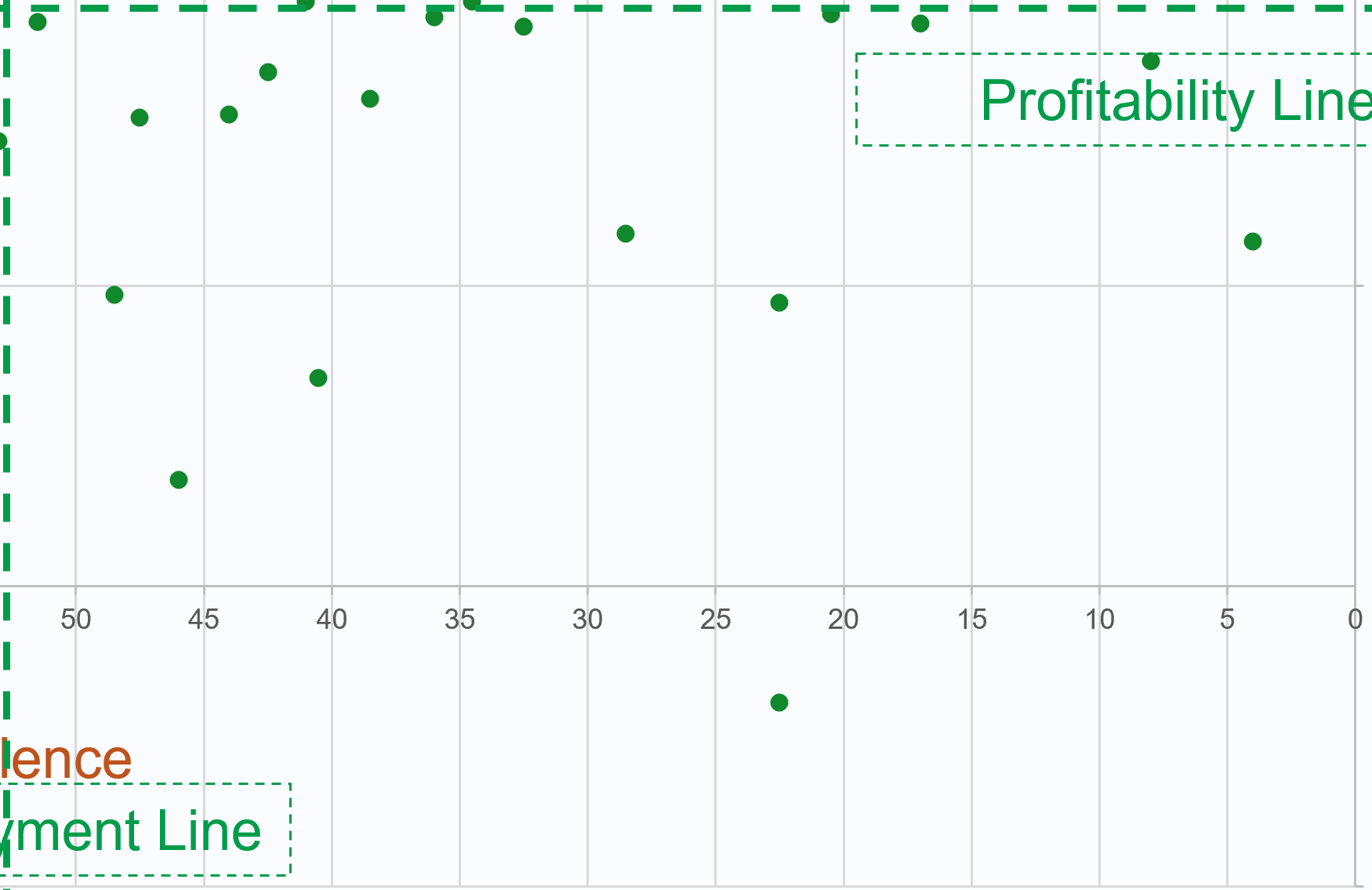

Recently, at the suggestion of Arlene Moss, we conducted an exercise. The exercise is simple: Divide your clients into four quadrants, high-profit high-enjoyment, low-profit high-enjoyment, high-profit low-enjoyment, and low-profit low-enjoyment, as you can see above. The idea behind the exercise is multi-faceted. First, that the exercise should give you an idea of “what to do” with clients who fall into each quadrant, but second, you might discover commonalities between them that help you avoid or duplicate various traits. In the case of “what to do,” there are a couple of evident prescriptives:

- High-Profit High-Enjoyment: Seek to duplicate.

- High-Profit Low-Enjoyment: Figure out why you don’t enjoy working with these clients.

- Low-Profit High-Enjoyment: Find a way to make these clients profitable.

- Low-Profit Low-Enjoyment: Find a way to make them more enjoyable, more profitable, or find a new professional to serve them who is a better fit for their needs.

We completed this exercise over the past few weeks, and today I thought I’d share the insights we took away from the exercise.

How We Completed the Exercise

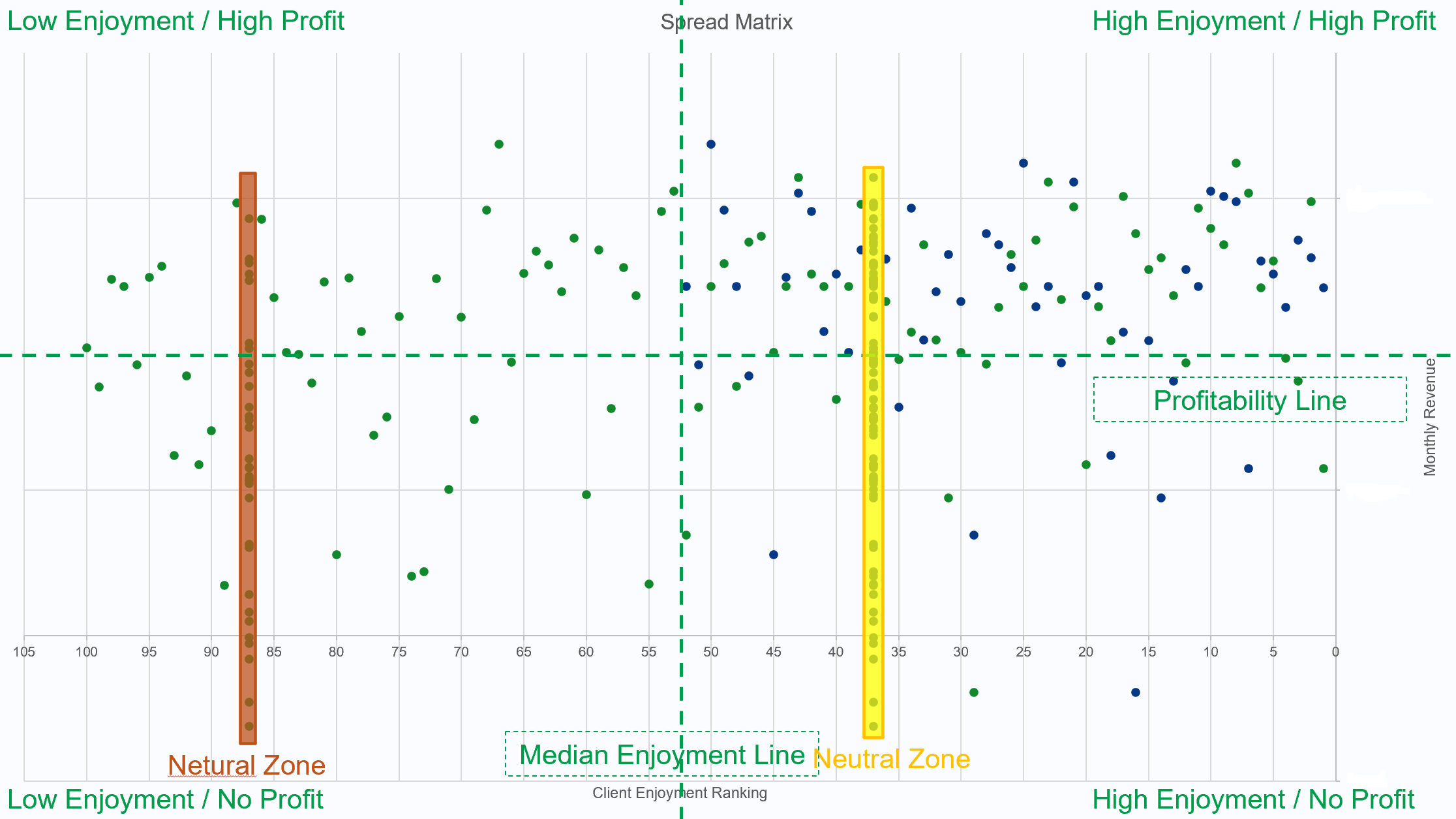

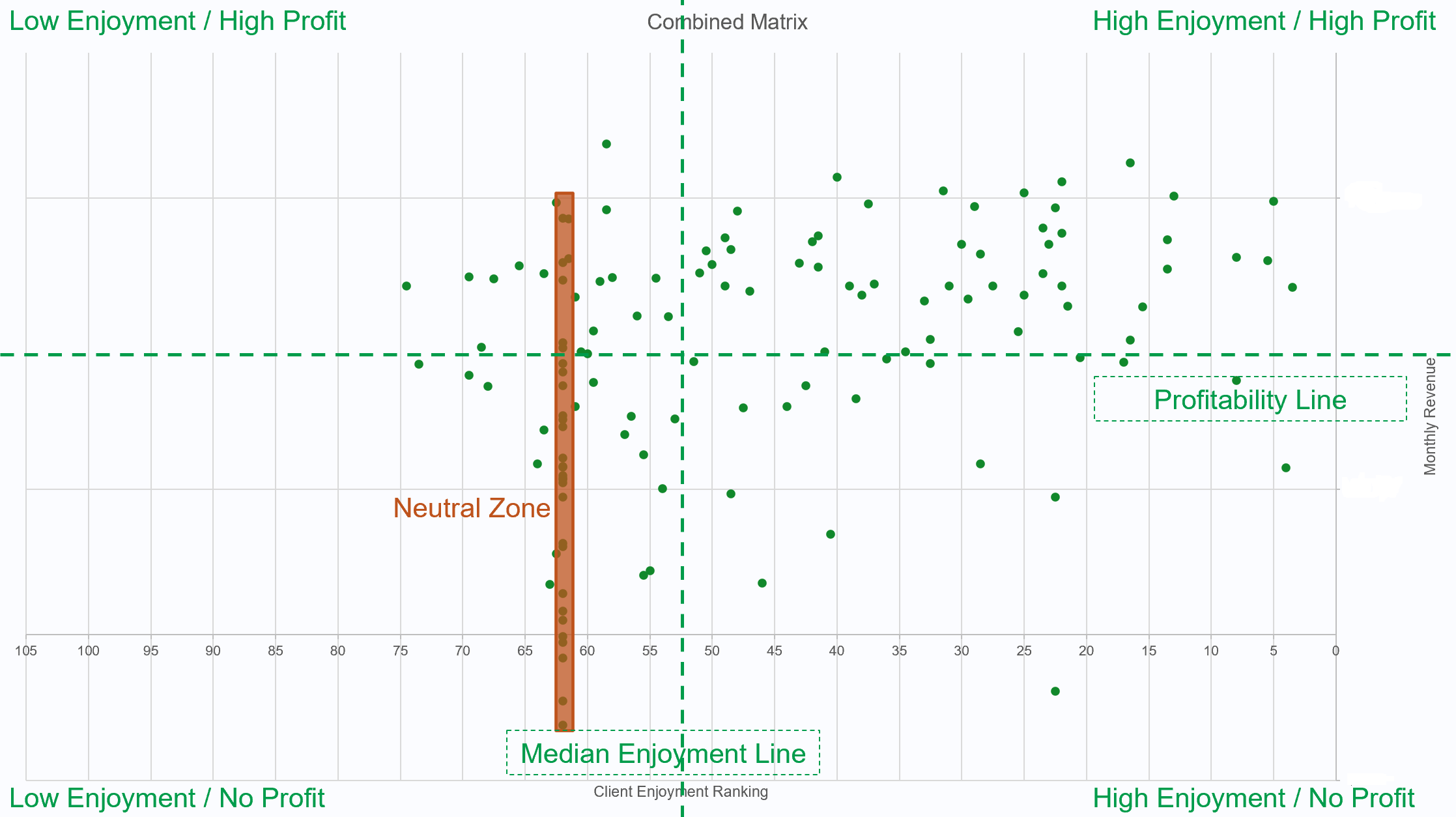

The guidance on the exercise is deliberately vague about how you define high and low profit and enjoyment. To measure enjoyment, both Samantha and I listed out clients alphabetically in an excel spreadsheet, then used the cut and paste function to move people up or down the list until we reached the bottom, having ordered them from “favorite client” to “least favorite client.” We then had a better understanding of Dan’s favorite clients, who Samantha’s favorite clients were, and the commonalities and averages between them. For the exercise, we then used the median as the line between high and low enjoyment. For profitability, we decided to look at it through the lens of the “subsidy” question: In any business with variable price structures, inevitably, some clients will be more or less profitable than others. We looked at our high vs. low-profit question through the lens of time. We took our annual firm revenue and divided it by 4,160, or the number of full-time hours for two full-time staff members in a year. This led us to an annual revenue per hour number, which we then divided by 12 to get to a monthly revenue per hour number, which felt like a better fit since all of our billing occurs on a monthly cycle. We then used this number as our high profit and low-profit line.

Results

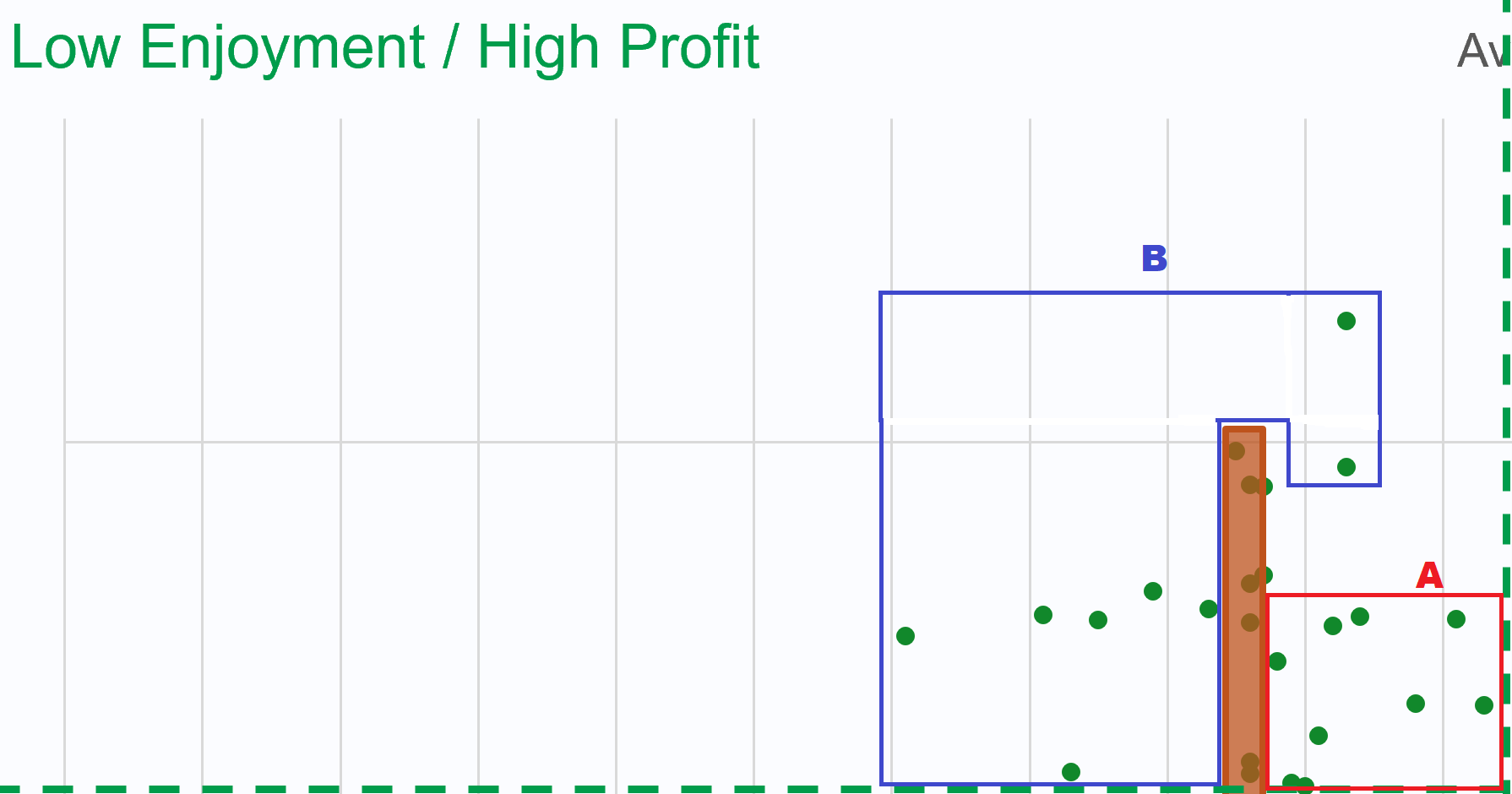

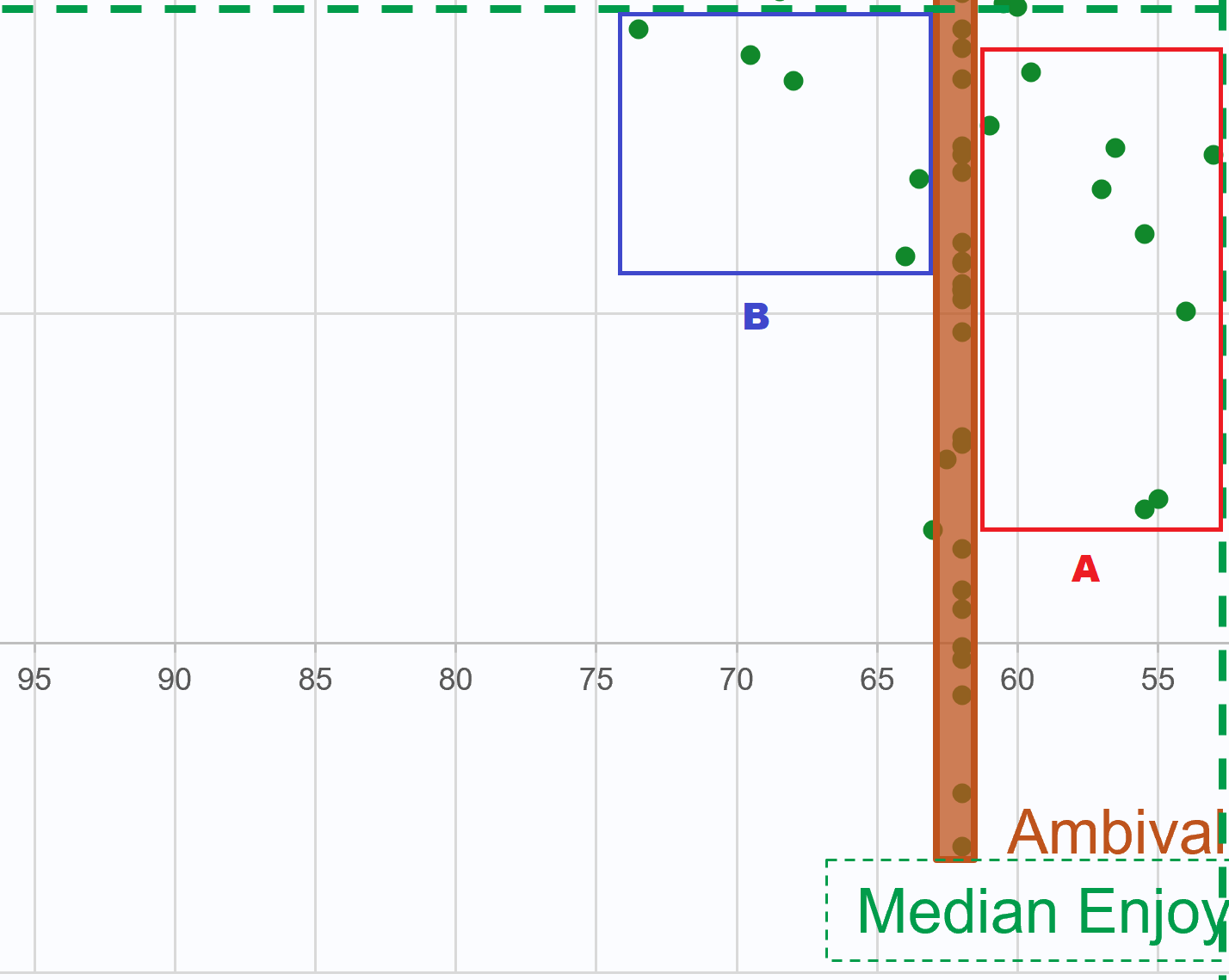

The spread matrix shows both my responses and Samantha’s responses. Mine are denoted by the green dots while hers are the blue, and the brown neutral zone is mine while the yellow neutral zone is hers. We’ll explain that part shortly. One key observation in this was that because I have a longer and more detailed history with our clients, I was more easily able to order clients, while Samantha had a much larger neutral zone of clients she did not have any significant relationship with or exposure to.

The combined matrix shows our client rankings averaged together. This is the version we’ll talk about most going forward.

Observations in the High-Enjoyment High-Profit Zone

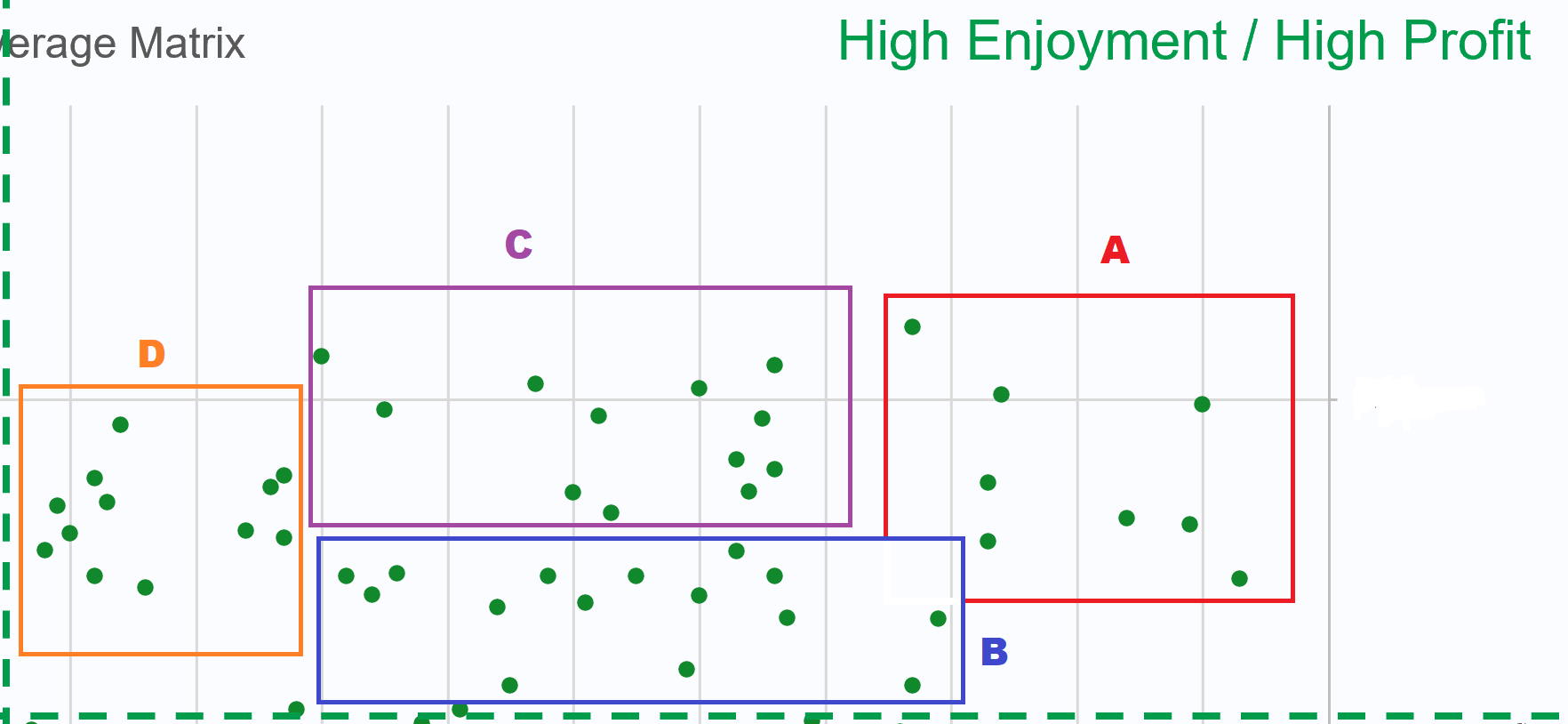

We found that our High Enjoyment and High-Profit clients fell into four distinct groups for the most part; none of the groups were entirely homogenous, so our descriptions are general, and each group did have a few exceptions. Group A was made up mostly of professional couples and a couple of professional individuals. These are educated, high-achieving, and driven people, who engage enthusiastically in financial planning, consult with us regularly on needs as they arise, and who leverage the value of financial planning in their lives. Group B was made up mostly of high-earning early-to-mid-stage professional households (either single or married), who are on a distinct path towards wealth building, but who are getting the most out of financial planning singularly from financial planning, rather than delegating investment management, either from lack of liquid assets or having a more DIY attitude towards investing. Group C was predominantly made up of retirees and pre-retirees; affluent individuals who have decided to delegate financial responsibilities to ensure their transition into and enjoyment of retirement are on sound footing. Group D was largely representative of what we’ll call “ex-planning clients.” These are individuals who had engaged us for financial planning in the past but transitioned to investment management-only relationships. As a result, we have had less frequent contact with these clients, and while we still enjoy working with them, it was evident in this analysis that having a less robust relationship with clients detracts from our overall enjoyment. The standout lesson from these groups is that we seek to replicate groups A, B, and C. These are all groups that are both profitable for us to work with and that we enjoy working with. Group D is profitable but is trending towards unenjoyable because, in some sense, they’ve “fallen out of” groups A, B, or C by shifting towards investment-only relationships.

High Enjoyment Low Profit

What stands out in this group is personality. There were essentially no significant commonalities between members in the group, other than that we just liked these people! Some small similarities included that some of them were early-stage professionals, and in other cases some of them were simply small legacy accounts where we’d accepted them as clients before shifting to our planning-required model. The standout opportunity in this group is that none of these clients are engaging in ongoing financial planning! The natural extension of this, then, is that we can likely easily move them into the profitability category by engaging them in a discussion about whether now is a good time for them to engage in comprehensive financial planning, which is based on our experiences from the high enjoyment high-profit category, suggests that we’ll grow to like them even more.

Low Enjoyment High Profit

This is perhaps the most challenging category for the exercise, but we recognized two clusters of commonality in this category. Group A are people we wouldn’t consider “low enjoyment” in a real sense. Because we divided enjoyment on the median line of client relationships, the people falling into group A happen to be on the “bottom half” of our client list when ranked by enjoyment, but we actually like and enjoy working with these people! Group B presents a more interesting challenge. This group is characterized by a lack of trust. That isn’t to say that we don’t trust these people or that they don’t trust us, but that in our conversations, members of group B indicate a skepticism towards what we do, and they engage in a behavior we would describe as “fishing for problems.” They ask questions that suggest our conclusions are wrong, raise objections to the math we’ve done, and otherwise ask or demand iterations and re-iterations of their plan models several times over. We normally do multiple iterations of a financial plan model in the early stages of a client’s planning process, but we’re talking about well over ten or twenty interations of the model, rather than the common two or three. To be entirely fair to this group, skepticism can be a healthy thing, and they deserve to ask questions until they’re comfortable with our service. However, in turn, it was clear in our evaluation of both this group and the low enjoyment low-profit group, that a clear negative trend in our enjoyment ranking was in people who generally communicated in a manner that suggested that despite the fact that they’d hired us, they somehow did not have confidence in the science of financial planning, modern portfolio theory, or the other tools we use to serve them. A takeaway we are considering with this negativity in mind is a restriction on the iterations of revisions a client can request; not because we don’t want the client to ask for more clarity, but because those who’ve done this in the past have not asked for one or two reiterations, but dozens, in a way that suggests they’re “fishing for a reason to disbelieve.” Ultimately a financial plan is a document and a process that gives you permission to do things, and it shouldn’t be used in an attempt to “prove a negative,” as there is no bottom to that particular pit.

Low Enjoyment Low Profit

This category is less difficult than the low enjoyment low-profit category, because the business case in this group should be straightforward: If you don’t like these people and they’re not profitable, don’t work with them! But remember what we said about Group A in the Low Enjoyment High profit. Not everyone who falls below the median line is actually a client we don’t enjoy working with, so this is potentially a reflection of an “area for improvement” rather than a mandate to lose the clients here. Still, this category is broken into three groups, with one group, in particular, requiring a bit of extra attention. The brown bar that cuts vertically through both of the low enjoyment categories is what we call the “neutral zone” or “ambivalence” zone. For my part, these clients were almost entirely SIMPLE IRA plan participants, whose investments we manage as part of a small business retirement plan but who, in turn, we have very little interaction or relationship with on a one-to-one basis. This means that many of those people who fall into this category are not people we enjoy or don’t enjoy working with; we simply don’t have a strong relationship with them. As a result, many of these people were “ordered” at the same point rather than being ordered from highest to least enjoyment, creating a “vertical bar” of clients for whom our relationship is somewhat neutral. For Samantha’s analysis, her ordering included many of these same people but also dozens of clients she’s yet to have had any real opportunity to interact with, simply because of schedule, time, or reduced interaction. One major component of these groups is the observation that we spend a lot of time communicating with these individuals. On a monthly basis, we call every single client to update them on their portfolio, the markets, and how those things are doing in light of their financial plan. But in the case of the dozens of SIMPLE IRA participants and small account balance/non-planning clients in this category, we essentially “lose money” by doing this outreach when comparing the cost of contacting them with the revenue that they generate. A solution to this is that we can try to provide a portfolio and market update deliverable to these clients that is not individualized, but still provides them with relevant and timely information.

Then we have Group A and Group B. Group A are people that we do actually enjoy working with, but there’s a valid question here regarding whether they can be or need to become profitable for us to continue working with them. In each individual case, there’s good cause that, like the people in the high enjoyment low-profit group, we should discuss if now is a good time to engage in a conversation about starting comprehensive financial planning, which would elevate these folks easily into Group A from the Low Enjoyment High-Profit category, or even up into the High Enjoyment High-Profit category.

Then there’s Group B. Group B is the hardest group of clients to reconcile with our business. For lack of a politer phrase, these are mean people. Notably, they didn’t start out as mean people, and we didn’t take them as clients thinking that they’d be mean people, but there’s an observation from Babe Ruth: “The loudest boos come from the cheapest seats.” Notably, the people in this Group B have a lot in common with the people in Group B from the Low Enjoyment High-Profit group. They are suspicious, generally skeptical of our advice and guidance, and question our advice and services to the point of hostility. There is no market condition that satisfies them: if the market is going up, why aren’t we all in on that one incredible investment that they read about in the news this morning? If the markets are going down, how couldn’t we have seen it coming? Why didn’t we move them to cash, and what good are we anyway? As we said earlier, clients have a right to display a healthy skepticism when presented with information they find challenging. But a singular and obvious characteristic of Group B is that they cannot be satisfied, but more so, are not paying us enough to put up with the attitude. Naturally, these are good candidates to transition to DIY or a professional whose business model can accommodate people whose desire for service outweighs what they pay, i.e., an hourly planner whose business is improved by someone asking them to “prove it” over and over again.

Overall Insights

This was a valuable exercise. I’m generally one of those skeptical people who doesn’t often see a coach’s value because I’ve often “heard their advice before.” Yet, I was pleased not only with the level of insights and information that the exercise provided but also with the value of identifying the opportunities among our existing clients for improvements and enhancements for them and within our own practice. For anyone who owns a business interested in duplicating this exercise for their clients, let us know, and we’d be happy to walk you through it!