“Be fearful when others are greedy and greedy when others are fearful.” – Warren Buffett

It’s a simple but powerful piece of wisdom that the Oracle of Omaha shares with others when the markets are booming or crashing. Human nature often compels us to wait until things are past the point of ideal to get involved in something, and often too late. The inverse is also quite true, in that often investors get out of the market after sustaining losses, and only get back in once markets are past the point of recovery. This week, we’re talking about one of the greatest dangers to your life savings or those of your family members. Before we go on, segment yourself into one of two groups: Targets or Guardians. You’re a target of this particular danger if you’re over the age of fifty or you know you’re not comfortable with investing or the stock market. Conversely, you’re a guardian if you don’t fall into this group. It’s on you to either protect yourself as a target or protect those targets in your family if you’re a guardian.

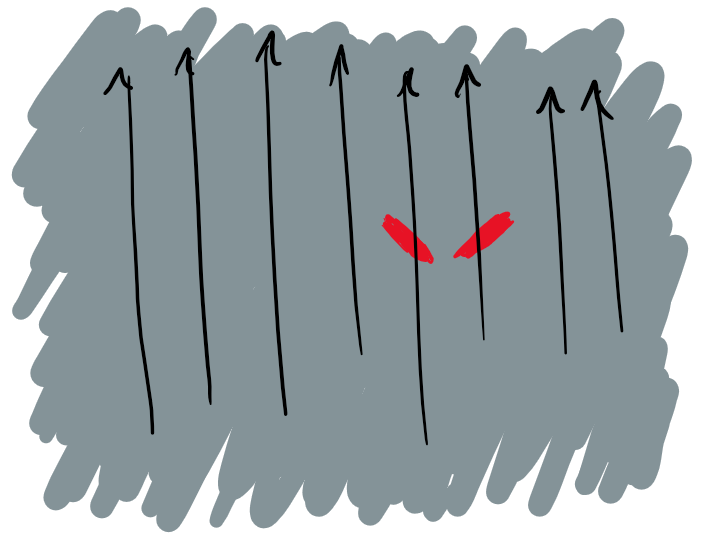

Now, where is the danger? Where are the wolves at the gate? It’s mostly in human nature. As long as I can remember in my career, not a day of the week goes by that I don’t hear a radio ad, see a billboard, or read an invitation to a steak dinner. Now this doesn’t sound too bad on its face, but it’s understanding the source of these invitations that’s critical. These invitations, solicitations, and ads always come from an agency or insurance carrier, specifically to “educate me” about “a safe and secure way to grow my/my client’s money”. As with most things in the world, if it’s too good to be true, it probably isn’t, and these invitations are no exception. Whether it’s the harmonica playing guy on the radio (106.7 listeners know who I’m talking about) or someone putting on a “social security seminar”, without fail, these all boil down to one thing: A pitch for annuities and/or permanent life insurance. This is where the classic wolf in sheep’s clothing story starts to play out.

Before we go onto the technical issues here, let’s highlight the benefits of these products. Annuities are an insurance product designed to ensure you have a fixed stream of income in retirement that you can’t outlive. Life insurance products are designed to protect your family members in the event of your untimely demise. So where’s the harm in a bit of protection and guarantees? The problem lies in the use of the products and how they are marketed. While term life insurance is a great use of money for a parent with kids, it is time limited and pays about 1/10th the commissions a permanent life policy pays to the agent who sells it. Annuities provide guaranteed lifetime income for their purchasers, subject to highly complex terms and conditions that are often explained and disclosed in several-hundred page thick documents. And here’s the rub: These are often great products for the right person at the right time. The danger is that they are often marketed to the wrong people all the time or the right person at the wrong time. Someone who bought an annuity in January this year? Great timing! In February, March, or April? Possibly the worst!

Right now, as the markets are scary, wolves are out dressed as sheep and knocking on doors (figuratively, but some literally I’m sure). “The market could keep crashing, you’ve got to get your money out of the market!” Some might say. “My clients haven’t lost a dime in this market volatility, wouldn’t it be nice if you had that same assurance?” “I can show you, in writing, guaranteed, where your money could be safely invested.” With these temptations at your door and your relative’s doors, it can certainly be enticing to consider the possibility of bringing some peace of mind to your portfolio. But herein is the true danger. While an annuity can guarantee a lifetime stream of income (subject to the solvency of the insurance carrier!), it bases that guarantee on the money you buy the policy with. If your portfolio has just declined 10%-20% in the recent market volatility, you’re buying that much less income for life; and the worst part? No take backs. Because of the high commissions these products pay to agents, they come with surrender periods that can last more than a decade, meaning that if you learn too late about the poor timing for this choice and want out, you’re taking up to another 10%-15% haircut on your life savings just to get out of the product. What about life insurance? While it’s a great product to protect your family, cheap term policies aren’t going to be marketed to people in the targets group. Rather, agents will be touting the value of “living benefits” and “cash value”; phrases such as “it’s a rich man’s Roth” will get tossed around, relying on your lack of understanding regarding the complex products to make them seem appealing. Once your signature is on the line? Not only are you potentially out thousands of dollars a year in high premiums for the policies, but those living benefits and cash value appreciation? Locked up for ten to fifteen years before surrender periods end, and let’s not forget that the agent got paid 115% of what you put into the policy in that first year.

So what can you do about it? If you’re a target or a guardian for others, how do you avoid these tempting pitches?

- Don’t make major money moves during a bear market or market volatility. If you’re looking for guarantees and security, that’s great, but don’t lock your life savings up during a downturn. Wait for the recovery of the market.

- Ask for a second opinion rather than relying solely on your own judgment. Asking a family member or close friend to review any major decisions you’re making at this time could help provide a check on your gut feelings.

- Ask questions to the point of irritation. If you are being presented with these options, then prepare to turn into a detective. What is the guaranteed growth, how long is the surrender period, how significant is the surrender period, what is your commission on this product, does anyone else benefit from this product, is this product proprietary, so on and so on.

Now, I understand I’m making this sound probably equally easy and complicated. So how will you recognize these particular pitches or filter them out? Well, that’s going to have to wait for Part 2. In our next issue, I will be publishing a conversation I had with a life insurance agent on behalf of a client a few months ago, and will highlight where the seemingly good answers to my questions are actually misleading and misdirecting in an attempt to trick the client into one of these traps.

Dr. Daniel M. Yerger is the President of MY Wealth Planners®, a fee-only financial planning firm serving Longmont, CO’s accomplished professionals.

Comments 1

Nice Dan