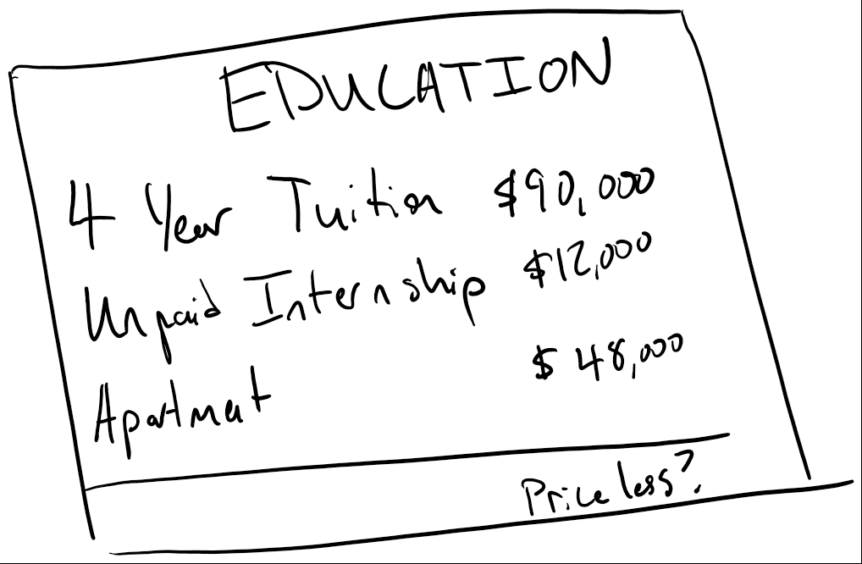

If there’s one thing Americans can bemoan, it’s the cost of higher education. Whether it’s lower tuition at a community college or tuition in excess of hundreds of thousands of dollars, Americans largely can agree that a good education is too expensive. Yet, a common financial planning challenge that comes up for families is not only how to pay for their own education expenses but how to pay for their children’s. While it’s not ideal to accrue significant debt for education, it’s still a recognized means to an end. In the meantime, parents looking to set up their own children for life success often are concerned about potential changes to the educational landscape and how that could affect their personal financial priorities. Today we’re going to take a trip around some of the issues currently concerning education planning and what we should be thinking about as we look to pay off our own debts and help the next generation fund their education.

How Much is Too Much?

A common point of contention between couples is how much education savings is appropriate. Some couples take hard-line stances and say they’ll pay or all or none of their children’s education, but what does that actually mean? In the case of none, that’s fairly straightforward, but “all of our children’s education” is an immeasurable quantity. Does that mean four years at a public in-state bachelor’s program? What about all the way through an out-of-state Ph.D.? Equal to the cost of in-state but if they go out of state will their children need to take out loans for the difference? What about high achieving versus low achieving children? If one child gets a full-ride scholarship and the other barely gets into college, is it fair, equal, or equitable to pay for one child’s education while the other got it paid for by the merits of their hard work? Does that child deserve something “extra” for getting their tuition paid for? Ultimately, these are family conversations, but it’s incredibly important that parents decide early in their child’s life how much they’re going to support, talk about the contingency considerations, and stick to that plan.

The Cost of Education Means College is Overrated

Not to beat up on a good education, but many parents have a view of education informed by their lack of confidence in higher education. Whether it’s the belief that COVID-19 showed that higher education was too overpriced for its value, or the idealism that politicians will one day do away with paying for college out of pocket, some families feel that saving for college is a useless exercise. While any of this all could be true or come to pass, the stats on college education are still fairly clear. The average graduate with a bachelor’s degree will have a weekly income of $1,173 and an unemployment rate of 2.5%, while a high school graduate will have almost half that at $712 per week and a 4.6% unemployment rate. Even with the cost of student loans potentially bearing down on a graduate, with programs like REPAYE limiting payments to 10% of income, that college graduate will still have $1,055, and to recover the lost wages of four years of education vs. employment will only take six years after graduation. From that point on, a graduate with a 40-year career will out-earn their high school counterpart by a whopping $714,896, and that’s not even counting almost twice the job security.

What if they don’t go to college?

This is probably the most relevant concern for a young family: What if we save all this money for our children’s education and they don’t go to college? Well, the savings vehicle matters here. While my first recommendation for parents is to maximize contributions to their own Roth IRA accounts (which can later have the principal pulled out for education if needed), the penalty for non-educational withdrawal from 529 and Coverdell college savings accounts is only 10% plus the tax that would have been due. If a parent really wants to hedge the possibility that their children won’t go to college, simply saving in a taxable non-qualified brokerage account to have extra money on hand if they do go to college is a decent alternative. While this type of saving can affect student aid and is likely to result in more taxes than a specific educational savings program, it can help parents hedge the risk.

Pay for their education? What about mine?!

Of course, a real concern for many parents is simply that they’re already burdened by paying off their own student loans. Fortunately, there’s some relief here. The CARES Act passed in 2020 and the follow-on Consolidated Appropriations Act later in the year created a program that allows employers to cover up to $5,250 of student loan and educational expenses as tax-free contributions (through 2025). This means anyone with annual student loan payments below $5,250 can have the entire amount paid for tax-free, which not only saves the participant potentially over a thousand dollars in taxes but also can spare the employer from payroll tax while the program is still in effect. And for those who are looking to pursue further education as part of their career, employers can provide education benefits to their employees tax-free so long as the education provides them with training and skills that enable them to perform a higher quality of their present work (to be fair, it’s also unlikely an employer was going to pay for you to get a masters in doing something not relevant for the company).

Dr. Daniel M. Yerger is the President of MY Wealth Planners®, a fee-only financial planning firm serving Longmont, CO’s accomplished professionals.

Comments 2

“. . . . COVID-19 showed that higher education was too overpriced for its value” ?? I do not understand this. What happened during COVID-19 that would indicate that college is overpriced for its value? I agree it is overpriced! but wonder what COVID-19 has to do with it.

We decided to pay for four years of college for our kids so they would not be burdened with a debt before getting started in life. So, we saved our money. Well, sure enough, when it came time to apply for grants etc. we had too much money in savings and so did not qualify for anything. One wonders if we shouldn’t have enjoyed exotic vacations after all.

Author

A major criticism that came about as a result of COVID-19 was that Universities were charging the same tuition despite not delivering the same product, i.e. moving from in-class to remote classes, losing the “college experience”, access to campus resources like gyms/cafeterias/writing centers/etc. Ultimately, the core value of Universities is the gatekeeping of access to a college degree, but if all students can receive from a college is the education and a degree but they have to pay 100x or 1000x as much for just the knowledge than they’d pay through self-directed education platforms like Khan Academy, Udemy, etc., it highlights how grossly overpriced higher education has become relative to its core value proposition.