Because of the compliance regulators that be, I have to take the fun out of this by saying that this is satire, intended to make a point. You absolutely should invest your money as appropriate to help fund long term goals, preserve the value of capital, and to compliment a broader financial plan. With that out of the way…

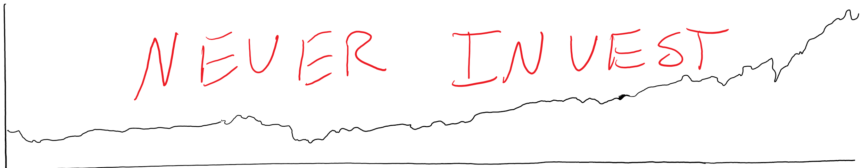

Invest your money? What are you, crazy? Didn’t you know that last year the Chinese had a regulatory crackdown? Didn’t you know that there have been trade wars, tax changes, bailouts of entire national governments? The stock market is scary! Not just scary, dangerous! Let me tell you the history of just the past two decades, and if that doesn’t scare you off of investing, I don’t know what will!

You Should Never Invest Your Money Between 2011-2021

Just last year, we had a whole bunch of stuff to be worried about. The Chinese kicked into a regulatory crackdown as much if not more than they have since 1949, and we went into our second year of the pandemic. That whole year only yielded a measly 22% return on investments in the market (the S&P 500 from here out).

You see back in 2020, there was a big kerfuffle over COVID-19. It killed over a million people, and naturally, it crushed the stock market. Since that event alone, the market (the S&P 500 from here out) is only up 44.5%. And let’s not forget the US Presidential election! What a crazy time that was! Who would put their money in the market during a time like that?!

Of course, in 2019, we had even bigger fish to fry. Do you remember that the sitting president was impeached in congress, even at the same time as there was a widespread report of a global slowdown in growth? The market is only up 90% since then! How could you be so ridiculous as to want to put your money into the middle of that?

Let’s not even get started on 2018. In 2018 inflation popped up to a whopping 2.2%! Okay sure it had been about 2.2% in the preceding decade, but the Dow tumbled over a thousand points! What are the points? I’m not sure, but points nonetheless! And there was a trade war that cost us… okay, nothing in the long run, the market is still up 81.7% since then, but it was a war on trade! Or something like that.

In 2017 the Federal Reserve raised interest rates for the first time since the great recession! That’s happening right now for the first time since then! Did you know that those rate hikes made it so that the market only returned 121.3%! Clear and obvious evidence that the market is a house of cards!

In 2016 did you know that the UK voted to leave the EU? It was called Brexit! It didn’t actually happen until 2020 and we’d all pretty much forgotten about it by then, but it was a big deal at the time! The market was only up 147.8% since the last time I checked. Definitely too risky.

Of course, back in 2015, we had the opposite of 2017, a global worry about deflation! Deflation is pretty much what happens to your tires when they get a hole in them: the thing that’s being deflated becomes worthless! Worthless I say! My money has never bought me- wait, deflation means that money gains purchasing power, not lose purchasing power? Well, scratch all that then, deflation is great, we should have more of that! Oh and the market? Yeah, it’s up 151.2% since then. Whatever, my money was worth more back then!

Now, we know that Russia is invading Ukraine right now, but did you know it invaded Ukraine back in 2014? It’s happened before! And there was another pandemic then, the EBOLA pandemic! It wasn’t quite as big a deal with only 11,323 deaths, but still, sounds suspiciously like what’s going on right now. And the market is only up 185.6% since then, so we should clearly be worried about what happens next.

Back in 2013? You’ve probably heard of this before: A temper tantrum. No wait, it was a “taper tantrum.” Not unlike a baby’s crying, the public got really upset when it learned that the federal reserve was going to stop quantitative easing! What’s that? It’s when the federal reserve pumps money into the economy! The market was shocked so badly that the market is up 278.1% since then!

2012. That’s the year! Someone is going to tell you it was a great year for the market, but you shouldn’t believe them. Sure the market grew by about 12% that year, but there was a major threat to the global economy because we bailed out Greece for the second time, and that caused the Euro (which I’ve never actually used) to be in danger! Okay, the market as a whole has grown by 338.6% since then, but think about the Euro!

You Should Never Invest Your Money Between 2002-2011

A whole ‘nother decade down the road and we find ourselves with another catastrophe, of course. The United States was essentially doomed in 2011. You’re probably thinking I mean 2008, but don’t worry, we’ll get there. In 2011, a single credit rating agency downgraded the credit of the United States. Ever since then we’ve been functionally financially insolvent and haven’t paid back our debts. Okay, we have, but we might not have, that’s what a credit downgrade means! Oh, the market? 347.9%. Whatever.

Back in 2010, we saw a flash crash this year on May 6th, where the market crashed between 12:42 pm and 1:07 pm MST by over 600 points on the Dow. I mean it recovered by the end of that 25 minute period, but imagine your portfolio suddenly dropping like that! I mean if you owned investments in 2010, your portfolio probably did drop like that, but it could happen again! Since the end of that year? 415.4% growth.

2009? Well, you have to know this one. This was the bottom of the barrel, the worst year of all years except 1931 and 1937. With the market hitting its almost all-time low where annual performance was concerned, this of course was the worst possible time to have money in the market. Sure, investors who bought at this time or who held their investments during this time have seen returns of 551.8%, but they’d have lost money or bought at a discount first!

Then we see 2008 with the bank failures. Here’s the trap right here. You see the market was down enough that you’d think, you’d suppose, that people would want to get into the market at this time. But hah! Compared to 2009’s 551.8% return, this year only had a measly 310.6%! See, timing the markets is impossible, so you should just stay out of the market at all times!

Then 2007, the big kahuna, the edge of the cliff that has led all market investors to oblivion! The sub-prime market blew up this year, kicking off the losses of 2008 and 2009. From that all-time previous high point? A pathetic 333.2% return on your money.

Investing before 2007 in 2006? Don’t even get me started! Did you know that we lost a planet? A whole planet? Pluto was a planet and then some nerds in a lab somewhere who probably haven’t even seen a planet before went and downgraded Pluto into a “dwarf moon,” and renamed it after Gimli from Lord of the Rings. Okay, I made that last bit up, but I didn’t make up that the market is up a small bit, only 401.6% since then.

2005? Worst weather ever. We’d seen hurricanes before, but had you seen a hurricane called Katrina? Not until 2005 you hadn’t! I mean, it had no lasting effect on the market, but I’ll bet you some portfolios got washed out to sea during that storm, which could also happen to you! Those investors were only going to pocket 426.2% for the next seventeen years, but with a storm that devastated only one part of the country, we should all be on the watch for marketplace storms!

2004 there was a tsunami that killed almost a quarter-million people in Asia, and even BIGGER storm than Katrina. I’ll bet it’s all you think about, that you’ve never forgotten it. Markets were shocked, so badly shocked that they only grew 483.5% since then. Of course, with such a disaster on your mind, I’m sure you weren’t silly enough to be in the market.

In 2003 we invaded Iraq! That war was essentially over in a matter of weeks before it became a big counterinsurgency thing, but over the chanting of “USA USA” you’d think the market would be a safe place. Not so, not so my friend! The market since the invasion of Iraq has only grown… hold on, 650.9%?! Geeze okay, maybe 2003 was… no, stay strong! Don’t do it, don’t invest! You should never invest your money!

2002 is my real evidence. The dot com bubble. Paul Krugman called it back in 1998 when he said the internet’s impact on the economy would be no greater than the fax machine’s, and you know he had to be right because he won a Nobel Prize in… something totally unrelated. And 10 years after that prediction. But you know, that whole internet fad turned out to be a dud, so since then, there’s never been any value in internet companies or stocks based on internet-based companies. This whole thing was written on a typewriter! The market lost so much money in 2002 that you’d have to be crazy to ever invest again. After all, the market is only up 484.9% since the internet completely went away.

You Should Never Invest Your Money, Even In The Present

If I haven’t convinced you by now not to invest your money in the market, I guess you’re a lost cause. If two straight decades of turmoil, terror, and awful events couldn’t convince you to hang up your investing shoes, nothing will. If you’re going to insist on taking the insane risk of not just burying your money in the ground for worms to eat, and you’re going to put it into the market, the best thing you can do is just ignore the noise. I would, but I’m too busy watching the financial news all the time and working myself up into a panic!

Investment returns are calculated as the cumulative total returns for the S&P 500 index, which cannot be directly invested in, only through products that attempt to match the index. Returns calculated from December 31st of the prior year mentioned in each respective paragraph up to the market value as of market close on January 31st, 2022.

It bears repeating: This was satire. If you take any of the fearmongering or idiocy above seriously, please seek professional help. MY Wealth Planners LLC and the investment advisers are not licensed counselors or healthcare professionals of any variety.

Dr. Daniel M. Yerger is the President of MY Wealth Planners®, a fee-only financial planning firm serving Longmont, CO’s accomplished professionals.

Comments 1

Fun, fun! A pleasant change and refreshing view. I’m sorry you had to spell out that it was a satire because those first words were priceless.