This is a rare occasioned blog in which I’m going to talk about the straight technical. This is a textbook case study of one of the most powerful financial planning techniques that we use with clients, and the good news is, you don’t have to be rich to benefit from using it, though its value does scale significantly. I’m talking about “Roth Conversions,” and today I’m going to talk about the strategies of Roth Conversions front to back so you can know enough to be dangerous the next time you’re thinking about ways to enhance your retirement plan.

Traditional Pre-Tax and Roth

There are three tax categories where a Roth conversion strategy is concerned. There is the traditional pre-tax bucket, which is identified by the use of traditional IRAs, rollover IRAs, SEP IRAs, SIMPLE IRAs, and all traditional forms of employer pension and defined contribution plans such as 401(k), 403(b), and so on. The pre-tax bucket proposal is simple: Get a federal and state income tax deduction today, pay the taxes later in retirement. This makes saving for retirement more affordable in the immediate sense and allows savers to put more money in, making qualifying for the full matching offered by a company plan more affordable, or simply keeping more dollars in your pocket. The average contributor to a traditional pre-tax account is, net of taxes, only going to feel like seventy-five cents or so came out of their paycheck per dollar they contributed, though the amount is bigger for those with higher income and lower for those with lower income.

The next bucket is the Roth bucket. Take almost every account I just mentioned and slap the word “Roth” in front of it and you’ve identified them (Roth IRA, Roth 401(k), etc.) Not every account out there has a Roth option, but many of them do. The proposal of the Roth bucket is simple: pay your taxes now, never pay taxes on that money again. Thus, for someone with extra income to spend on taxes today, or for someone in a very low tax bracket, it makes sense to pay Uncle Sam his share today so that the future dollars will be tax-free.

The question often arises: Which is better? The complex answer on this is, as with many things, “It depends.” Here’s the basic principle underlying all of this: The way you calculate returns over the long term on a series of investments is called “geometric mean”, which differs from “arithmetic mean.” Arithmetic mean you simply add up all the returns and divide by the number of returns. In geometric mean, you multiply the returns sequentially (though the order doesn’t actually matter if there’s no new money or money being taken out along the way) and arrive at the end value. Let’s give an example: Let’s say your return on a three-year investment is 3%, 5%, and 10% in years one through three.

The arithmetic mean would calculate ((0.03+0.05+0.10)/3=6%.

The geometric mean would calculate (1.03*1.05*1.10)-1)/3=6.32%.

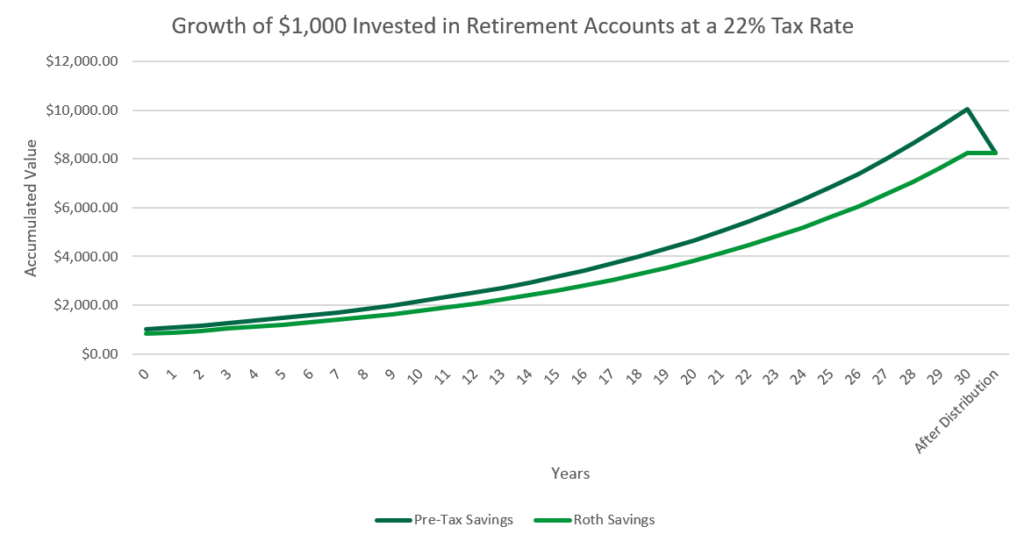

Not a huge difference, but the geometric mean takes into account the compounding factor of the returns, whereas the arithmetic mean does not. Notably then, for those of you who remember PEMDAS, the order of the returns in either calculation does not matter. So why does this matter for thinking about pre-tax and Roth investments? Because if the tax rate paid at the original time we save and the tax rate paid at the time we take money out is the same, and the same amount of money is contributed to the retirement account, and the rates of return are equal, then the end amount will be the same.

Assumptions: $1,000 invested at a 22% tax rate in a Traditional IRA and a Roth IRA, with an 8% rate of return, and a 22% tax rate at the time of distribution.

“So it makes no difference?” You might ask. No, there is a difference. We are saving for retirement in conditions of uncertainty, after all! We do not know for sure what tax rates will be in five, ten, twenty, thirty, or fifty years. We only know what tax rates are today. Thus, making an educated decision about whether to contribute to pre-tax or Roth today relies upon knowing your current tax rate and making an educated assumption or a calculation as to what your tax rates will be in the future. Thus, the real decision relies upon this: Do you expect your tax rates to be higher or lower this year than in the year(s) you plan to take retirement income? We’ll talk about this in greater depth soon, but not just yet.

Back Door Roth Contributions & After-Tax Dollars

The question that arises for high-income earners that I hear often is this: “But Dan, last time I looked, I make too much money to contribute to a Roth.” That might be true at face value, but as you’ll soon see, the income limit to Roth contributions is really just a gate with no fence on either side.

You see, in 2023 if you’re single and make more than $138,000 a year, you enter a phase-out that reduces your maximum Roth contribution until it hits $0 at $153,000 of income. Likewise, for married couples, a phase-out begins at $218,000 and you hit $0 of allowable contributions at $228,000. However, herein we have the “back door Roth contribution.” You see, at any level of income equal to or greater than the contribution limit in any given year, you can make a non-deductible traditional IRA contribution ($6,500 in 2023 or $7,500 if you’re 50 and older.) The only limit on this is income; if your earned income for the year is $3,000, then you’re limited to $3,000. Now, an after-tax traditional IRA contribution differs from a Roth contribution in that you pay with after-tax dollars like a Roth, but the interest and growth off of those dollars are pre-tax and tax-deferred like a normal traditional IRA contribution. With this in mind, there is no limit to how much pre-tax money you can convert from a pre-tax account into a Roth in any given year. So, the income limit on Roth contributions is a gate, and the ability to contribute after-tax to a traditional IRA and then immediately convert those dollars into your Roth IRA, is the missing fence on either side. Because the after-tax dollars were already taxed, the conversion itself is a tax-free event, because there is no pre-tax money being converted. One only has to be mindful of the pro rata “problem.”

Before explaining that problem, we should also note that there is a “mega backdoor Roth” strategy. This strategy involves maxing out your contributions to a defined contribution plan like a 401(k), followed by making after-tax contributions above the employee contribution limit, that are immediately converted into Roth balances. These avoid the pro rata “problem” we’re about to discuss but are also not available to everyone. Every defined contribution plan is different and has a set of guidelines and rules related to what participants in the plan can or cannot do, so while the mega backdoor Roth strategy is available to some people, it’s not available to all people. Now, let’s talk about the pro rata “problem.”

The Pro Rata “Problem”

Let’s say you have $30,000 in a traditional IRA today, all pre-tax, and you make so much money that you can’t directly contribute to a Roth IRA. You’ve just read the first half of this magnificent blog about how to do a back door Roth IRA contribution, and you excitedly contribute $6,000 to your traditional IRA on an after-tax basis and then submit an order to convert $6,000 into a Roth IRA. How much of that conversion is going to be subject to tax? If you’ve only read up to the paragraph above this one, you might excitedly shout: “None!” But unfortunately, you’d be wrong. The correct answer is $5,000.

“Why $5,000?” You ask. Because of the pro rata rule. The pro rata rule states that all pre-tax IRA and after-tax IRA assets of a household (an individual or married couple) are pooled together for calculations for conversions. This means that after the after-tax contribution was made to the traditional IRA, the traditional IRA then was a $36,000 IRA with a $6,000 cost basis. When you then converted $6,000 from the $36,000 IRA with a $6,000 cost basis, you had only 1 in 6 dollars become converted on an after-tax basis, and 5 in 6 dollars were converted from a pre-tax basis. Thus, the net result of the transaction would be:

|

Before |

After |

|

|

Pre-Tax Traditional IRA |

$30,000 | $25,000 |

|

After-Tax Traditional IRA |

$6,000 |

$5,000 |

|

Roth IRA |

$0 | $6,000 |

Not quite what we had intended. So why is “problem” in parentheses in the header? Because it’s only a problem if you let it be. First of all, the pro rata rule only applies to IRAs, not pensions and defined contribution plans. Thus, if you had $30,000 in your pre-tax 401(k) and made a $6,000 after-tax contribution to a traditional IRA with a balance of $0, then there would be no pro-rata issue. All $6,000 of after-tax money would convert to the Roth IRA. Secondly, if your long-term strategy is to convert all of your pre-tax retirement assets into Roth accounts anyway, this is just a tax hiccup along the road to ultimately having only tax-free Roth assets. Just be mindful of the tax bill that can arise year to year if the pro rata issue is present.

Understanding the Tax Bomb of Required Minimum Distributions

Now, to get to the brass tacks of why Roth conversions are so incredibly powerful, we now get to talk about where they really kick into gear. We already understand at face value that the math on pre-tax versus Roth is equal, all other things being equal. We already understand that there can be taxable events from converting pre-tax dollars into Roth dollars. So where does this strategy become valuable? Well, here a case study is going to be very helpful.

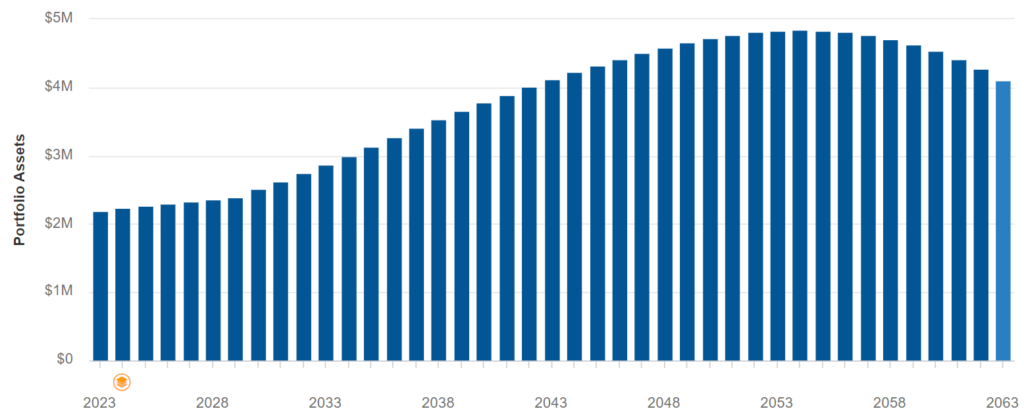

Meet Greg & Susan. Greg and Susan have earned $200,000 a year and have saved up $2 million dollars in pre-tax IRAs by the age of 60, and they plan to retire at the end of this year (2023). They don’t plan to claim social security until age 67 and were born in 1963. Assuming a 6% rate of return on their investments net of any expenses and a 4% rate of inflation, along with $80,000 in annual cost of living before taxes, here is their expected retirement wealth trajectory.

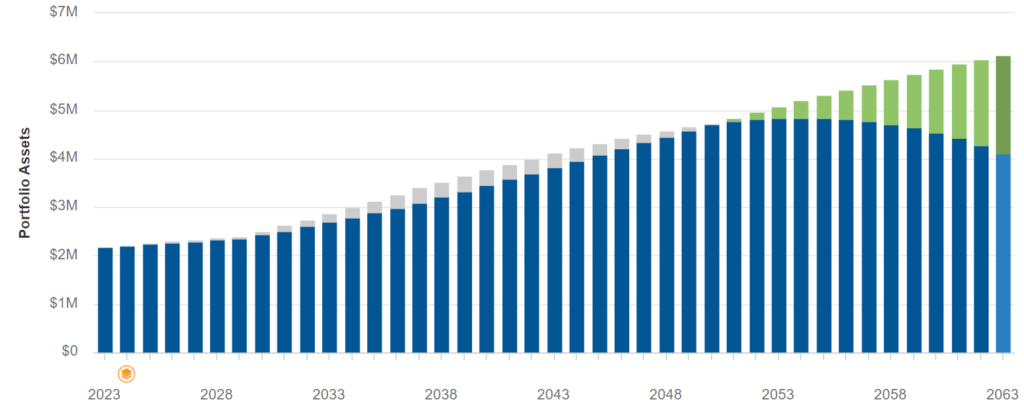

As you can see, their assets will remain fairly flat until they start claiming social security, after which they’ll see a decent rise in their asset levels until their 80s, after which they’ll start to see a decline in the value of their assets. So what’s causing this?

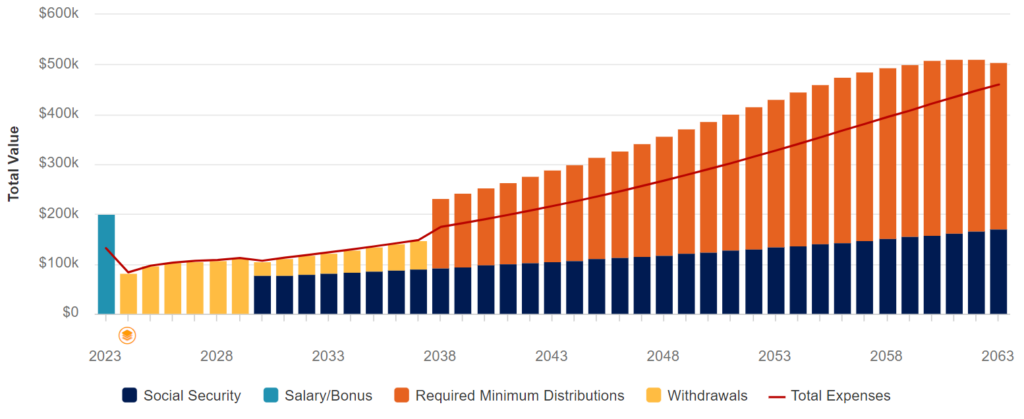

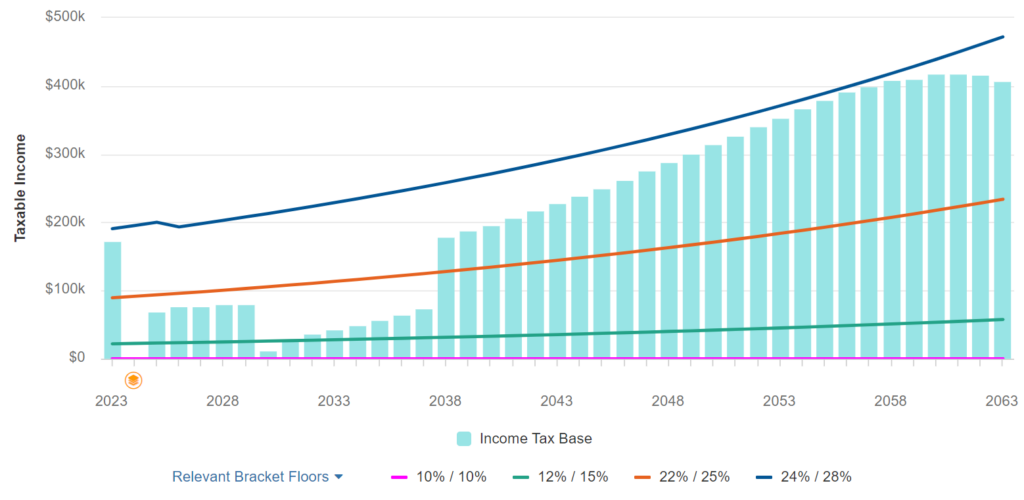

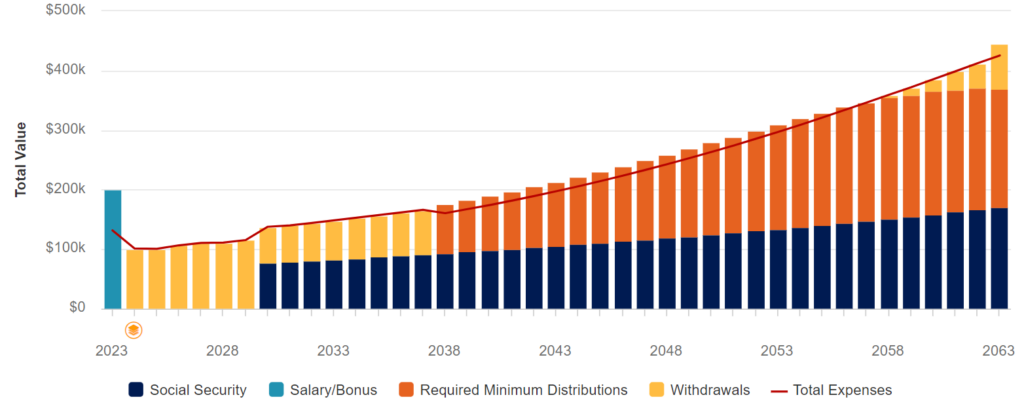

As you can see here, they will earn $200,000 in 2023 before they retire at the end of the year. From there, they’ll live solely on pre-tax portfolio distributions until 2030, at which time their social security will kick in and pay for about 2/3rds of their retirement income. This is where their overall portfolio value starts to go up in the previous chart. Yet, we see that starting in 2038, suddenly they’ll start taking out a lot more from their portfolio in the form of required minimum distributions (“RMDs”). RMDs are statutorily set distribution requirements at each year of retirement starting at age 73 for those born 1950-1959 and age 75 for those born 1960 and beyond. Thus, at age 75 in 2038, we see a sudden spike in the taxable income for Greg and Susan because their RMDs are greater than the size of their actual needs. The results in terms of their tax bill can be seen below.

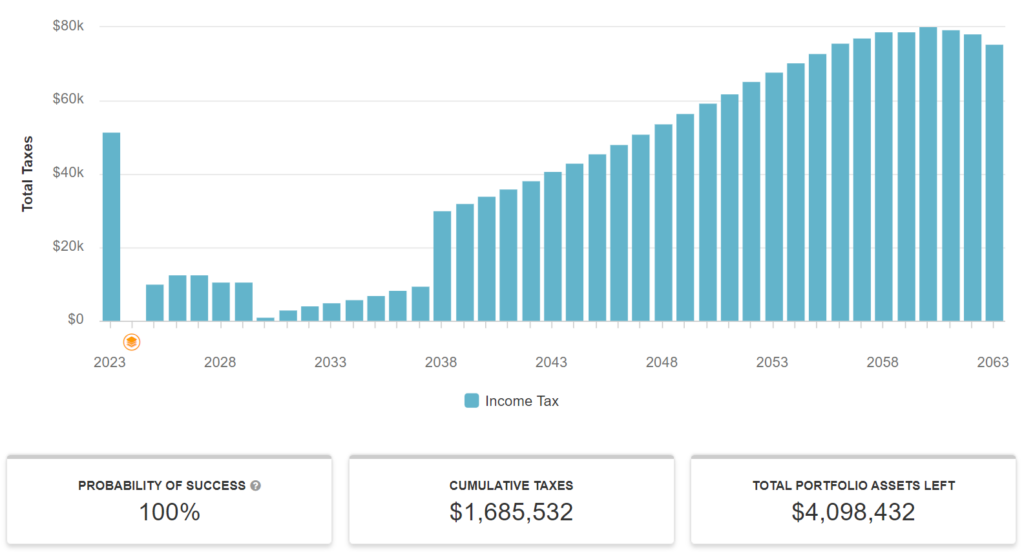

As you can see, Greg and Susan had around $50,000 in taxes during their last working year. The next year they had enough cash left over from their earnings in 2023 to take nothing out of their retirement accounts, so there is no tax due at that time. Then for the next few years, they’re paying around $10,000 in taxes on their IRA distributions until they reach their social security full retirement age in 2030, after which their taxes are even lower (because social security income is less taxed than normal earned or IRA distribution income). Suddenly in 2038 when they turn 75, their taxes leap upward to around $30,000 a year, and keep climbing every year thereafter! You can see how this happens in the next graph.

You can see in their working years that Greg and Susan were well into the 22% tax bracket. In 2024 they have no taxes whatsoever because of their cash savings from 2023. In 2024 through 2028, they’re in the 12% tax bracket and the 15% tax bracket (you can see the change occur between 2025 and 2026 as a result of the expiration of the tax cuts and jobs act). Then in 2030, their taxes are down in the 10% bracket and until age 75, they never get out of the 15% tax bracket. Yet as soon as RMDs kick in, they’re suddenly paying 10% more in taxes by being forced into the 25% tax bracket! This is an enormous tax bomb that cuts into their wealth by hundreds of thousands of dollars. So how can we solve this problem?

Defusing the RMD Tax Bomb with Roth Conversions

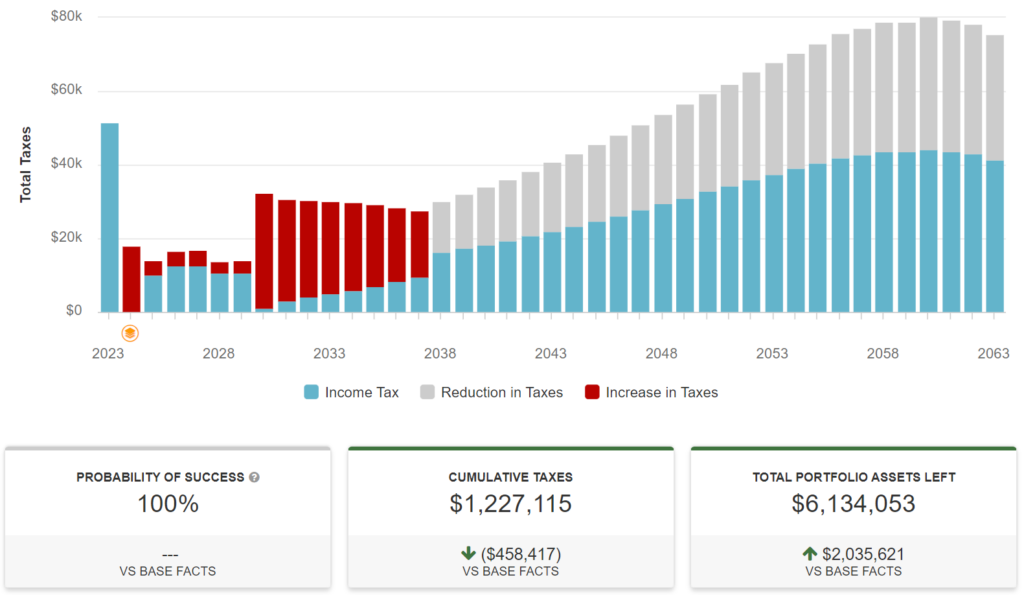

Take the same clients, and let’s apply one simple strategy. Their goal is to convert as much of their pre-tax IRA wealth into Roth IRAs between age 64 and age 75 when RMDs start as is financially beneficial. A number of strategies could be applied to this, but for this demonstration, we’ll utilize the strategy of converting pre-tax IRA dollars to Roth Dollars every year until the ceiling of the 12%/15% tax bracket is hit. The result?

As you can see, there is a $2,035,621 bump in lifetime net wealth. But, pay close attention to the time between 2030 and about 2050. See the gray bars on top of the blue followed by the green. This indicates that there is actually less net wealth in the household through those years. Why? Because in converting pre-tax IRA assets, we’ve had to spend money to pay those taxes. It’s only after decades of reduced taxes and compounding returns on the new Roth dollars that we see a positive return on the strategy when the green bars start appearing on top of the blue bars later on in life. So how is that strategy appearing in practice?

Because of the Roth conversions, we now see that “expenses” are much higher each year in the interim between retirement and age 75. This is a reflection only of the cost of the taxes of performing the Roth conversion strategy. We also see that while there are still required minimum distributions just slightly higher than their actual expense needs in retirement, we’re now seeing those be moderately higher than their actual cost of living, rather than being dramatically higher, and by the later years of a long retirement, we actually see that the required minimum distributions are less than their actual retirement income needs.

Ultimately, the Roth Conversion strategy ends up saving Greg and Susan $458,417 in reduced lifetime taxes. We can see their taxes being front-loaded into their early retirement years, but this in turn results in not only dollars saved from not being lost to taxes later on due to RMDs but those dollars being reinvested tax-free in the Roth IRA over decades, which produces the aforementioned $2,035,621 increase in lifetime wealth. This is also beneficial from an estate planning standpoint, as the Roth IRA inheritance left behind to family members will not be taxed to those family members, not only increasing lifetime wealth for Greg and Susan but legacy wealth for their family.

Is a Roth Conversion Right For Me?

That’s the question. The scenario we just demonstrated is a very simple one. There is a married couple with a very level amount of income, and a very reasonable level of expenses in retirement, who have accumulated a decent amount of wealth. Their assets are non-complex and their situation is not unusual or hard to predict outcomes for. In your individual case, your assets and liabilities, income, expenses, and overall finances are likely much more complex. It is imperative that you don’t see this strategy and, like our earlier pro rata example, simply jump off into starting to do a lot of Roth conversions. It is imperative that you work with a CERTIFIED FINANCIAL PLANNER™ to evaluate the pros and cons of the strategy for you individually, and that you work closely with a tax professional to ensure full compliance with all the reporting and tax return requirements that come with Roth conversion strategies. Ultimately, you may find with the help of these professionals that you’re better off without a Roth Conversion strategy. But this has been one example of hundreds of techniques that we use daily with our clients to help them improve their financial position and to build wealth. We hope you’ve enjoyed learning about it!

Comments 1

Pingback: Cash Management for Couples - Sharing Expenses with Ease