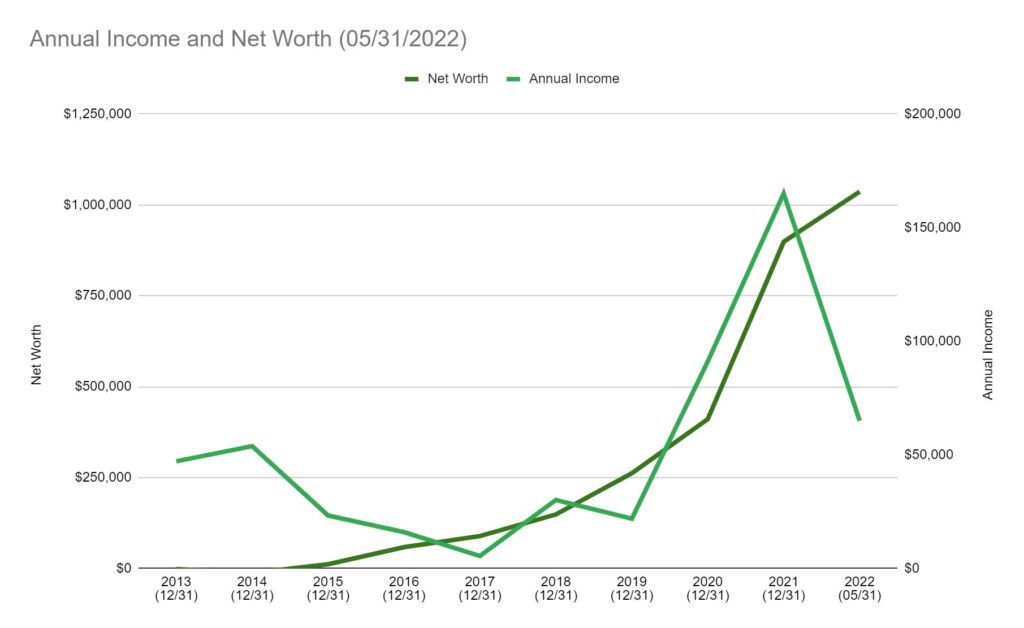

Well, this is an awkward brag of sorts, but as of May 31st this year, it appears I’ve become a millionaire. I’ll get it out of the way and say that I don’t feel like a millionaire. I certainly don’t live like one, or at least, I don’t live like what I’d think of a millionaire as living like. I’m also keenly aware that many reading this might find it a bit crass to talk about reaching this socially vaunted “accomplishment” during a market downturn and while fears regarding a recession are being stoked in the media. I ultimately have chosen to share the news and story more as a motivating illustration of a rough path that can still have a good outcome with time and patience. To be frank, there are plenty of reason to doubt that I’d ever make it here. Please know that I decided to share today in the spirit of gratitude and humility. So, here it is: the story of becoming a millionaire before my thirty-second birthday.

2013

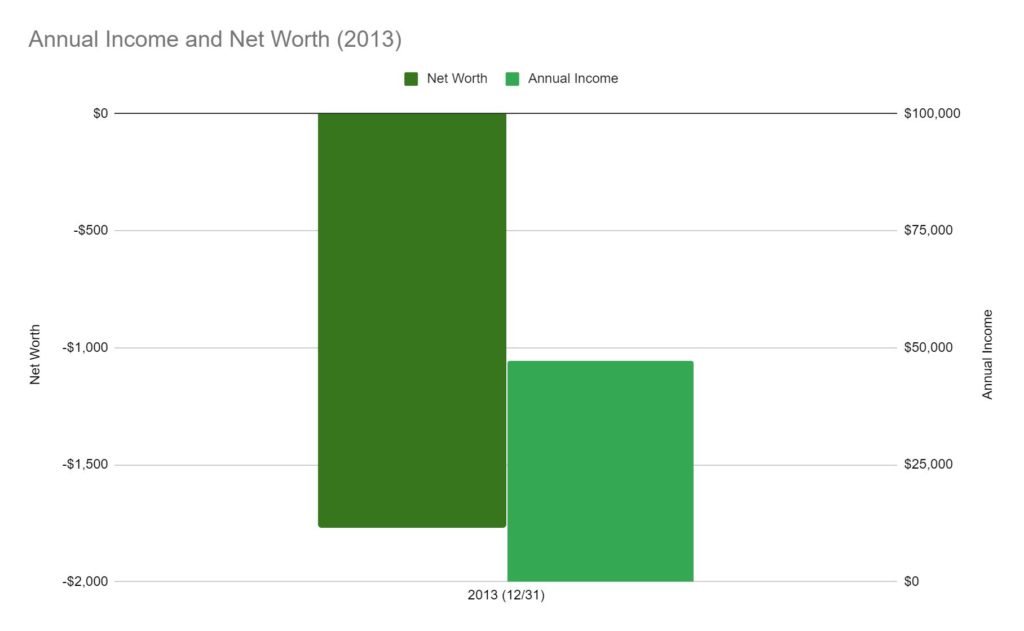

Though the financial journey from negative net worth to millionaire (the titular seven years) started in 2015, some important groundwork began in 2013. In 2012, I’d transitioned to civilian employment out of working solely for the US Army up to that point, and started a job with IBM. The position was originally as a contractor in their IT Services division where I worked on a Department of Defense account, supporting the IT infrastructure of the various stores on military bases. I quickly was promoted from an entry-level position to a role as a trainer. I was still serving in the Army Reserve, but a year into my civilian job, I’d decided I wanted to get my MBA. This was a big change from my undergraduate studies (History, Political Science, and Military Science,) but represented an important pivot. I’d studied those softer subjects because my intent at the start of undergrad had been to stay in the United States Army for my full career. Part of my transition to only being in the reserve component had been that some health issues had begun to crop up, and it was becoming increasingly likely that I wouldn’t be able to stay in. Without the Army as a full-time career path, a serious course adjustment to my education and skills needed to be made. Knowing about the history and political functions of the world made sense when you planned to serve in the military for life, but outside of government service, those skills limited the upside significantly. So I made the transition to a business graduate degree and started in the Fall of 2013. At the time I started grad school, my take-home income was about $2,480 per month from IBM, plus just under $300 take-home from my Army Reserve drill weekends. I was spending just under a thousand dollars on rent a month, which left me with around $1,800 for everything else. Being single, without kids, and with essentially no debt up to that point, I made the commitment that as I went through grad school, I’d pay $500 per month towards paying off the student loans I’d accrue. In a twenty-one-month program, that would put me over ten thousand dollars ahead with respect to my total debt load. However, by the end of 2013, I’d earned a gross income of $47,125, and with the accrual of a semester of student loans, my net worth was negative $1,765.

2014

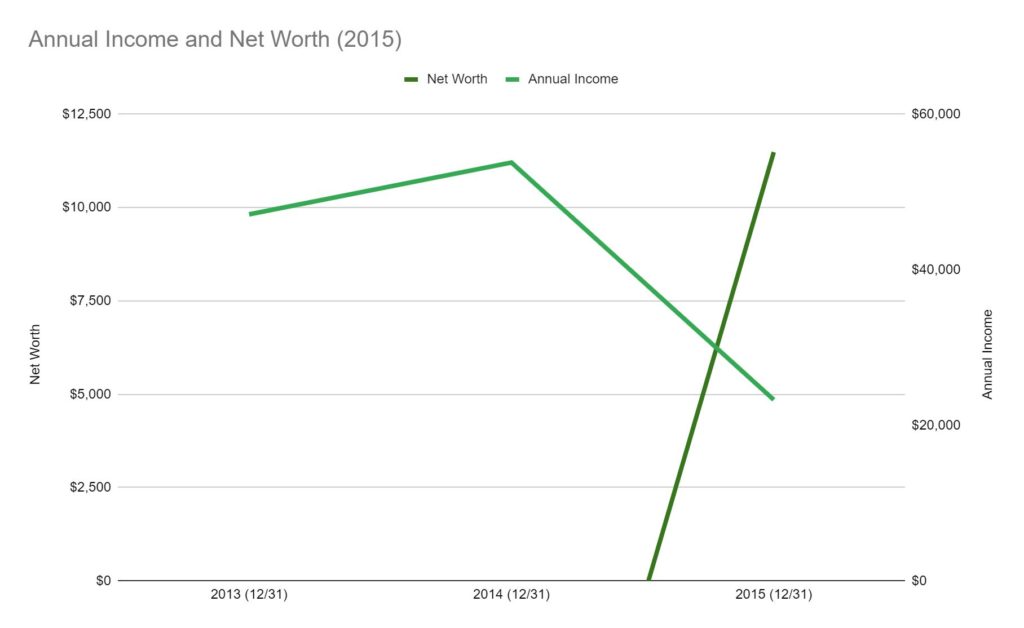

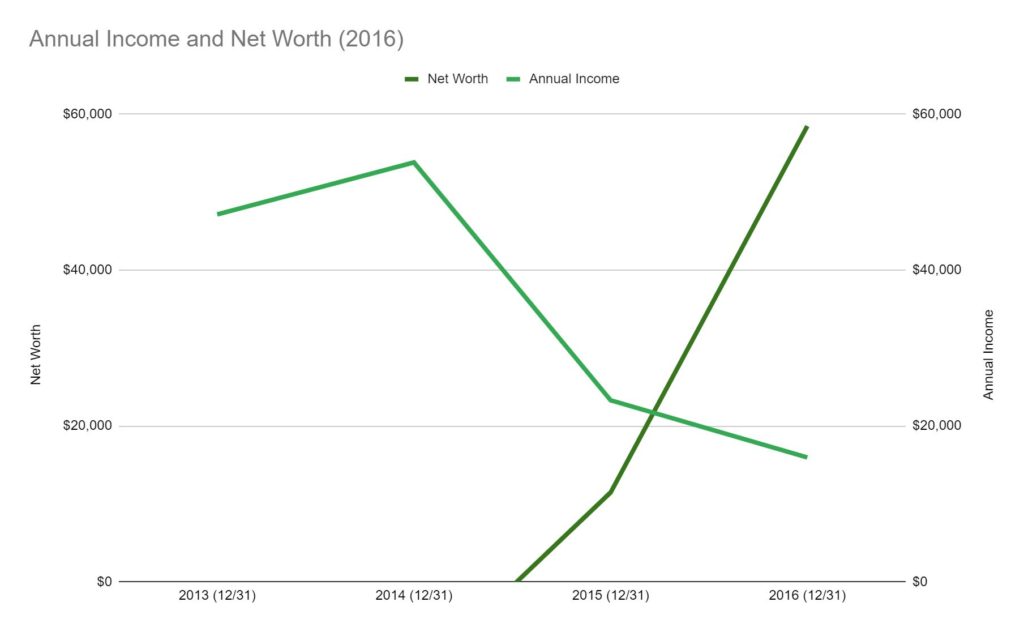

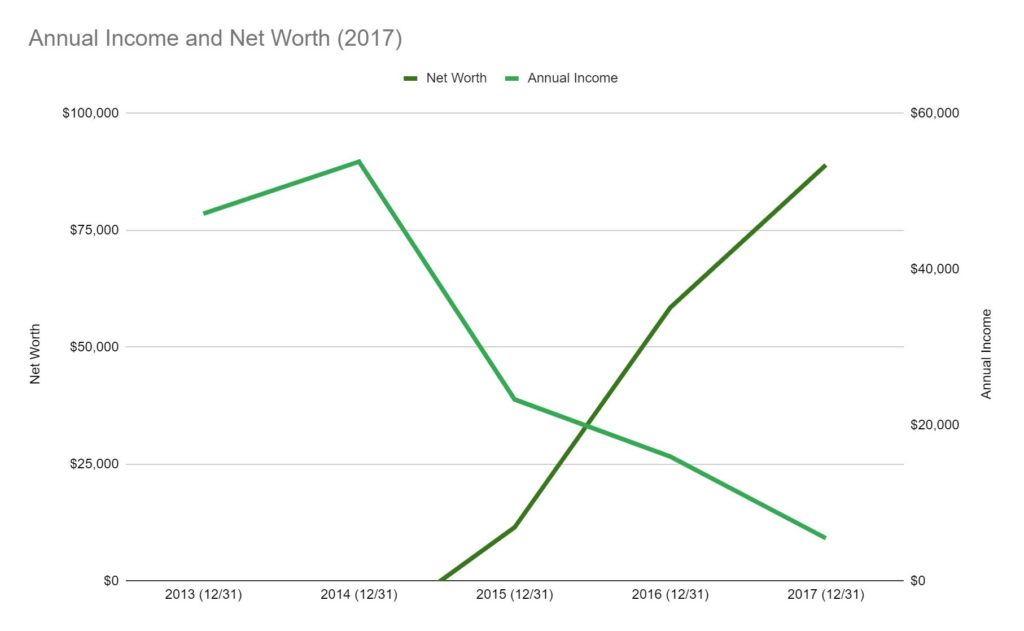

The next year came with a few changes but more or less the same course. I was still in the Army Reserve but completed my term of service and received an honorable discharge in August. At the same time, I’d been assigned to a new client project at IBM and was on a team responsible for transitioning the services of a Fortune 500 company’s IT division over to IBM for outsourcing, and as a result, had a significant amount of overtime. Another important event was that I’d been converted from a temporary contract with IBM to a “Regular” position, meaning that I had a permanent position with IBM. An important choice during this time was to select a concentration in finance as part of my degree. Still, grad school required financing, so while my income in the aggregate increased, my net worth was continuing to decline. By the end of the year, I’d booked $53,791 in income and my net worth had declined further to negative $12,542.

2015

Here’s where the story of becoming a millionaire picks up in earnest. In 2015 a few major events occurred, both good and bad. First, I graduated with my MBA from CSU with a concentration in finance. Second, after interviewing at dozens of financial institutions, including banks, insurance companies, institutional finance, and personal finance firms, I’d made the decision to take the leap and become a full-time financial planner. I handed in my two weeks on July 1st at IBM, and my practice officially started on July 16th, 2015, which also happened to be my twenty-fifth birthday. In preparation for the change, I’d spent months studying for and obtaining my securities and insurance licenses (Series 7, Series 66, Life, Accident, and Health,) as well as starting to save as much extra as I could while still putting extra $500 payments into my student loans. On the day I launched my practice, I had $2,864.53 in savings, $2,316.06 in checking, and $14,928.61 in student loans. I owned a 2001 Santa Fe Hyundai with 110,000 miles on it, some personal effects, and lived in an apartment. I had a negative net worth of $9,748.02 and no income.

A Quick Lesson on the Financial Planning Business

Before our story continues, a quick lesson on the economics of financial planning practice and the valuation of a practice. When I started my practice, I was affiliated with Waddell & Reed Financial Advisors (a firm that no longer exists), where I had a 1099 contractor role. From a very literal government regulation and taxation standpoint, this essentially made me a salesperson for Waddell & Reed. In practice, the business structure was that you were starting an independent financial planning practice, where you would pass business through Waddell & Reed using their investment platform, technology, and coaching resources, in return for a split of revenue (essentially 60-40, with some tweaks and costs built into it.) This meant that I was free to help clients with financial planning, to advise them as I saw fit, and to recommend the products or services I could provide, but that I would only be paid out 60% of the total revenue generated; And that was before costs such as marketing, extra technology, mileage, an office, and other costs of doing business came into the picture. The last lesson I’ll share on the topic is one of valuation: financial planning practices are highly valued as business assets because of their very clear financial metrics, strong regulatory protection of the business, and their significant potential for recurring revenue streams. As we go forward, a major part of my millionaire story is one of the accumulation of value in my practice. While practices are often valued at anywhere from 3x-10x the trailing twelve months of revenue in the practice, I’ve always taken a very conservative approach to valuation. For your understanding, I’ve valued all transactional business (the one-time sale of something like a mutual fund or insurance product) at 1/4th the annual revenue generated and the value of all recurring business (investment management, financial planning subscriptions, etc.) at a conservative 2x valuation.

Back to 2015

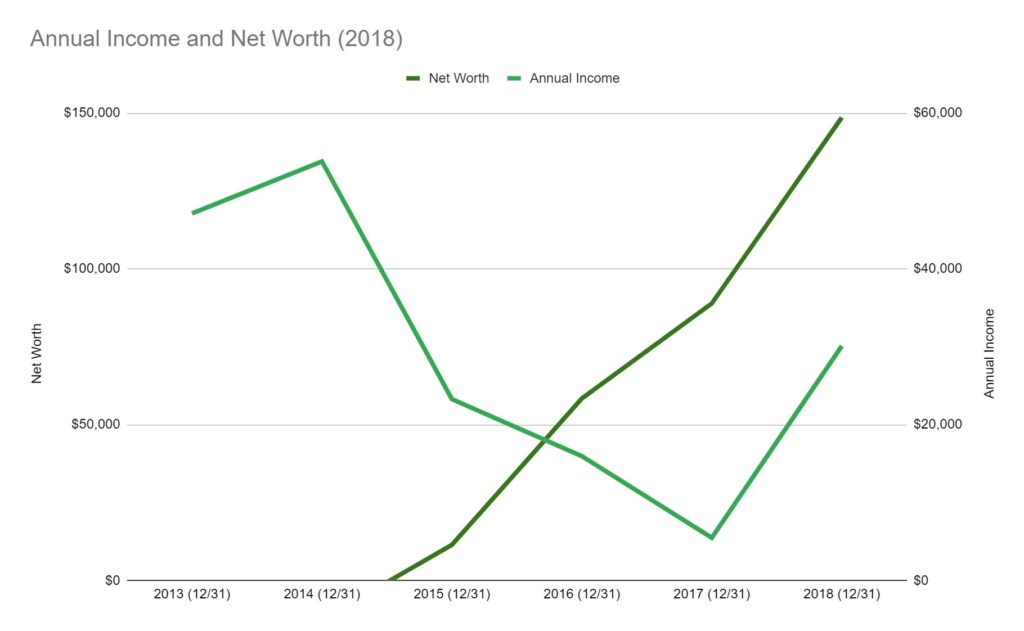

The start to the practice was rough. While I had a few early victories in the first few weeks, I essentially burned through my cash reserve by the beginning of October (only two and a half months into the practice) and was facing either a shut-down or taking on debt to keep going. I bit the bullet, took out a credit card with a 15-month no-interest promotion, and began a cycle that would persist for years. Spending up to the limit of the card, hitting a break in the practice, paying off the card, and then living off the card again for the next few months. I would repeat this practice in increasing cycles for the first three years of the practice, at one point holding $24,000 in credit card debt. By the end of 2015, I’d managed to net an annual income of $23,296, which was essentially the money I’d made from IBM before starting the practice, and having booked a loss on the practice’s first six months of operations. In turn, my Net Worth had turned positive, reaching $11,485, but only by the measure of the meager transactional business and small amount of recurring revenue I’d built with initial clients.

2016

My first full calendar year as a financial planner perpetuated some of what I’ve already described. While I managed to hit a 12-month revenue target of about $91,000 in my practice by its first anniversary, I immediately hit what W&R’s district manager called the “sophomore slump.” From July until almost November, essentially no new business came into the practice. I’d hit the rock bottom of $14,000 available on the two credit cards I had at the time, and only by the sheer miracle of a single referral from a client, did I bring on one large new relationship in November that “righted the ship” and brought me back to about net-zero. After launching the practice, I’d gotten very conservative with my treatment of student loans, dropping payments from the $500 per month I’d done while still a student to the loan-payoff minimum of $173.13/month. However, by the end of 2016, with business losses from 2015 dragging and a significant number of business expenses in attempting to grow the practice, I showed only $15,969 in net income for the year on over $111,000 of new business. On the positive side, the value of the practice had jumped a bit, and my net worth reached $58,454, purely through the combination of paying some of my student loan balance down and the appreciation of the practice.

2017

This year represented the bottom of the “swoop.” There’s a comic about successful entrepreneurship that uses the metaphor of jumping off a cliff, assembling a plane mid-fall, and swooping up just before hitting the ground. 2017 was the year that I finally constructed the plane. That year, I showed around $150,000 of revenue in the practice, but as with 2016 and as mentioned before, throughout the year a cycle of taking out a new interest-free credit card and building up the balances before hitting a business success and accomplishing a payoff had hit its maximum point, with mid-year credit card debt reaching $24,000 at the low point, paying for everything from utilities to rent. A few positives did kick in this year, however. I moved into a rented house with my girlfriend at the time, which helped decrease the rental costs by a bit, and some of the recurring revenue from the practice had started to pick up. One of the mechanisms Waddell & Reed offered to new financial planners in their network was the ability to “advance” up to three years of recurring revenue fees. If a client invested $100,000 at a 1% annual investment management fee, you could be loaned $3,000 by Waddell & Reed, which could then be recouped over the next 36 months. By the merit of good investment selection and healthy markets in the time since I’d started, a lot of my first-year recurring revenue loans had been paid off in less than three years, which meant I started to be paid on those lines of business again. Still, by the end of the year, despite the continued growth of the business, I showed a net worth of $88,945, but an income of only $5,496. However, the future was looking up, with recurring revenue beginning to pick up month by month both through the loan payoffs, and the growth of the practice.

2018

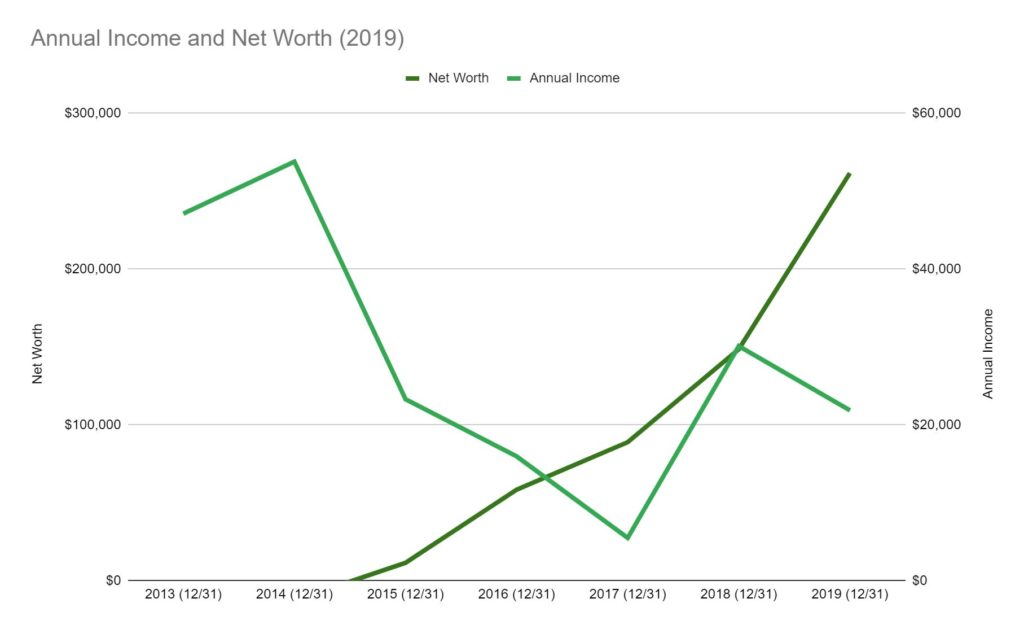

This year served as the first year that I really had a base of income and started to get ahead with respect to the cycle of taking on debt and paying it off. Throughout the year, I finally got the gross $24,000 of credit card debt paid off and began to live on a consistent base of recurring revenue from the practice, finally being able to focus more on the long-term growth strategy of the practice instead of constantly having to work for short term wins to stay in business. This year also brought some major professional wins, having reached the required experience of 6,000 hours of practice to hold the CERTIFIED FINANCIAL PLANNER™ Certification, and also completing the curriculum to become an Accredited Investment Fiduciary. By the end of this year, practice revenue had leaped over the $162,000 mark; while this might seem like a slowdown compared to the previous jumps from $91,000 to $110,000 to $150,000, a major component of this was that almost all of the revenue was from recurring business, rather than having a much more equal division between transactional business and recurring revenue. This was also aided by the implementation of a “synergy” program at Waddell & Reed, in which you could negotiate a higher split of revenue in partnership with another financial planner affiliated with the firm, which allowed my practice to start receiving 75% of the revenue generated. All of this meant that by the end of 2018, I finally had an upward trajectory in income, showing $30,114 of net income, and my net worth had grown to $148,560.

2019

This was a year that changed everything. In May of this year, I attended the Financial Planning Association’s Retreat, followed by their Nexgen Gathering in June. I learned a lot at these conferences, but the most significant thing they provided for me at the time was a shift in perspective: I didn’t want to do transactional business anymore. One of the primary appeals to working with Waddell & Reed and being a fee-based advisor up to that point in time had been the value of “having the full toolbelt.” By offering financial planning, and then having the ability to implement most of the solutions financial planning prescribed (investments, life insurance, long-term care insurance, etc.,) I felt that I was a valuable one-stop-shop for my clients. This had also been incredibly valuable to the survival of my practice. While I would swear under oath that I only ever recommended transactional business (insurance, mostly) in the best interest of my clients and after a financial plan had dictated the necessity of those products, I was keenly aware that my practice had only survived up to that turning point in 2017 by the revenue produced by the commissions from those products. While recurring revenue from investment management and financial planning had been picking up year over year, they grew very slowly compared to the sudden spike of income an insurance policy could provide. As I thought about my practice at these conferences, I realized that going forward, I didn’t want to have the conflict of interest a commission created in my practice anymore. Even though to this day, I often recommend clients obtain more insurance or purchase commissionable products from time to time as part of their plan, I wanted to give that advice knowing that the advice was given solely because their financial plan indicated its necessity and have not a shadow of a doubt that a commission could influence that recommendation. I took months to adjust and prepare, but in October of 2019, I gave my notice to Waddell & Reed that I would be converting to a fee-only practice, where I would only be paid by my clients. For the next two months, my practice would effectively be shut down while waiting for the State of Colorado to complete its due diligence regarding the launching of a fully independent registered investment adviser firm; this meant for a stint, I was once again living on savings, but by December the practice was approved by the state, and we were able to transition our clients over to the model. Still, the interruption cost us tens of thousands of dollars in revenue and ate into savings. By the end of the year, my income had dropped back down to $21,874, though my net worth had still climbed up to $261,551.

2020

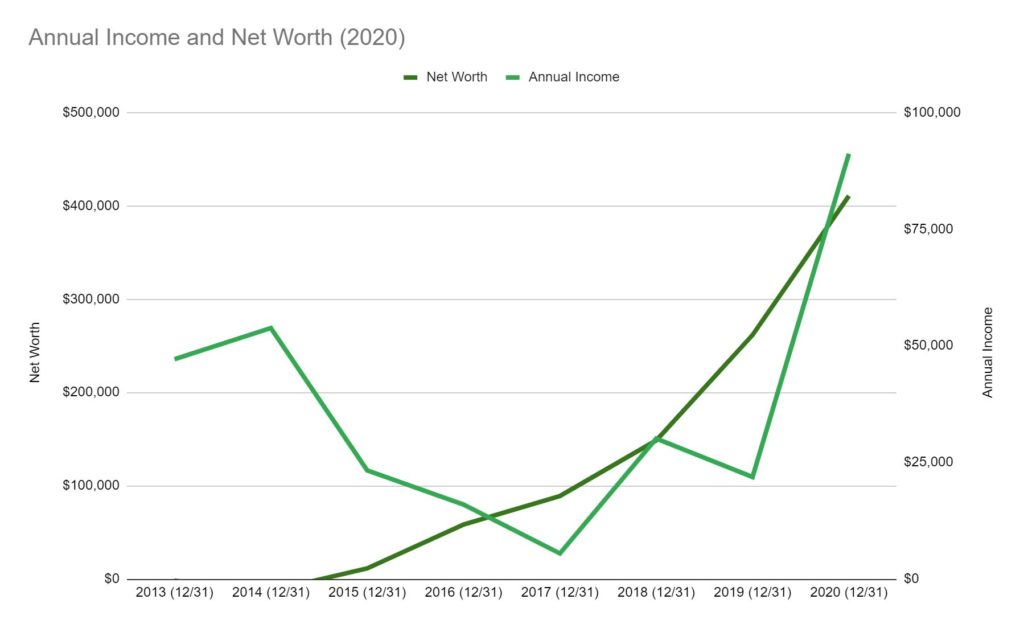

Twenty-twenty was a big year for everyone, and I don’t think we’ll ever forget it. But in terms of my financial journey, it represented a number of major shifts. After the practice had gone fully independent and fee-only, the growth of the practice shot off like a rocket. Not only had we been able to cut the costs our clients paid by offsetting their fees by the difference we now had in terms of revenue (the practice bringing in 100% of revenue versus 75%) but the demand for financial planning, and fee-only financial planning, in particular, the practice grew rapidly. With all clients being converted to long-term relationships through subscription-based financial planning and investment management, as well as the incredible demand for our services, our revenue grew by 90% year-over-year in 2020. This year also signaled a decision to expand the practice beyond myself, presenting an offer to my summer intern, Samantha Rauch, to join the firm full-time when she graduated in 2021. Recurring revenue and profitability were also high enough that I was able to max out contributions to both a 401(k) plan and a Roth IRA that year. All of this, both the rapid growth and the conversion of all lines of business to recurring revenue, brought my income up to $91,985 for the year, and my net worth grew to $410,593.

2021

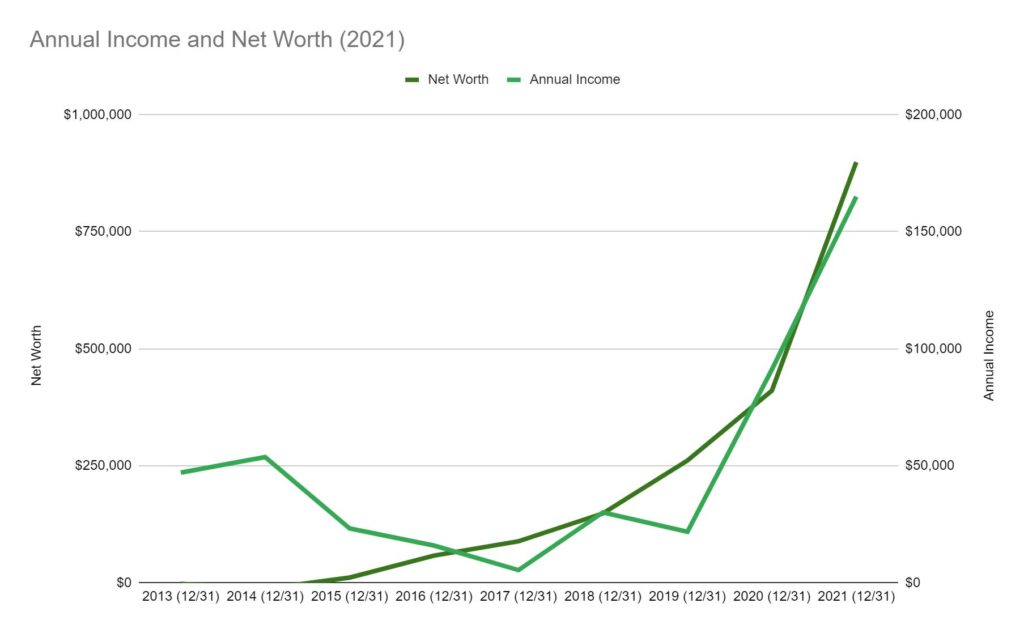

Another blockbuster year for the practice and for me personally, the demand for fee-only services continued to swell, and the practice grew by more than 70% throughout the year. Further, my girlfriend and I made the decision to purchase a home together. In the first half of the year, we aggressively saved, building up tens of thousands for both a down payment and closing costs. I was finally able to return the favor of being one of my first clients to our realtor, and she helped us close on a home in June for a home that cost $645,000, which we financed all but 3.5% of at a 3.125% interest rate. With the increasingly rapid growth of the practice, maximizing retirement account contributions, and a screaming hot real estate market, my net worth shot up to $898,566 by the end of the year, and a combination of the salary I pay myself and the profit and loss of the practice put me at $164,985 of income for the year.

2022 to Date

So here we arrive at the conclusion of the story thus far. I update and recalculate the variables of my financial plan on a monthly basis, practicing what I preach to clients around tracking income, expenses, assets, liabilities, and cash flows. When I sat down on the morning of June 11th to update the numbers, I was surprised to see that I had cleared the fabled million-dollar mark, arriving at a net worth of $1,036,147, largely by merit of a bump in the practice value and the equity in our home. As of six years, ten months, and sixteen days after starting an entrepreneurial journey, I get the dubious honor of calling myself an American millionaire. I’m not unique or alone in the distinction of being a millionaire at 31, but I know that it’s far from common and certainly not usual. While I have the benefit of hindsight and the comfortable safety of having “made it,” at this point, I’m not sure that I would recommend it. I was not born an entrepreneur, it’s not “in me,” per se. I became an unintentional entrepreneur for a number of reasons. Because I didn’t think my career at IBM was going anywhere fast and was validated in this belief when almost all of my peers at IBM were laid off in 2019 as part of one of IBM’s infamous “resource actions.” Because when I interviewed at all of these financial institutions, none of them were interested in paying a premium for someone with a master’s degree and a veteran’s background; they’d made offers, but they just weren’t any different than what they’d offer the undergraduates with no work experience. Even when presented with the opportunity to start a financial planning practice, I’d have gladly accepted even a single job in the financial planning industry if it had been salaried; but all of them were some version of sales jobs or firms that supported you starting your own practice. I ultimately started my own practice because I didn’t feel I had any other choice than to go down this path (I’ve shared this in my book, GETTING IN THE DOOR.) Yet, today, I am a millionaire. Not a cash millionaire, mind you; I couldn’t go to the bank and ask for it all in bills, but a millionaire through the assets of my home, my practice, and my investment portfolio.

Lessons from Becoming a Millionaire in Seven Years

I had literally hundreds of sleepless nights along the way. I had never owned a credit card prior to starting my practice, but I’d heard plenty of nightmare stories about people accruing enormous debt trying to keep a business that failed from going under, only to file bankruptcy themselves. I cannot begin to count the number of times that I longed for a paycheck; a literal longing every first and fifteenth when instead of seeing a comfortable bump in my bank account, I instead was looking at the available credit left on a credit card and running out cash flow spreadsheets to see how much runway I had before I was literally bankrupt. I can’t begin to count the number of times I cried out of frustration when someone who I’d bet on heavily becoming a client ultimately turned me down or said they’d consider it later. I can honestly say that I would not be in practice today if even a single person who became a client in the first year, hadn’t become a client.

Multiple studies have shown that the two greatest correlations with extreme wealth (multi-millionaire and billionaire status) are entrepreneurship and investing in value-generating assets: achieving leverage beyond the time and effort they put in themselves and ultimately creating an institution of increasing value for their customers, employees, and ultimately, the owners (whether a personally held business or a publicly traded company.) But almost all millionaires also show a fanatical obsession with saving: maximizing 401(k) plans, spending significantly less than they earn, and focusing on wealth-building behaviors above and beyond simply making a good living. That leverage shows up even in my journey, having only earned an income of $518,769 in the nine years and five months this story covers. Absent from my own story and the statistics about significant wealth is mention of the graveyard of attempts. Two out of five businesses fail in the first year, and four out of five fail in the first five years. Among financial planners and their adjacent financial advisors, the stats are even worse, with only 13% left after four years on average. If there is a single takeaway I want you to consider for yourself from this entire story, it’s that “Dan has been incredibly lucky and fortunate.”

But there are also some other things I want you to take away. First, when a friend or family member makes an entrepreneurial leap, please support them. Whether you can be a customer or a client of theirs or not, understand that doing business with them might literally be the thing that keeps them in business. You never know if you’re going to be the person who makes their company instead of it breaking. Second, even if you can’t directly support their business by being a client or a customer, every bit of support helps. Buy them dinner, give them someone to talk to, share about their business with your own network, and be an unabashed advocate of them. Third, and possibly the most importantly: You do not have to take this path. Entrepreneurship is incredibly difficult, and despite the potential, it is absolutely a high-risk high-reward activity. The story of income and net worth suggests it but doesn’t spell it out explicitly: There were multiple times I was within a few dollars of hitting the point of failure in this journey. A slower but more safe is probably best recommended: If you want to become a millionaire in your own time, an incredibly reliable formula is to simply be deliberate in building your income, controlling your costs, and being fanatical about saving. Even a small amount of savings over a long-term period, can grow into making you a millionaire.

Regardless of the path you take, simply remember to be humble, grateful, and to focus on your long-term goals as best you can.

Gratitude

I have inferred or implied about a number of people on this path, and I want to take a moment to explicitly share my appreciation for them. Dave, Vicci, Louis, Alisha, Sheila, Chris, Tory, Lawrence, Eddie, Danielle, Sandy, Leiah, Harshad, John, Sally, Anthony, Brandon, and Hoss. I would not have made it this far without your support in that first year, and I will never forget it. Thank you too to each and every individual and family who places their trust in MY Wealth Planners and me to help them on their own financial journey. Thank you, Jared and Anthony, for making practice-saving referrals in the early days. Thank you to Jared again, as well as Ryan and Greg, for your friendship and mentorship. Thank you, Kaitlyn, for being my partner for much of this journey, putting up with me generally, and supporting me every step of the way. Thank you, Ian, Hannah, Autumn, and the other members of the financial planning community who helped me take the leap from fee-based to fee-only and to full independence in my practice. Thank you to the faculty at Kansas State University who put up me with as a student and who have taught me more in two years than I’ve learned in a lifetime. Thank you to Samantha for putting her faith in me as the founder and leader of our firm, and for giving me the enormous responsibility of guiding her in her early career. Thank you to the professional partners who have helped me grow my practice, and who I have the privilege of helping in turn (Mike, Sarah, Karin, Malyka, Kurt, and many more.) Finally, thank you to all of you for following me on the journey so far. There are many miles yet, but I would not be this far without any of you. I would not have been a millionaire in seven years.

Dr. Daniel M. Yerger is the President of MY Wealth Planners®, a fee-only financial planning firm serving Longmont, CO’s accomplished professionals.

Comments 8

Congratulations! It’s refreshing to hear about humble beginnings and the hard work you have put into your practice.

Glad you believed in yourself enough to endure. Chris and I have never waivered in our belief you and your skills. We count ourselves as very lucky to have you as our financial fiduciary and to call you friend.

Congratulations! ??

I could not be more proud of you Son, well done and keep the future train rolling.

Thank you for sharing your story! Your practicality, planning, determination, perseverance are all important qualities to become & stay financially stable. And having known you for part of this journey, I’m happy that you can maintain a personal life and share calmness and thoughtfulness of others.

Congratulations to you for your achievements!

Dan, I knew if anybody could it, it would be you! Success certainly comes through hard work (and some brains). Congratulations and thanks for your continued guidance and friendship.

Pingback: First Impressions - A Bad First Financial Experience

I appreciate that you created a 7-year formula and plan. People should adapt it as it suits their circumstances. It is important to understand that no one gets rich alone or overnight.