It’s not uncommon for us to hear about being underemployed; the popular “college graduate working at Starbucks” sort of observation is often raised as a criticism of higher education and the low return on investment from many majors. Yet, there is an inverse term that we’re talking about today: overemployed. This term shares a resemblance to the expression “working two …

Activity Doesn’t Equal Results

We’re almost nine full months into what we could all easily describe as a disappointing investment year. While the fourth quarter could show signs of recovery and positive momentum, it seems fairly clear that this year the market’s esprit de corps lives and dies by the Federal Reserve’s perspective on interest rates and inflation. The Federal Reserve has been plain …

2022 Colorado Statewide Ballot

We received our 2022 Statewide ballot information packet in the mail yesterday. Not one to let an opportunity to read exciting political descriptions of things like mill levies and income taxes pass us by, we’ve decided to pass comments on the financial impact of each ballot measure. Whether you support the underlying issues and causes is a separate question, but …

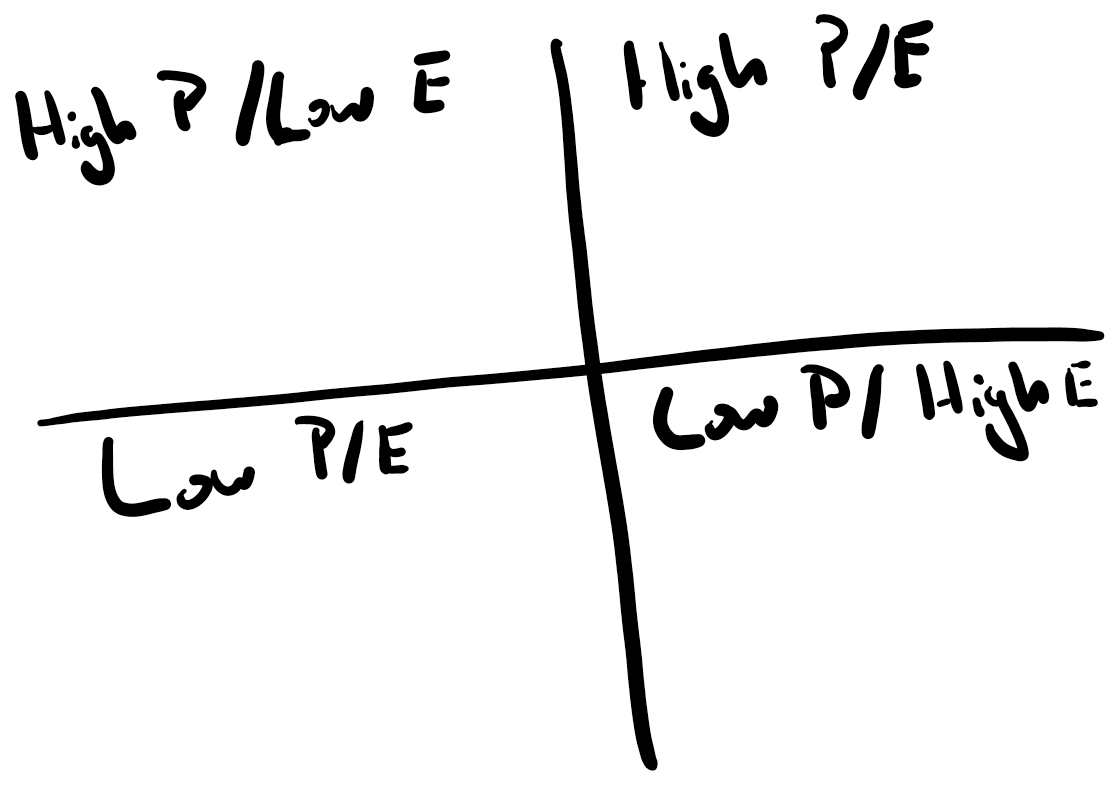

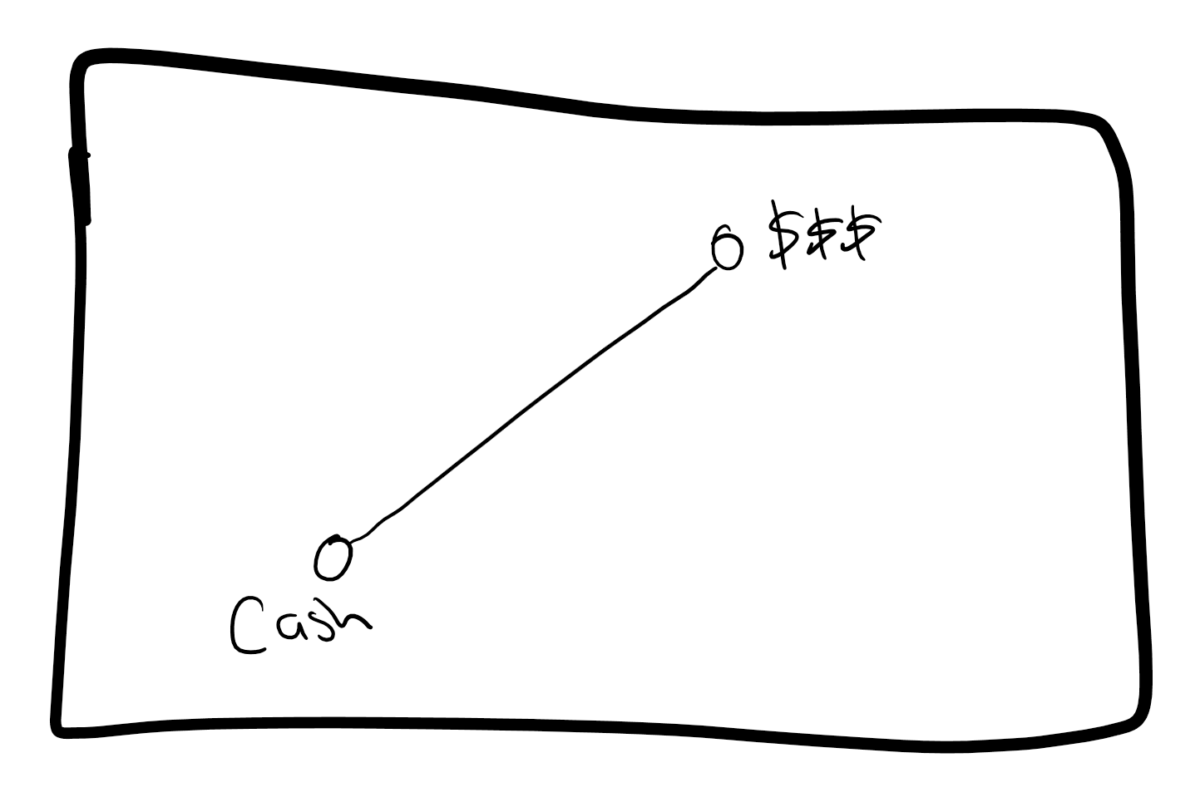

High Enjoyment and High Profit

Recently, at the suggestion of Arlene Moss, we conducted an exercise. The exercise is simple: Divide your clients into four quadrants, high-profit high-enjoyment, low-profit high-enjoyment, high-profit low-enjoyment, and low-profit low-enjoyment, as you can see above. The idea behind the exercise is multi-faceted. First, that the exercise should give you an idea of “what to do” with clients who fall into …

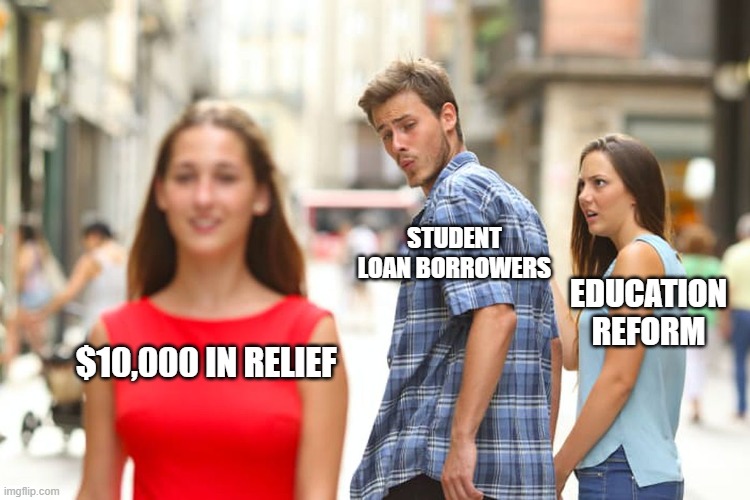

Student Loan Forgiveness

Well, it’s official. As of last Wednesday, the Biden administration has come out with an executive order to slash student loan debt. While it remains to be seen whether the order will make it through implementation or whether lawsuits threatened by the GOP and others will somehow stop this, at present, the proposal has some clear points to it and …

Knowing Your Budget – A Step By Step Guide

Hello there! This week we’re providing you with directions on how to perform your own step-by-step budget analysis! This is less of our usual general education and more of a recommended exercise to get your arms around where your money is really going. Without further ado, let’s jump into it! First, The Data This exercise is best completed through the …

Recession Impact 2022

Reading last Thursday’s WSJ headline: “U.S. GDP Fell at 0.9% Annual Rate in Second Quarter,” I had the brief flash to Fiddler on the Roof’s song “Tradition,” save that the titular chorus was replaced with “Recessioooooooon!” It’s official, the US Economy has entered the definition of a recession. Yet with a recession officially on the books, you might note that …

PTE 2020-02 Misses a Major Point

I’m consternated. For anyone who reads my normal weekly content, this may or may not be for you. This is more of a complaint or concern than an educational piece, but it’s one I feel a need to voice. This year, “Prohibited Transaction Exemption” or “PTE 2020-02” was released, giving guidance to financial planners and advisors about how they needed …

First Impressions

I’m an extremely passionate advocate for the value of financial planning. I’ve written a book on starting a career in financial planning, am halfway through a doctorate in financial planning, and serve on regional boards and national committees for multiple financial planning organizations. It might surprise you then to know that I had a terrible first interaction with a financial …

Reducing the Cost of YOUR Healthcare

Here’s a simple experiment: The next time you buy any good or service that isn’t clearly labeled with its price, ask what it costs. For example, if you go to a high-end restaurant and they list cocktails without prices, ask the server what it costs. They will likely know immediately or be able to check out the price quickly on …