I recently had the experience of turning down an $8,000 per year client. They were nice enough people, planning to retire soon, who had saved up a sizeable nest egg and were looking for someone to manage their investments in retirement. We had an initial consultation, discussed their objectives and financial interests, worries and concerns, and explained our financial planning process as it is: a comprehensive and holistic financial planning process that addresses each element of a client’s personal finances, not just one area such as investment. They agreed that would be a good fit for them, went off to gather their financial data, and scheduled their next meeting to review. Yet, when it came time to review their financial data in preparation for that next meeting, we found that they’d given us account balances and nothing else. No holdings, no insurance information, no mortgage or debt information, no estate documents, none of it. This happens from time to time, usually because folks get pulled into the onboarding portal and forget the notes about how to provide additional information that we need. So we reached out, explained that there was missing data, and asked that they provide it before the meeting, and they agreed that they’d look at it and get it done before the meeting. Come time for the meeting: no data.

So we sat down and asked: Why no data? The husband proceeded to explain that he didn’t really have questions about things like life insurance. We explained that life insurance was one small piece of the financial planning puzzle, but that as with any good and comprehensive financial planning process, we want to ensure we’ve looked at everything and covered all bases, lest unknowns cause risks to our objectives. Further, we explained that while life insurance was a piece of the puzzle, we needed information about all the requested areas of their personal finances. Yet, as we gave different examples, the husband would immediately jump in to explain that he didn’t want advice about those things or help with those things, or he wasn’t interested in changing this thing or that thing, or he didn’t really see the need or purpose of reviewing those things. He just wanted us to manage their investments in retirement. In the end, we simply had to say it: “Then I’m sorry, we’re not a good fit for you.”

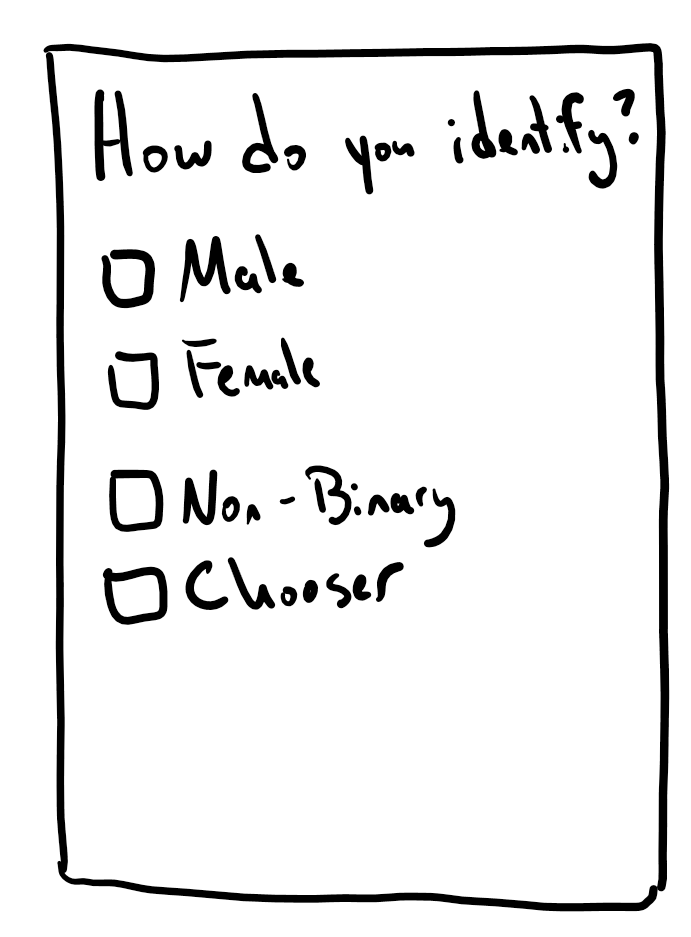

You might think the response is silly. After all, if a client is willing to pay you thousands of dollars to do less work than you’d otherwise do, surely it’s worthwhile, if not actually a great deal, right? Sadly, while the logic is there, the answer is no. Because when you’re good at what you do, nay, world-class, at what you do, you know exactly what you have to offer and how best you can deliver on the value of that offer. This applies to more than simply deciding whether to onboard obstinate clients; the same can be said of whether you should take a job or project or agree to volunteer. So let’s talk about when you need to be a chooser rather than a beggar, and how you can be careful to best use your time.

Say No To The Job

I spend a great deal of my time encouraging people who want to get into the financial planning industry to take a job, any job. The reason for this, is because the marketplace for entry level positions in financial planning are brutally competitive, whereas the market for employees with 2-3 years of experience is incredibly attractive for the job candidate. Naturally then, when someone has skills and is good at what they do, the advice changes for experienced and talented people with a demonstrated track record, rather than for entry level career changers or starters.

Let’s say you’re a skilled software developer. If you are highly proficient in any coding language, or several coding languages, employment is a rare challenge for you. After all, demand of jobs who need talented programming talent vastly outstrips the available supply. Consequently, then, it’s not uncommon to see a software developer change jobs every few years, or even every year, pursuing projects or working for companies that both pique their interest and satisfy their professional drive to do something great. The byproduct of this talent ecosystem is that you see a lot of “vesting compensation,” in which the base salaries are not only staggering in the hundreds of thousands of dollars, but there are often also restricted stock units or other stock grants and bonus compensation designed to entice the talented people to stick around.

An interesting correlary thus arises: Many talented software developers (among other professionals such as talented doctors, lawyers, and project managers) will make a critical mistake. They will say “yes” for the money, when they should say “no” to the work. Their current company will offer something like $225,000 for a base salary and $100,000 in stock compensation that vests over four years, but another company will offer to buy out their existing stock options, pay them the same salary, and offer them a new wave of stock compensation. Seeing an easy opportunity to make a cool $100,000 four years sooner, they’ll job hop to the new opportunity. Taking the money itself isn’t the mistake, but failing to look at the nature of the company or the work itself can be. Let’s look at another profession for the clearest example:

Lawyers are famously miserable at work. This isn’t to say all lawyers, but the subset of “big law attorneys” are often some of the unhappiest. This would seem to make little sense. After all, with things like the Cravath Scale providing even first year attorneys from top law schools with $225,000 salaries, the compensation environment is incredibly competitive. Yet, in an environment where legal talent is borderline as fungible as the money they’re paid with, this can lead to lawyers simply taking offers or better packages left and right, while failing to recognize that even though they might be a talented environmentalism attorney, their cases might go from saving the world from environmental damage to undermining the ecosystem based on a different set of clients and objectives from firm to firm.

We Would Love Your Time

Another area where this can arise is with passion projects. As a volunteer with a number of organizations I’m passionate about (the Longmont Area Chamber of Commerce, the Financial Planning Association, the National Association of Personal Financial Advisors) it is not uncommon to be asked to volunteer for just one more thing. Maybe one group needs help handing out name tags at a symposium, or another would like you to join a working group or committee for a special project. Whatever the ask is, it’s important to know what your boundaries and commitments are ahead of time, because if you simply say yes to everything, you’ll find yourself overcommitted and burned out; worse, on top of that, you may have become a crucial piece of the organization’s puzzle, and feel compelled to stay overcommitted lest things fall apart without you. So, you might decide you can afford to give two hours a week to causes, and if that’s the case, you’re welcome to volunteer however you like within those two hours.

Yet, no good deed will go unpunished. The more often and visibly you volunteer, the more likely you’ll be asked to take on another role or activity. So what’s another 30 minutes a week or hour a month? It turns out: quite a bit. When you’ve hit your predetermined capacity for giving your time, the most difficult part arises: saying no. Yet, a no can be a literal no, or it can be a “yes but.” The version of no is easy: “I appreciate you asking, but I’m at the limit of my ability to take on new projects/roles at this time, and must decline.” The “yes but” is simply the offer to exchange. “I would be happy to volunteer on [the thing], but to make time for that, I would need to stop [existing volunteer activity]. Does that work with what you’re looking to accomplish?” Many organizations will recognize that the trade is worth it or that they’d hoped to have their cake and eat it too, and will decline to give up the good you already do.

Resources are Fungible, but Time is Not

Whether it’s work, play, or anything else, the point is this: You are uniquely talented at what you do, and your time is best spent on that thing. Whether it’s taking the right jobs or volunteering in the right places at the right time, be meaningful in how you spend your time. If you find yourself doing work that you hate, it’s okay to make a change. If you find yourself spending all your time on others and not on yourself, it’s okay to step back. If you are underpaid or underappreciated for what you do, then ditto. You can’t always get what you want and you will find yourself in a position to compromise from time to time, but when push comes to shove, be mindful of your needs, what you enjoy, and how you’d like to spend your time. After all, while they say beggars can’t be choosers, we are far more often going to be in a position to choose.

Comments 1

Yea, verily, so easy to over commit and remembering the operative words “chooser” and “boundaries” makes our retirement “free time” a relief from the rat race and not just a jump from one race track to another.

Also, limiting our commitments means that we have the energy and time to do a good job at what we have chosen. What a luxury to have the time to do something well.