Welcome! Today’s reading covers how recently someone chose to give up $933,353 over $84,735. Interested? Read on!

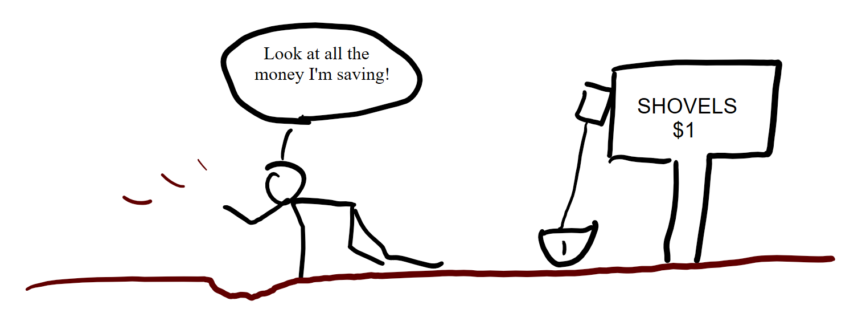

Recently I set up a Retirement Plan for a medical practice. With over a dozen team members, the practice had utilized a 401(k) plan up to the present day that was structured more like a traditional pension, i.e. where everyone’s money goes into one big pool and then their share is divvied up when they want to take their money out. These plans are pretty rare nowadays because it’s impossible to build a portfolio for dozens of participants that uniquely meets their individual needs; but that’s not the point of this story. In the fixing of the retirement plan, we made the decision that participants would have individual accounts and the option to direct their own investments or to work with an Accredited Investment Fiduciary (AIF®) to manage their portfolio. When one of the employees came in (and a very highly compensated one at that), the very first question he asked was: “What are the fees?” Now this is a question I encourage everyone to ask of their financial providers, because it’s a big deal, but that’s also not the point of this story. I told him that he had the option to self-direct or if he wanted his account managed, we charge a flat 1% fee over the course of the year (the same as we charge for all other accounts we directly manage). Without hesitation, he said: “I don’t want to participate then.” Now, bear in mind two things. First, he had the option to self-manage and not pay the fee. But second, having had no discussion of what having his account managed actually entailed or the benefits it provided, he immediately wanted to opt out of a retirement plan that would double his money up to 3% of his compensation (almost $10,000 of extra money to his savings a year). Herein, we find someone being penny wise and pound foolish.

This is not an uncommon thing in our society. We’re all asked to make choices regarding that which we want and don’t want, but more importantly, what we’re willing to pay for what we’ll get in return. Here’s a thought exercise: Let’s say you’re going to buy a car. You go to a dealership and they tell you the only car available costs $60,000. Now that might be more or less (maybe a lot more or a lot less!) than your usual car budget. But whether that price tag makes sense is dependent on the car. For example, that would be an outrageous price to pay for a Toyota Camry. It would be a good price to pay for a Tesla Model S. It would be a terrific price to pay for a Lamborghini Veneno (which, for the non-car people like myself, retails at $4.5 million.) But if you immediately freeze on the price of something without taking the time to evaluate the value of the thing, you’re letting cost-consciousness get in the way of what might be a screaming deal. Let’s return to our penny wise and pound foolish employee for a demonstration.

The employee was opting out of participating in a 3% matching program on his savings over a 1% fee for management on an annual savings of about $20,000 a year. If he kept working for the next twenty years, that means he would have not saved $400,000, of which he only contributed half. In the same time period, assuming the money never grew or lost value, he would have paid $42,000 over the years (assuming the bill came on the last day of the year). That’s still a net of $158,000 on top of his own savings. Now let’s throw in the average S&P500 return for the past 20 years. He’d have grown his money $1,018,088, and net of that 1% fee, a sum of $933,353. Of course, here’s the trick: could he get that return? Well, maybe. Possibly. Let me explain. There’s a study called the Dalbar study done every year that tracks investment return (such as investing in a low cost S&P500 index fund) and compares it to investor return. On average, the average investor nets 3% less than the investments they invest in! This comes back to a number of factors such as tax efficiency, churning of investments, behavioral finance, and other things we won’t dig into. Suffice to say, let’s assume the employee gets the Dalbar average. Now over avoiding a 1% fee, on his own and without that cost, he would have only saved $716,572, or $216,781 less than he’d have earned by paying it. Of course, this whole set of hypotheticals are just that: Hypotheticals. But if there’s one lesson a financial planner learns early on in their career, it’s that the odds apply to everyone, but especially those who don’t think the odds apply to them.

Beyond something as extreme as long term retirement savings, this bias shows up all over the place. Articles like “The Latte Tax” espouse that you should be cutting back on your coffee intake to make up what you’re not saving in retirement. But is that $5 coffee really the culprit? Or is it hundreds of dollars in monthly subscriptions, a high car payment, insurance you haven’t reviewed, or a second mortgage for a nicer sink in the kitchen that’s really cutting into your long term financial success? So, the next time your response to something is that it’s expensive, take a few seconds to consider. Is it expensive or is the value not justified? What would change my opinion of this thing? Am I buying a Toyota or a Lamborghini? Am I paying for a Toyota or Lamborghini? Because you never know when you might just being penny wise and pound foolish.

Comments 5

Great content! Super high-quality! Keep it up! 🙂

Hmm it appears like your blog ate my first comment (it

was extremely long) so I guess I’ll just sum it up what

I submitted and say, I’m thoroughly enjoying your blog.

I too am an aspiring blog writer but I’m still new to the whole

thing. Do you have any helpful hints for rookie blog writers?

I’d certainly appreciate it.

Author

I’m 100 miles from a subject matter expert on blog writing, but the only “keys to success” I’ve come up with is to set a calendar and stick to it.

I was curious if you ever considered changing the layout of your blog?

Its very well written; I love what youve got to say. But maybe you

could a little more in the way of content so people could connect with

it better. Youve got an awful lot of text for only having one or 2 images.

Maybe you could space it out better?

Author

Certainly possible in the future!