Well, it’s official: as of yesterday, March the 6th, I’m an “All But Dissertation” or “ABD” Ph.D. Candidate (as opposed to a student!) In honor of the occasion, I’m summarizing a recent piece of research that I enjoyed and talking about the issues leading into the research and the takeaways therefrom. The piece is “Off Target: On the Underperformance of Target-Date Funds” by David Brown of the University of Arizona and Shaun Davies of CU Boulder. The impetus for this paper was to investigate the idea that a target date fund is “all you need” for a retirement portfolio. However, this claim is perhaps generous and overbroad to its subject matter, so let’s crack into it!

What is a Target Date Fund?

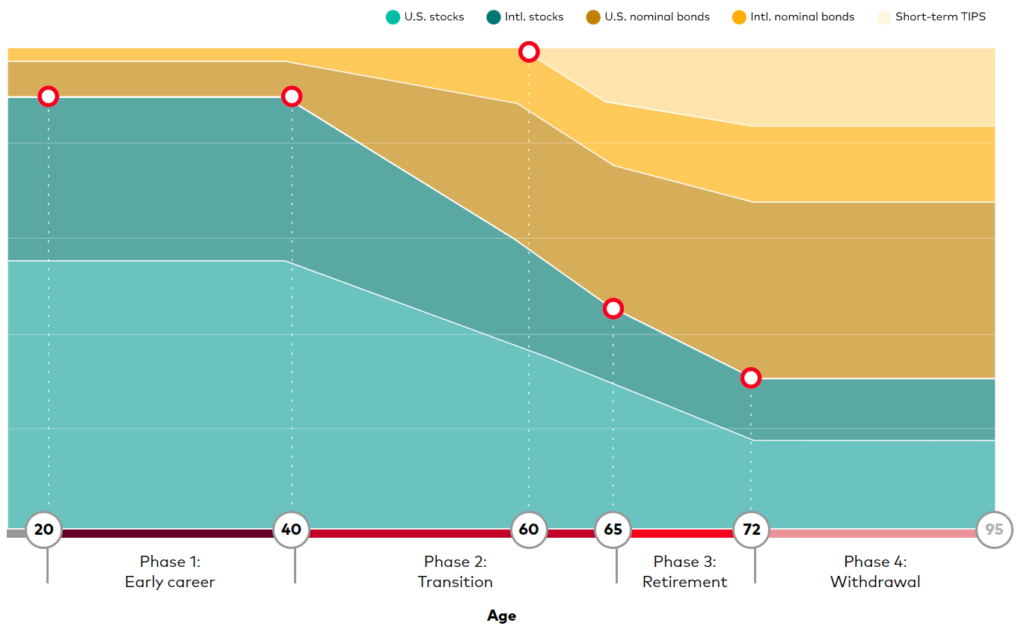

A target date fund is typically a series of funds offered by a mutual fund company (Vanguard, Fidelity, Blackrock, American Funds, and so on) that offers a range of funds with, as the name implies, target retirement dates. These are most often found inside 401(k)s and other retirement plans as the “qualified default investment alternative” for participants, wherein if a participant doesn’t pick their own portfolio, they’ll default into one of these funds based on their expected retirement age and the funds that matches the year of that age the most closely. So, for example, if someone was born in 2000, an appropriate target date fund for them would be the “Fund Company 2065 Target Date Fund.” The funds are typically made up of the company’s own mutual funds and go from a high-risk high-reward allocation to a low-risk low-reward allocation as they approach and pass their target date. Vanguard’s as an example is below:

Source: vanguard.com

What this depicts is that the fund will be about 54% U.S. Stocks, 36% International Stocks, and a 10% blend of U.S. Bonds and International Bonds at the starting phase. At age 40, the portfolio begins to reduce its exposure to stocks and increase its exposure to bonds. By age 60, the portfolio is now 60% stocks and 40% bonds, and by age 65 (the regular “target point” for retirement in target date funds), the portfolio is now 50% stocks and 50% bonds and cash equivalents. As time goes on, the portfolio shifts risk down even further to be 30% stocks and 70% bonds and cash equivalents.

All of this is not a bad idea, but I often like to describe target date funds as “good ideas with poor execution.” The study we’re reviewing today explains why that is.

Definitions are Important

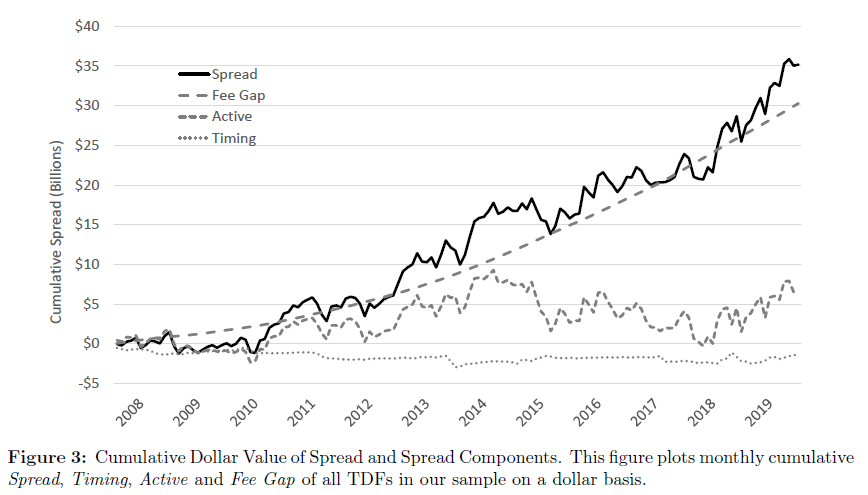

One of the first issues that arise in the target date fund discussion is that of defining the glidepath itself. Some target dates are set based on the anticipated date of retirement (again, typically set around age 65), and others are set all the way out to the point of death. While this seems like a nominal difference, this can create substantial differences in the profile of risk and reward found in mutual funds. If your fund is designed to be at its lowest risk at its targeted date, whether that date is at age 65 or age 90 makes a huge difference in what will happen in the twenty-five years following age 65! However, the issues go deeper than this. The study highlighted that there were three primary factors that could cause performance issues in target date funds: Timing, fees, and active management. The good news was that timing ended up being a fairly nominal issue, making barely a blip on the performance of target date funds. Essentially, this meant that the managers of funds were doing a good job of tracking the market and not deviating too greatly from its trends in the management of the funds. However, herein the issue of fees and active management becomes bigger.

Active Management is a Loser; Always Has Been

A debate for decades in finance has been the argument between “active management” and “passive management.” Historically, there was a preference for active management because the idea was that if you got a group of smart people in the room together, they could identify trends and outcomes in the market, place smart bets for their clients, and produce excess returns by picking winning investments and avoiding losing investments. However, as time has gone on, studies have shown that not only are most professional stock pickers bad at it, even those that outperform the market tend to then underperform when the cost of the smart people in the room is factored in. Whatever value there is in active management, it’s often quickly sucked out and put in the pocket of the fund company, not their client. In fact, the data shows that less than one in fifty actively managed funds outperforms their benchmark over a period of a decade or longer. At any given time, you might think a fund has the potential to do that, but are you going to bet your life savings on a one-in-fifty shot of outperformance when you can take the forty-nine-in-fifty probability of just investing in the market and getting its performance at a lower cost?

All of this compounds when placed in the target date fund discussion. Many fund companies (Fidelity as an example) will offer both a passive index target date fund series and an actively managed target date series. This affects not only the cost of the funds but also affects performance, as active managers traditionally don’t outperform their benchmarks with any real consistency. The result? On a monthly basis, active management alone accounts for anywhere from 0.4%-4.5% of the monthly performance differential between the fund and comparable benchmark products in a matching portfolio.

Fees are an even bigger issue!

The fee debates get old among financial advisors and planners, but when we’re talking about products, it really starts to matter. Because target date funds are “funds of funds”, meaning that they are a fund made up of smaller funds, there can be two layers of fees: one for the target date fund and another for the underlying fund. While some fund companies have pulled back, only charging on the underlying layer of funds or on the target date fund itself, many did this after simply rolling their fees from one side into the other (e.g., “We won’t charge fund fees, just the target date fund fee! By the way, our target date fund fee has gone up by just as much as the underlying fund’s fees.”) However, fee drag can become a serious problem, accounting for anywhere from 0.6%-5.5% of monthly performance differential from comparable benchmarks. Simply put, while passive index target-date funds like those offered by Vanguard might barely underperform their equivalent exchange-traded fund products in a matching portfolio, the more expensive and actively managed the target date fund is, the more performance and quality tend to drag on the financial results of a client.

What do you do about Target Dud Funds?

Source: “Off Target: On the Underperformance of Target-Date Funds” by Brown & Davies.

Simply put, target date funds are a good idea with bad execution. While it’s not intrinsically a bad thing to invest in a target date fund, they are empirically shown to underperform a comparable portfolio of passive index ETFs. This underperformance can add up dramatically and raises the question of whether people are better off using target date funds or hiring a financial planner, along with other benefits, in the first place. Target date funds can be a convenient and simple tool for retirement saving, but if you’re currently using a target date fund in your 401(k) plan, it would probably make sense to review your investment options to see if you can do better or if your financial planner can help you do better given the catalog available. If you’re using them in a retail account or a self-directed account, the same caution applies, as well as a cautionary tale about the potential for taxes in a target date fund that you might not be aware of! Either way, it makes sense to do a bit of due diligence to ensure that, at the very least, you have a target date fund, not a target dud fund.

Comments 2

Hey, your artwork is improving but I kind of miss the drawings –

Author

Were it that I could say I was this good an artist, but the meme generator has forever made this part easy!