Odd title for a blog, I know, but bear with me for a moment. Let me place a hypothetical in front of you: You run a business with a traditional progression path from entry level to intermediate level to advanced level, and finally onto executive or management roles at the top of the career ladder. Like most organizations, your company is built up in a pyramidal hierarchy: There are more advanced people than managers, more intermediate people than advanced people, and more entry-level or early-career folks than intermediate people.

With this obvious hierarchy in place, you’re presented with an opportunity: Technology has sufficiently advanced for you to eliminate the lowest tier altogether, thus saving you not only the related payroll and benefits costs, but also the costs of training and developing the people in that tier and improving overall efficiencies to boot! So here’s the question: Do you take that deal?

That deal has existed many times before and in many industries. How often do you go through a self-checkout instead of letting a clerk ring up your purchases at a Target or King Soopers? Do you gravitate to the self-service kiosks at the airport to check a bag or do you stand in line at the counter for the one clerk working behind the counter? How many of us are even answering our own phones instead of letting everything go to voicemail and then reading the voicemail transcript or otherwise letting a voice response unit filter out the robocallers and spam calls we get? It seems like an asymmetrically good idea to take advantage of the opportunities to automate away these rote or otherwise unremarkable positions.

But what does that do to the future opportunities of those who come next? This week, we’re exploring the financial ramifications of what happens when the most competitive job markets are not at higher levels but at entry levels, and further, what the downstream impacts of a world with fewer entry-level opportunities looks like.

Disintermediating “Grunt Work”

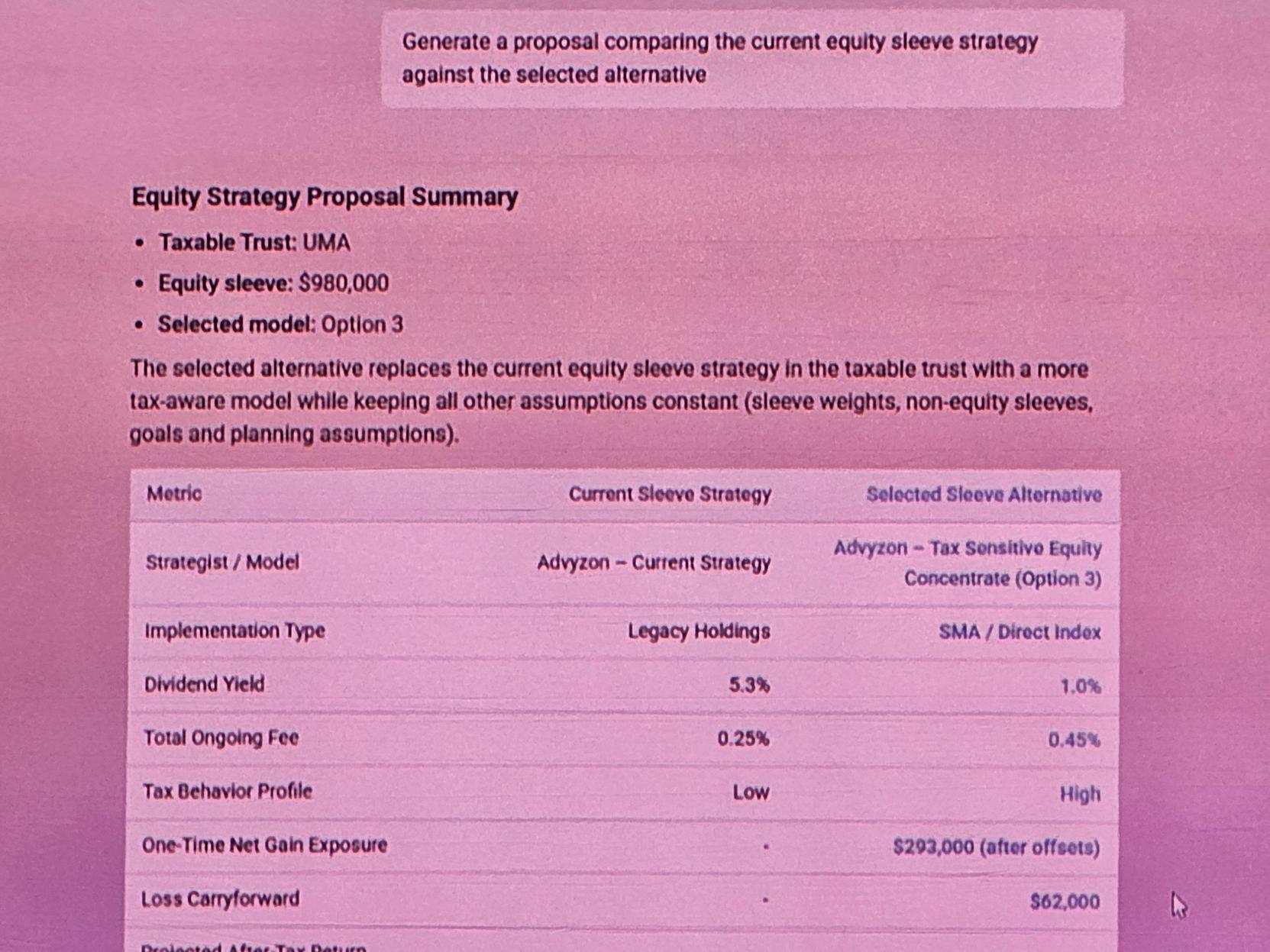

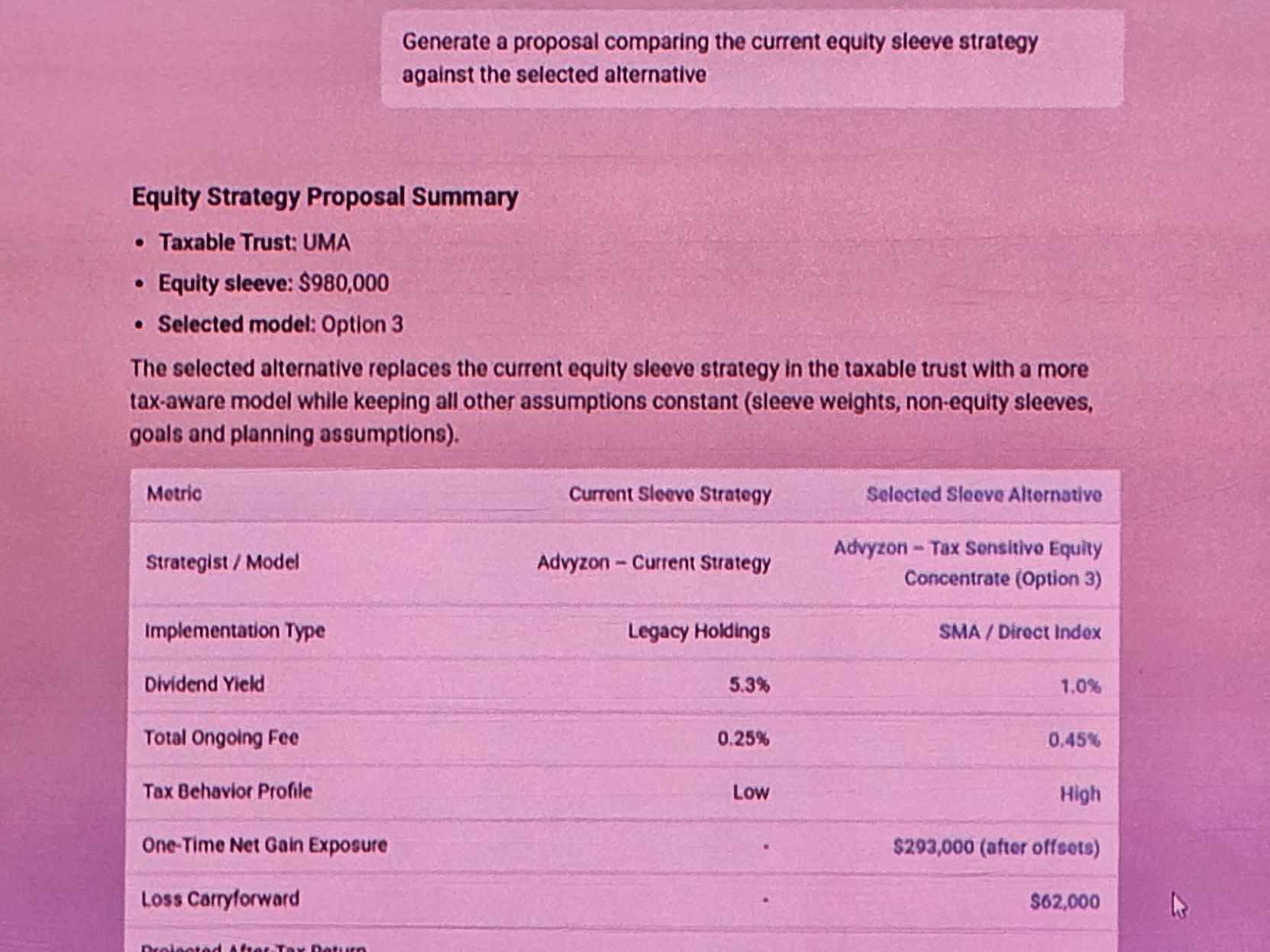

For the past several years here at MY Wealth Planners, the team undergoes a ritual process. We pull up every comprehensive financial planning client’s profile and planning data: their accounts, their transactions, their taxes saved and incurred, their income and expenses, the notes we’ve taken throughout the year in our ongoing conversations with them, the whole bit. We then proceed to refine that mass of data into a clean 3-5 page letter, reporting what it is exactly that we’ve been doing for them and gotten done in the prior year. This is, traditionally, an entirely manual process.

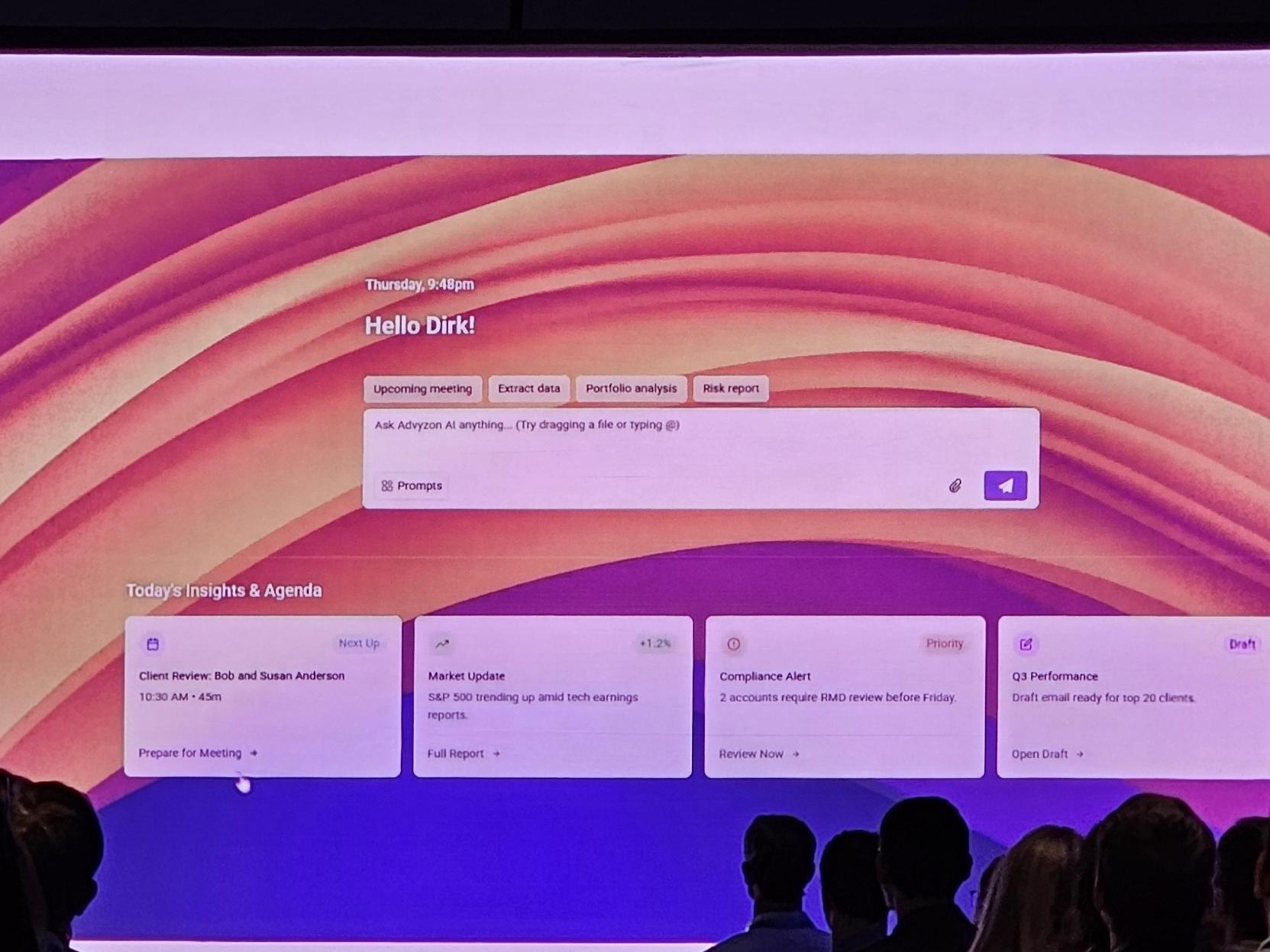

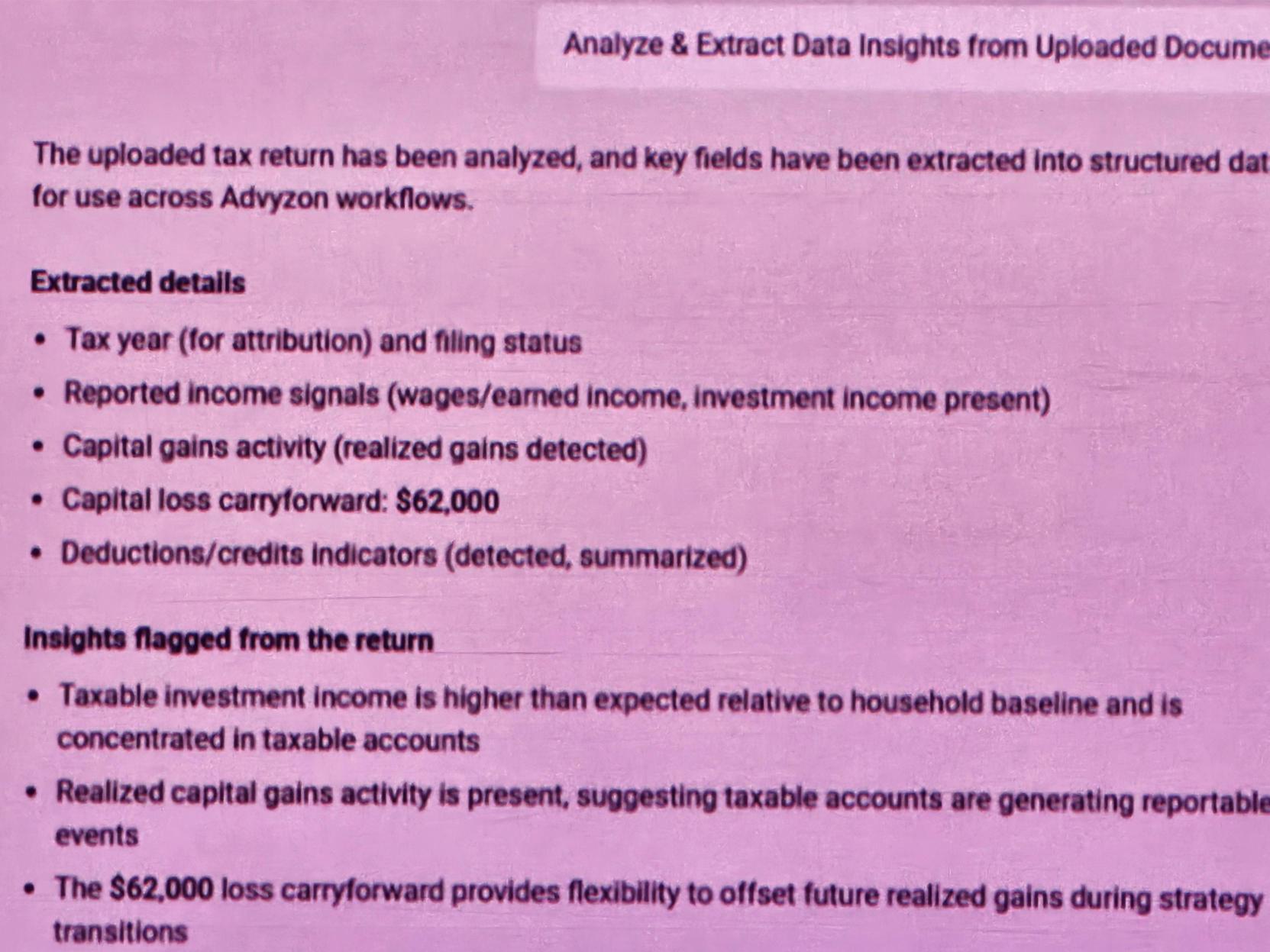

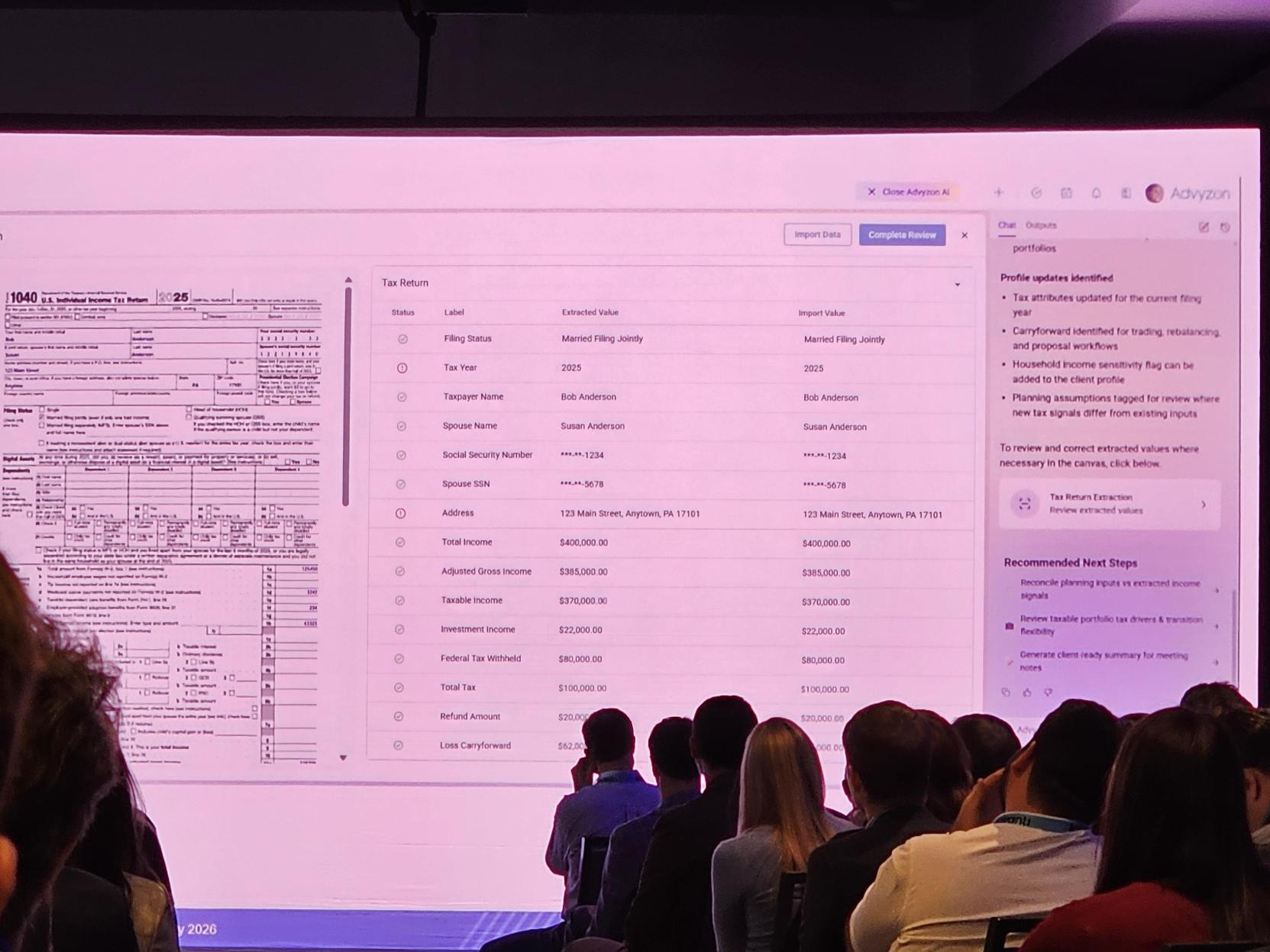

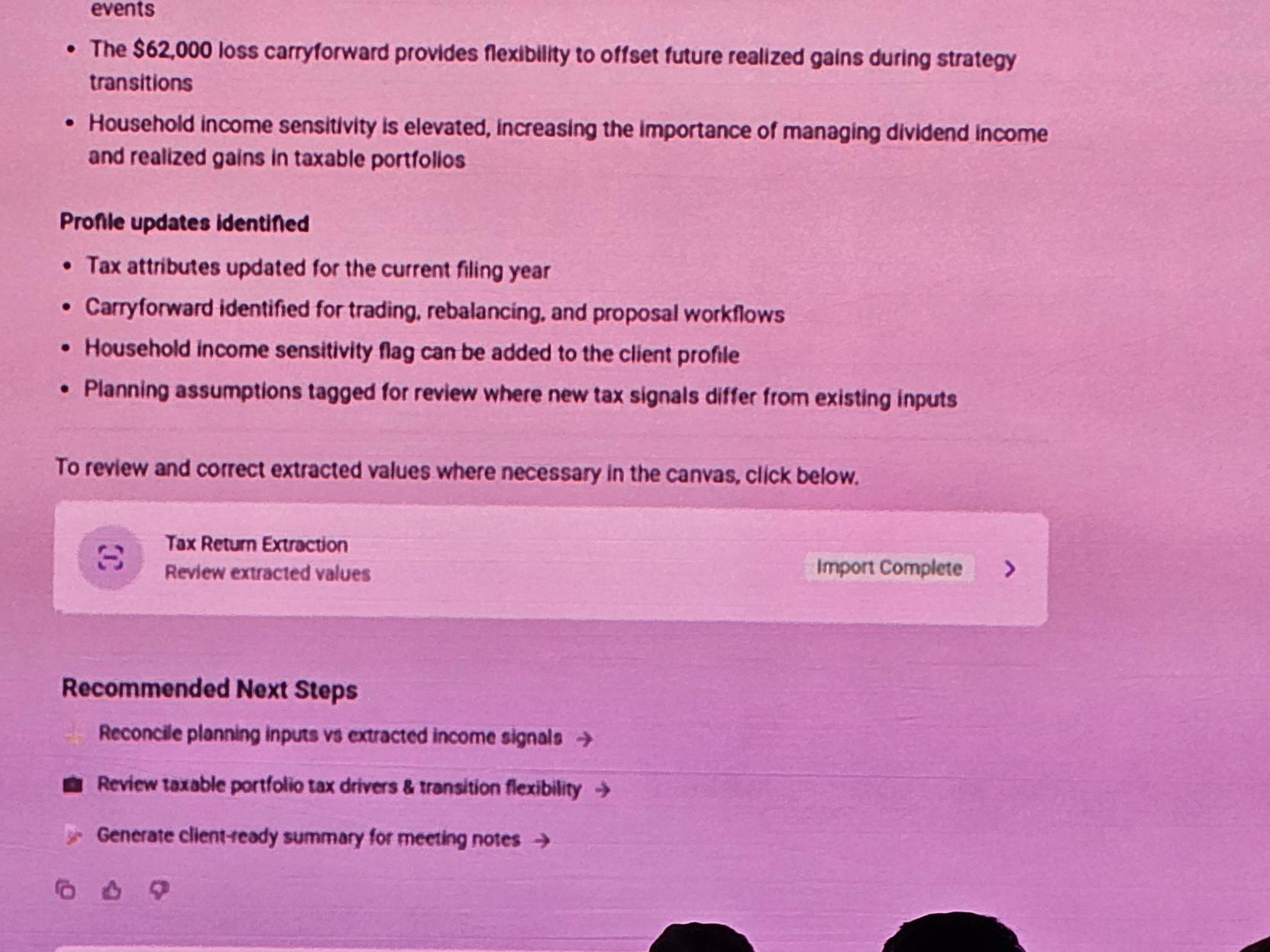

I’m presently writing this week’s blog from the Advyzon annual conference. Advyzon is our core tech system, combining client records with investment reporting, billing, notetaking, just about everything you can think of that we do either lives in Advyzon or has a close relationship with it. The relevance of my location at the conference is that they’ve spent a good part of the morning demonstrating their upcoming internal AI tool which will convert natural language inputs into refined reports, prompts for action, and task workflows that will remove an enormous amount of manual input on our end.

Click arrows to see other examples. Apologies for the quality, these were taken zoomed in 24x from about 300 feet away from the screen.

So, what has been a ritual exercise of junior team members consolidating and sorting through all of a client’s data for the year to produce such reports might be replaced by a simple prompt next year: “Generate annual wealth planning report for all comprehensive client households in separate PDFs including only action items from 1/1/2026-12/31/2026.”

Now, return to the earlier hypothetical: This seems like a great opportunity to save our junior people from being grocery baggers of our work product for the last year. But this “Grunt Work” has served an important purpose historically: Giving team members a “wax-on wax-off” experience to review every client household, learn details about their situation and planning objectives, and to be immersed in the common strategies and financial planning issues we help our clients with.

Apply the same technological advancements to other common tasks such as note taking, report generation, and client issue handling. In a world where any and all of these may soon be automatically handled, how does one provide such Mr. Miyagi-esque wisdom to their team members, sans the grunt work that gives them a foundational understanding of what it is that a financial planner can do for their clients?

Expand the notion to other fields

This isn’t a unique problem to financial planners. Hospitals and medical networks have been adopting AI tools as rapidly as possible for everything from note taking to patient scheduling. Big national accounting firms have been outsourcing work overseas to reduce staff overhead for so long that they’re chomping at the bit to outsource India to Indian server farms. And what Lawyer doesn’t dream of having an AI assistant so efficient at legal research that they don’t have to supervise a team of assistants and paralegals to get the same work done?

But this creates a problem. Remember the pyramid from before? Those entry level and starting roles were the foundation of the organization. So take all the entry level roles and do away with them (or make your organization so efficient that it and every other one like it only needs 1 person for every 10 it used to need), and ask the question: When it comes time to grow the intermediate ranks, how will we find people with the experience?

Put more directly: If we can use technology to get rid of all the things done by people with 0-2 years of experience, where will we find people with 3 years of experience 3 years from now?

This is a problem. A good problem in a certain sense, but still a problem. If you haven’t noticed, in the United States we’ve had steadily more exacerbated social unrest. In large part because the haves have gotten more and the have nots have gotten less. We’ve outsourced jobs, made manufacturing more efficient and otherwise offshored enormous portions of what was once part of the agricultural and industrial economy in favor of a service economy. And if you were ready to pivot into that, terrific; but otherwise, this has left an enormous barbell of those who figured it out and others who (often through no fault of their own), got left holding an empty bag.

Committing to the Next Generation is a Business Problem

Over a year ago, I submitted a question to the “Kitces & Carl” podcast, which discusses financial planner issues. The question was: “Do financial planners have an obligation to bring on the next generation?” And the chilling but honest answer was: “No.” They articulated it in far more detail, but the simple answer was no. The core problem at the heart of all businesses is that they need to hire people not out of the goodness of their heart, but because those people perform a valuable service at the company that the company can then reasonably invest in paying them for.

We’re faced with the same problem writ large across many professions and industries: If you don’t have to hire entry-level people, and invest in training and developing them, why would you? Particularly if the cost to the business is greater than the value received? Thus, it’s a business problem that entry level employees not only have to be exceptionally valuable, or that otherwise they (without any experience) must somehow invent a way to be valuable. Ironically, this makes the old-school “eat what you kill 100% on commission model” strangely viable in a world that has otherwise steadily shunned that model as exploitative into the darker corners of the professional services world.

Deliberately “Planting” Grunt Work

So what is the basic business case? Well, simply put, it’s to go ahead and grow your talent instead of competing it for. Well before the advent of AI to replace all of us, I was giving presentations at industry conferences pointing out that almost everyone in the financial planning world wants to hire CFP® Professionals with 4-5 years of experience; the demand when I first started tracking this problem was about 20:1 for these CFP® Professionals vs. the entry level roles out there. You can all do basic math, so you can naturally see that there’s a problem with trying to hire more professionals at a certain experience level than are even entering into the business; and the result has been enormous inflation of planner compensation over the past decade or so. Meanwhile, it’s the same handful of firms that are doing most of the hiring (into either cubicle farm call center roles or sales jobs), and the rare few “best opportunities” lie in the smaller firms providing salaried and stable starting positions.

Therein, I would argue, is the business case. Any small, medium, or large business can be known as a place where people get their start. Where even though they use the technological efficiencies of the day to make all of the work easier, they still take seriously the importance of apprenticing the next generation of talent, because in turn, they will be seeking to hire or retain that talent within the next few years.

What does that mean for the entry level folks looking for opportunities? Simply put: Dig in. If I have a critical observation of my students over the years I taught investments and retirement planning at CU, it was that every class had a minority of 3-4 exceptional students taking it seriously, and the rest were essentially there as if being in the classroom was somehow the only way to get a grade; checked out but for their literal presence in the space. Yet, as time wore on, that same checked out group became replaced with people interested in “gaming” college, insofar as they were willing to do anything to get the grade they wanted except for actually learn the content. Meanwhile, the same core 3-4 exceptional students not only learned something in class, but were going to demonstrably be able to do something with that knowledge when they graduated.

In a world where hiring “entry level” may soon be a luxury good to a firm or an act of altruism, it will become all the more important to take the “rare” opportunities to perform “grunt work” all the more seriously. There may not be many opportunities left, after all.

Dr. Daniel M. Yerger is the President of MY Wealth Planners®, a fee-only financial planning firm serving Longmont, CO’s accomplished professionals.