they might show up in your life.

The Origin of Money Scripts

There are two origins for money scripts; those that we recognize academically and those that affect you personally. The academic origin of money scripts comes from the “Klontz Money Script Inventory,” an assessment that indicates how much you do or does not show evidence of assorted money scripts in your life. The documented money scripts include money avoidance, money focus, money status, and money vigilance.

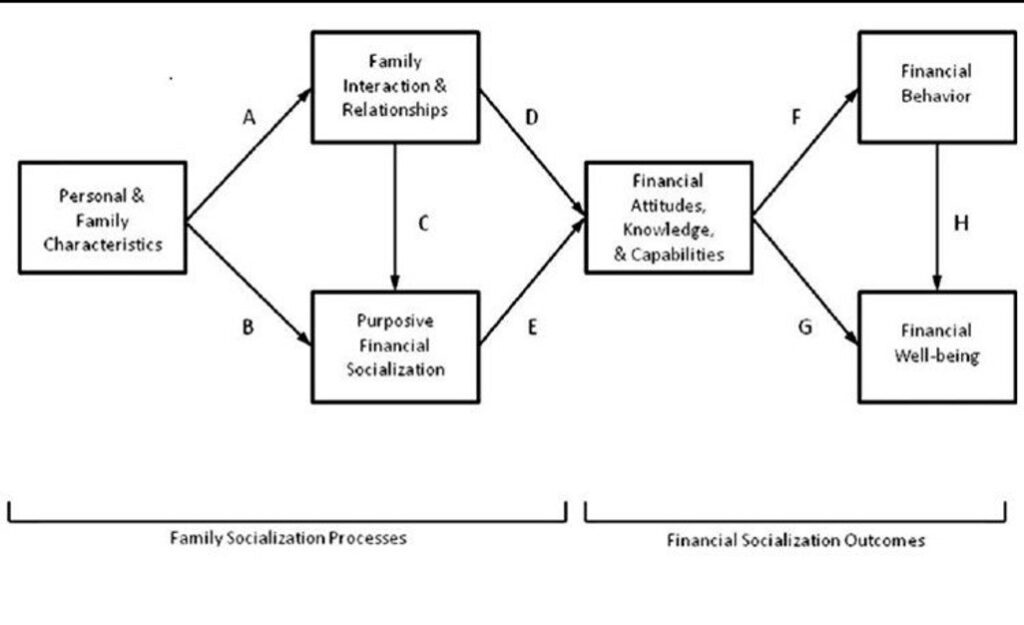

Insofar as to how you’ve developed money scripts, you, unfortunately, had little say in the matter. Money scripts are engrained from early childhood as we are exposed to money directly and indirectly by our family members through a process known as family financial socialization.

This process is informed by many elements, including your cultural background and upbringing, direct money education by parents and peers, and the lessons passively adopted over time. An interesting element of financial socialization and money scripts is that even people born in a very similar situation, such as twin children of a single household, may develop different money scripts based on the slight differentiation of their perspectives and how they processed the experiences with money they had in their youth. For example, if such twins were brought up in a low-income household, they might separately have a money avoidance and a money focus script, respectively. One might internalize that because the family never had money, they need to constantly obtain it and hold onto it, while the other might rationalize that no matter what they do, there will never be money, and thus they spend recklessly.

It’s important to know that going in, money scripts are like seasonings. A little bit of any given money script can be good for someone, but too much can be disastrous for their financial, mental, and physical health. All that said, let’s talk about the four money scripts and what they may signify in both good and bad terms.

Money Script #1: Money Avoidance

Money Avoidance manifests in negative beliefs about money. We’ll share some examples of how money scripts can manifest, provided in “The Psychology of Financial Planning” by Klontz & Chafin here and in other sections:

“Rich people are greedy.”

“Good people shouldn’t care about money.”

“It’s not okay to have more than you need.”

“It’s hard to be rich and be a good person.”

“Most rich people do not deserve their money.”

“Money corrupts people.”

“There is virtue in living with less.”

Does this sound familiar? These negative beliefs can lead people to exert both external and internal negativity around money. Because of the money avoidance script, external manifestations can include being judgmental or hostile toward people with wealth. It can also form a sort of envious behavior, not one that desires to have other’s wealth, but rather, one that manifests in a desire that others do not have wealth. Phrases such as “tax the rich” come to mind here. In terms of internal negativity, the money avoidance script can manifest in the form of forgoing the accumulation of wealth. This might mean taking work or occupations that yield lower incomes and failing to save or invest money for the long term.

Yet, as mentioned previously, a light application of a money script can be beneficial. Those with a money avoidance script may act more generous with their money, supporting friends or family members, or donating to charity regularly. This can be seen in the individuals who, despite lower incomes, may still give a percentage of their income as tithes to their church or as regular donations or money “loaned” to others despite a regular experience of never being repaid. Ultimately, the benefits or harms of a money avoidance money script tend to be reflected in whether the avoidance of money is hindering an individual’s long-term financial health.

Money Script #2: Money Focus

Somewhat the opposite of the money avoidance script, money focus manifests as an obsession with the accumulation of money. From “The Psychology of Financial Planning,” we see the following examples:

“More money will make you happier.”

“There will never be enough money.”

“You can never have enough money.”

“Money would solve all my problems.”

“Money is power.”

“Money buys freedom.”

Sound like any billionares or dragons you know? An important element of money focus is that the obsession with having money itself does not necessarily manifest itself in opulent displays of wealth. This type of behavior can be seen in those who might be described as an “Ebeneezer Scrooge”* The accumulation of money does not serve to provide for a great quality of life, but for its own sake. The external negatives of this type of behavior can be displayed as a lack of generosity or miserly nature, particularly in those who might otherwise have the means to provide support or philanthropic support to others. In internal terms, the negativities of a money focus money script can manifest by failing to spend money necessarily on themselves. This can include forgoing healthy food or medical care, never taking time off of work, or avoiding what the individual might perceive as frivolous spending where others would see the benefit. Ultimately, the money focus script’s primary negativity is that the attention of the individual is on the money itself, rather than what the money can provide. At MY Wealth Planners, we often like to say that “money is permission”, and a money focusing individual is more interested in having the permission than using it.

Yet, as with money avoidance, the money focus money script can have its benefits in light doses. A focus on money can lead an individual to display responsible financial behaviors, such as pursuing increased income and growing their career and earning potential, saving and investing money consistently, and planning ahead for the accumulation of wealth. A money script of money focus is not so uncommon among financial planners and those people you know who do successfully build financial wealth over time; but as with all things, we must keep in mind that we can’t take it with us, and consequently, it behooves us to carefully use money to better our lives.

Money Script #3 – Money Status

Money status is a money script that can also be called “money worship”. A money status money script displaying individual is not concerned with the accumulation of money like a money focused individual, but is focused on displaying their money or ensuring that their wealth is visible. While a money focused individual might live in a small house and drive an ancient beater of a car, a money status obsessed individual would never be caught dead in anything second best. From “The Psychology of Financial Planning,” we see these examples:

“Your self-worth is your net worth.”

“If something is not considered the best, it’s not worth having.”

“People are only successful as the amount of money they earn.”

“I will not buy something unless it is new.”

“If someone asked me how much I earned, I would probably say more than I actually do.”

If you were wondering, yes, this is the money script almost every “wealth guru” demonstrates. Every video you see of someone driving a Lamborghini or selling courses on how to get rich quick, is typically someone with an extremely overinflated money status money script. That said, the impacts of a money status money script are glaringly obvious. In terms of the external damage, this type of individual can influence their peers to overspend or engage in reckless financial consumption in an attempt to “keep up with the Joneses.” Internally the damage is no different. While some people do have such high income or levels of wealth that they can live a fairly opulent lifestyle, this doesn’t apply to the vast majority of people, and consequently, many people who look rich on the surface are “all hat, no cattle” as the saying goes.

Money Script #4 – Money Vigilance

A curious manifestation of a money script, money vigilance is a contrasting hybrid of money focus and money status. While obsessed with obtaining and growing wealth, the money vigilant individual is also rather cautious about spending or sharing their wealth. The final examples given from “The Psychology of Financial Planning” are as follows:

“Money should be saved not spent.”

“It is important to save for a rainy day.”

“You should not tell others how much money you have or make.”

“It is wrong to ask others how much money they have or make.”

“If you cannot pay cash, you shouldn’t buy it.”

“It is extra extravagant to spend money on yourself.”

“I would be embarrassed to tell someone how much money I make.”

“It is not polite to talk about money.”

Can you see where some of these beliefs can be helpful and others harmful? While saving money for a rainy day is likely a positive financial behavior, things like not talking about how much money people have or make can lead us to tough financial positions. The external examples of a bad money vigilance script are things like an inability to talk about money; this can be harmful to people’s career and earnings, but also can set up family members for financial struggles. Think of the parent who won’t tell their children about their money situation, potentially setting their children up to have to pay and care for them in old age, or who give their children money to help them in life while sacrificing their own financial security to do so.

Internally, money vigilance can lead someone to fail to handle their own finances. An inability to discuss money with others can lead people to fail to ask for help when necessary, or can set one back in their ability to address financial challenges when they are too self-reliant or lack the ability to overcome a financial hurdle without being more open about their finances.

That all said, money vigilance, like all other money scripts, can have its upsides. Saving money is beneficial. Ensuring that you’re not overspending or buying things you can’t afford helps you avoid the obvious financial problems that come with spending more than you make or accumulating debt to fund a lifestyle beyond your means. Money vigilance can, like all the others, truly be a valuable bias… in small doses.

Dan’s Money Scripts

You can take a Klontz Money Script Inventory to get a score in the various money script dimensions, but as I often do, in the spirit of sharing, I’ll share my own money scripts. I display a moderate money vigilance script and a low score in the other money scripts. Not too surprising for a financial planner, I hope? Understanding that I do have a money vigilance script that can lead me to be overly stingy or otherwise horde money inappropriately, I have set boundaries for myself. I’ve written about this in greater detail before, but here are some of the highlights:

1) I do maximize saving in my 401(k) plan and fund Roth IRAs for myself and my wife. Otherwise, I don’t deliberately save or invest other than twice-monthly transfers to savings, HSA funding, and the premiums on a variable universal life policy.

2) I pay all bills “in advance”, so that we’re ahead on mortgage payments, utilities, student loans, and any other liabilities that might exist throughout the money.

3) I spend whatever remains without any concern for whether it’s “prudent” or not.

Now admittedly, the financial means to accomplish #1 aren’t available to everyone. #2 is a luxury afforded by having the savings to “pay ahead” rather than “pay when due”. And #3 certainly leads me to eat out a bit more than I should or to fly first class when I’d probably be just fine flying coach. Yet, the intention of these systems is founded in the understanding that without some of these rules in place, I would likely be over-saving even more than I already do, and that could come at the cost of the quality of my relationship with my wife and those in my social circle. A recognition that no day is guaranteed to me, and that ultimately, life is meant to be lived.

Money Scripts in Closing

So what are your money scripts? What phrases jumped out at you as you read through as things you’ve said or believed? Perhaps even still believe at this moment? Remember, money scripts are not intrinsically bad. They are like anything else, best taken in moderation. We don’t have a lot of choice over the money scripts we have and those we grow up to develop, but being conscientious of our money scripts can be helpful in recognizing when we’re giving into an indulgence or withholding things that are necessary for living a good quality of life. Be mindful of them and they can be helpful; be thoughtless about them and they can be harmful.

*Amusingly, Dr. Klontz has also written a book called “The Financial Wisdom of Ebeneezer Scrooge.”

Comments 1

Most interesting! This information is more up my alley – I get it and even understood every word! A good question: do I have a “healthy” relationship with money?

P