Insurance is boring. Really boring. Experimenting eating paint chips might be more entertaining, if significantly more hazardous for your health. This boredom, along with education and training on how to evaluate insurance, costs consumers over a billion dollars a year in fees, conflicts, and opportunity costs. You too, probably find insurance pretty boring, but when you’re given an opportunity to evaluate an agent who wasn’t aware they were going to be graded on their proposal, you often will catch many equally alarming and amusing misstatements and omissions. This week, we’re continuing our review of the Wolves at the Gate; unscrupulous actors who will use the current economic and healthcare panic to take unethical but legal advantage of consumers. Below, we’ll review a conversation I had with a life insurance agent on behalf of some clients a few months ago.

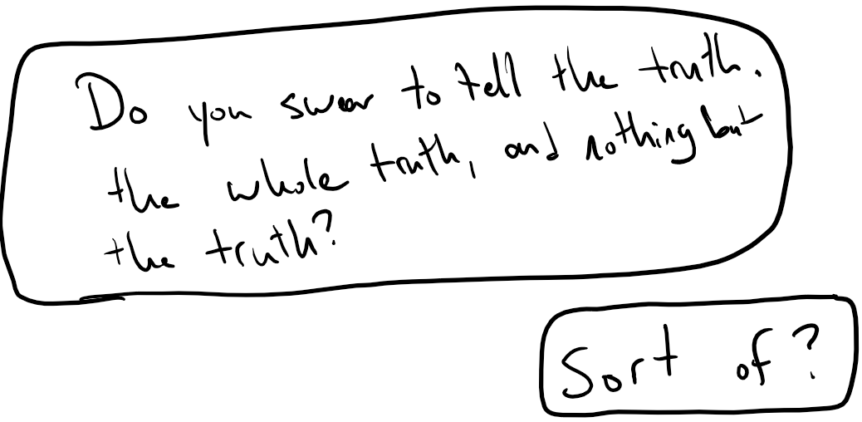

Mr. & Mrs. Client are a real case study. Having started a business recently and experiencing great success, they were looking to protect themselves and each other from the possibility of death and the subsequent failure of the business. Upon evaluation, they likely needed somewhere in the neighborhood of $2-$4 million in 30 year term insurance (insurance that lasts for a set period of time) depending on how they finalized their wishes for coverage. What they were presented with by a “Family Friend” (an alarmingly common agent demographic) was $6.2 million in term insurance that would last for 46 years, and that rather paying a flat fee every year as with most insurance, would grow by double-digit percentages every year thereafter. Alarmed by the proposal, I asked the clients if I could interview the agent to get a better understanding of the what and why behind the recommended policies. A summary of the questions asked of the agent follow, with his responses in red and my notes in blue. There are 29 Q&As here, with more that were on the list but that were eliminated during the conversation. While I tend to err on the side of misunderstanding/ignorance over malevolence or ill intent, the amount of omissions and misrepresentations made by the agent were overwhelming, and are illustrative of how easily consumers can be misled.

- What method was used to calculate a required death benefit of $6.2 Million for both Mr & Mrs. Client?

- $20,000 in monthly income for the rest of their lives and paying off liabilities of $600,000.

- If this was the intended model, even the basic “4%” rule would require more funding than this, as it would require $6 million in insurance coverage just for the income, plus another $600,000 for the liability payoffs. All of this is also based on their current debt load and payments, which amount to several thousand dollars a month, which would not be required expenses. So while $20,000 a month in income would be incredible, it would be an unnecessarily large amount of income for their needs.

- What assumptions were used in that calculation?

- $20k income per month, 6% investment return, at a 20% tax rate

- This math doesn’t add up. The capital retention model shows that the total insurance need at 6% interest would only be $4.6 million, and even at a conservative 4% interest would be $6.6 million. Life insurance death benefits are tax free but future reinvestment is not tax free, nor is the distribution of cash value beyond the amount of premiums paid, though it can be managed for capital gains and have an effective tax rate of 0%-15% (or higher, but you would have to inflate your lifestyle significantly).

- What is the surrender and death benefit price per unit of insurance on these policies?

- I do not know what that is.

- This is a basic calculation that shows you what the cost per $1,000 of insurance is in the event that you receive the death benefit or in the event that you cash out the policy for cash value (only applicable to a permanent policy.) This is how you find out the “real cost” of the insurance, rather than the everything-baked-in cost. It’s not uncommon for life insurance agents not to know this because most agents are taught sales techniques in order to help them get their agency started, not the technical underpinnings of the product they use. This is akin to a car salesman not knowing why a car costs what it does.

- What are the exact assumptions in the “scheduled premium” and “net cash flow” portion of the illustration?

- Based on 7% historical average return of [the carrier’s] core fund.

- All investments legally must come with a disclosure: “Historical performance is not an indicator of future results.” Using historical return can be illuminating but cannot be relied upon unless the rate is guaranteed by the carrier, meaning they’re accepting the risk that their investments don’t perform as well as assumed, while you accept the potential opportunity cost if the investments perform better than expected.

- What was the rationale behind illustrating a 46 year policy rather than a 20 or 30 year term policy?

- [The carrier] believes if someone needs insurance for 30 years they should just own it, we don’t offer 30 year term policies.

- While that’s a reasonable philosophy, you do not need permanent insurance. It also doesn’t make sense that if they feel you should just own a policy if it’s 30+ years that they would then illustrate a 46 year term policy.

- Why annually renewable increasing premium rather than level premium?

- Because I think they should have permanent insurance so renewable term keeps the cost down until they can make that conversion.

- This is also a reasonable strategy, but insurance gets more expensive every year you get older, so if you genuinely needed/wanted permanent insurance it would be better to purchase today, as the premium will likely increase by hundreds or thousands of dollars per year for a permanent policy. For example I carry a permanent $1,000,000 policy on my own life; it costs $488/month, and the 30 year term version only cost $130/month. If I’d waited until I was a year older, it would have cost $545/month.

- If the stated strategy is to convert to a permanent policy to accumulate cash value, why issue a term policy now and a permanent policy later?

- I was recommending permanent today ($500k permanent each).

- This is problematic. You need significantly more insurance than $500,000. The purpose of insurance is to protect you, not to provide an investment vehicle, which is the only reason a smaller policy would make sense (other than making the policies more affordable than a $6.2 million permanent policy; for context, at age 28 I was issued a $1 million permanent policy that costs $5,856/year. At your ages, a $6.2 million policy would likely cost tens of thousands of dollars a year.)

- If the policy is convertible to a permanent policy only until age 60 and the strategy is to convert to a permanent policy, why not issue a 25-year term policy at levelized premium with a guaranteed conversion rider?

- I was recommending permanent today ($500k permanent each and term for the rest). We don’t issue fixed terms longer than 20 years.

- This is the same double-speak as before. While the agent is making it clear that he’d prefer to issue a much smaller death benefit permanent policy for you, he keeps saying that they don’t offer long term policies, yet the policy being illustrated is a 46 year term policy.

- What are the premiums for a non-premier rating?

- I did not run them, as I felt they would qualify for higher ratings given their lifestyle.

- It’s an optimistic assumption on his part, but as the agent is not an underwriter or medical professional, the agent is making no more than an educated guess about the underwriting outcome for a policy like this. If an agent “guarantees” you’ll be rated premier/preferred/super-ultra-whatever, they are flagrantly lying, it’s not a guarantee they can make because it’s not within their power or skillset to rate you.

- What are the comparison quotes from other carriers written as (term/conversion/etc.)?

- 30 years and 20 years with convertibility riders. [My carrier’s] term policy can be converted until age 60 for the 80 year version or for the first 10 years of a 20 year policy.

- Given the lack of need for a permanent policy, this is somewhat immaterial, but having a 10 year time limit on conversion is unusual. They typically can be converted all the way up until they expire at the majority of carriers. This seems more like a limitation to reduce risk on the part of the carrier and increase the pressure to convert the policy earlier.

- What are the premiums at both premier/preferred and standard ratings?

- I can run those if you’d like.

- This is always a question to ask and to get the answers in writing. Agents can compare quotes very easily, it should be no issue for them to provide copies of the quotes to you rather than just telling you what they think is best.

- What are the premiums for the same death benefit for the permanent policies your strategy assumes?

- I haven’t run those but I can.

- They are likely to be significantly higher (to the tune of over $10,000-$20,000 a year for each spouse.)

- What are the premiums for that policy at premier/preferred and standard ratings?

- I haven’t run those but I can.

- Same issues as before.

- Is the permanent policy you’re proposing whole life or universal life?

- Whole life accumulates cash faster than Universal Life.

- This is a false equivalency (as much as “trees are faster than grass.”) Whole and Universal Life have to do with how the functional internal expenses of the policy are handled. Whole life is designed to firmly reach a value of the death benefit by age 100 (or a similar target age) come rain or shine. Universal life follows a “bucket with a spout” metaphor in which premiums go in the top and expenses flow out the bottom at an increasing rate as time goes on. There is no evidence to support the general statement that “whole life accumulated cash faster than universal life”, as the accumulation is heavily based on the type of life policy (Fixed, Indexed, or Variable – more on this later.)

- Is the permanent policy you’re proposing fixed, indexed, or variable?

- Traditional fixed.

- A fixed life insurance policy puts all of the “investment risk” of the policy on the carrier but will statistically yield the lowest possible rate of return compared to all other forms of permanent life insurance. Indexed policies come with an investment component but limit the potential downside and upside. Variable insurance policies have unlimited risk of upside or downside returns, but long term because the insured carries the risk, the long term average return is the highest of the three types.

- In an email to Mr. Client yesterday you referenced “you can simply cash it in and walk away with a really nice rate of return and free coverage.” Can you clarify what rate of return you were indicating and upon which product that rate of return is guaranteed?

- 7% Internal Rate of Return, which isn’t guaranteed, but the average has historically been 7%. Only 15% of the fund is invested in stocks and the rest is in 30 year treasuries which generate a really nice rate of return.

- This is an alarmingly bad representation. First, because the agent had just described the policy as “traditional fixed” which this policy is not. Second, the current [at the time of the conversation] 30 year treasury rate is 2.11%. Generously assuming the other 15% is invested in an index fund mirroring the NASDAQ 100 (one of the most high risk high return market indexes), the weighted average of that fund last year (a banner year for stocks that returned up to 42% in the Nasdaq) would have been 8.41%, and it would be criminal malpractice for them to invest the fund that way.

- You’ve said a couple of times that [your carrier] has the best insurance around, can you explain what you mean by that?

- It’s the highest rated insurance company yielding the highest internal returns of any insurance carrier and has been around for 165 years and has never missed a dividend payment.

- For credit rating (a measure of ability to pay claims), [the carrier] is tied with another carrier for ability to pay claims based on two different credit rating agencies, and based on CFP Board recommended carrier evaluation criteria, there are 17 other carriers with sufficient credit to consider. The issue with the claim regarding internal rate of return was addressed in my notes on question 16. The claim that [the carrier] has never missed a dividend payment is potentially true, but as with rate of return “historical performance is not a guarantee of future results.” For example, some companies and insurance carriers will issue a $.01 dividend to ensure that they don’t break their streak. While $.01 is better than nothing, it’s hardly the same as a 7% return on thousands of dollars a year.

- If fixed, what is the rate guarantee?

- There is no rate guarantee.

- This is quite alarming. Fixed whole life policies typically come with some level of guaranteed rate (2% – 3% in the current market). Apparently [the carrier] doesn’t guarantee any return on the money, they only increase the cash value based on the performance of the company’s general fund (the aforementioned 7% claim).

- If indexed, what are the indices, participation rates, and cap rates?

- We don’t offer indexed products.

- This is acceptable; indexed products are tricky for people who are in their middle age. On one hand, while securing a downside protection of the cash value can provide some desired security, there’s still decades of potential accumulation ahead that the annual caps or participation rates on an indexed policy could really tamp down on.

- If variable, what are the sub-accounts available and what are the costs?

- I’m not recommending a variable product.

- This flies in the face of the agent’s proposed strategy (the $500,000 permanent policies for cash value). The risk assumed by the person seeking insurance by using a variable policy inherently increases the long term average rate of return due to the shifting of risk; if the agent is really interested in putting you in a permanent policy that will pay for itself in time and that will yield a “really nice rate of return”, their general fund isn’t going to be the ideal vehicle. It would be very hard for an 85% federal treasuries portfolio to outperform a 100% equities portfolio in the long term.

- What is your compensation in the first year as a percentage of the premium for the policies you’re proposing?

- 50%

- This is suspiciously low, since the compensation rate for most policies in the first year is 115%. His compensation may be 50% after a split is taken by [the agency] for expenses (most agents are paid a percentage of their production, rather than the gross commission, as a way for paying for their office, software, support, etc.)

- What is your compensation in the trailing twenty years as a percentage of the premium for the policies you’re proposing?

- 2%

- This is reasonable, though some companies will pay higher in the first few years and then steadily decline to this figure. Most trailing compensation in years 2-5 are 3%-10% depending on the carrier

- If a conversion from term insurance to permanent occurs, do you receive a renewal or a new policy commission for these policies?

- Yes.

- This is a material conflict of interest, meaning that if you buy the term policy this year, he claims he’ll be paid 50%. If you then convert to permanent, he’ll be paid another 50% commission on the new premium.

- Does your production related to the commissions generated by [the carrier’s] policies count toward your minimum production required with [the carrier]?

- Yes.

- This is a common and not unacceptable conflict of interest, but one to be aware of. No one is surprised if they go to a Ford Dealership that they’re going to want to sell you a Ford. But you should be aware of the answer to the next question in context.

- Does your production related to the commissions generated by external policies count toward your minimum production required with [your carrier]?

- No, just toward my qualification for the Million Dollar Round Table.

- This is two separate conflicts of interest. By contract [the agent] must sell a certain amount of [the carrier’s] life insurance premium per year or his contract will be terminated. This means that while he will be paid, for non-proprietary products, it does not help validate his contract. Additionally, it does qualify him towards the “Million Dollar Round Table” which is an awards and recognition association for life insurance agents who sell high volumes of life insurance in any given year.

- Have you met your annual production requirement as of this meeting?

- No.

- This means he is still on the hook to sell more [of his carrier’s] policies until he meets his contract requirement, and is a compounding of the existing conflict of interest.

- Does your production related with any of these policies assist in qualifying you for a bonus, increased commission grid, incentive awards, incentive travel, or any other form of 3rd party compensation?

- Yes, I am bonused by [the carrier] for their policies and I can qualify for trips and incentives from other carriers .

- This means he may receive additional bonus compensation or awards for selling [his carrier’s] policies over other policies, but can receive incentives from other carriers as well.

- Can you explain the circumstances related to your two financial disclosure events in May of 2019, June of 2019, and November of 2010?

- No, just some credit consolidation.

- Reading the FINRA disclosures for these events, he has failed to make payments on over $20,000 in debt and had to file some sort of structured settlement to reduce the payments. This is not a credit consolidation, this is failure to pay debts and negotiating a settlement of the balance.

- Do you have any other material disclosures you would like to make at this time related to your recommendations or services?

- Nope!

- The list of disclosures required by [this carrier’s] agents is 8 pages long for CFP® Professionals (which he is not), and all disclosures he made during the conversation had to be prompted or asked about explicitly. He is not divulging anything he’s not asked to and is not being forthright in his answers.

So there you have it. While the answers being given are rarely explicitly untruthful, they rely on a consumer not knowing the technicalities or differences between options or variations available to them, as well as not understanding the compensation and incentives of the parties who are involved. While none of what was represented by this agent was outright illegal, for these clients they could have very easily ended up sinking tens of thousands or even hundreds of thousands of dollars into policies that were not in their best interest. So, beware the wolves at the gate, because while they may not be here today, they’re certainly out and on the hunt in this economic environment.