It never fails that investing lives in a perpetual Schrodinger’s Box of reputation. Investments simultaneously are too risky and also the reason billionaires exist. The market is equally “overpriced” and also “losing too much to buy into right now.” Cash is “safe” yet loses a guaranteed percentage of its value every year. On and on, the paradoxes of an investment …

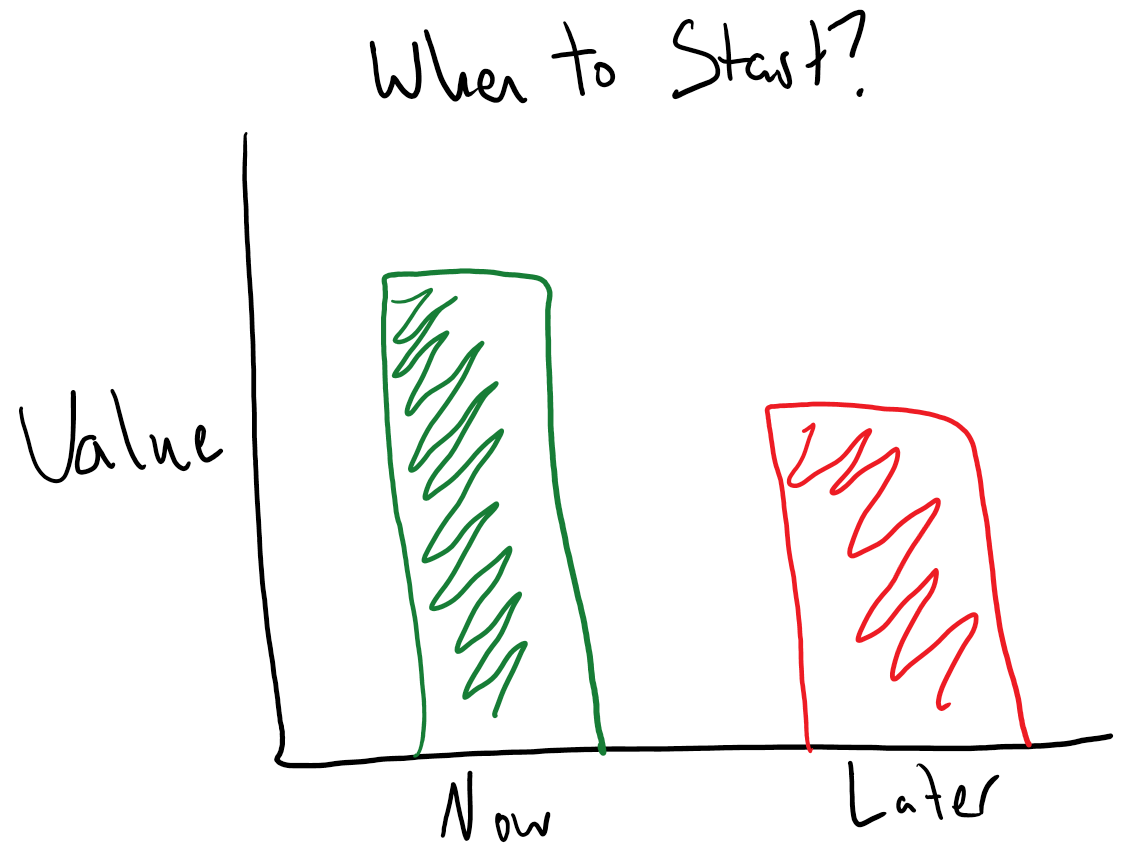

Financial Stress and Time in the Markets

An acute observation in psychology is the effect of stress on human beings. Studies on soldiers during war show that they can handle the stress of combat for only up to about 60 days straight before they reach total psychological catatonia. Even those not in that pinnacle stressful environment can experience anxiety, depression, digestive problems, headaches, muscle tension, heart disease, …

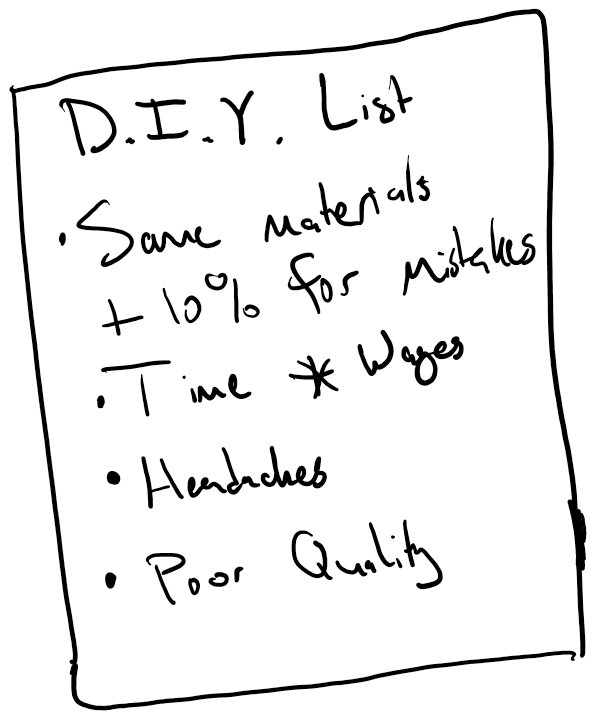

Being Cheap is Expensive

There’s an old expression amongst professionals: “If you think paying for service is expensive, just wait until you see how expensive doing it yourself is.” The premise of the point is simple: Many people do not respect the time, energy, and effort that go into a professional’s services. Not only the service as someone receives it but also the education …

Fair Pay for Fair Work

Recently a client raised a question about the assumptions of their financial plan. “It has my income increasing by inflation every year, but in another year I’ll hit the top of my pay band, and raises will stop unless I go into management when I’m not planning on doing.” This was a major red flag for me for a number …

Colorado Perks

Colorado is a great state. We all know that at a fundamental level, with a high quality of life, high incomes, a beautiful natural landscape, and a vast number of activities and hobbies available for everyone to enjoy. While the lifestyle and recreation are beneficial, there are a couple of other perks to living in Colorado that we probably don’t …

You Should Never Invest Your Money

Because of the compliance regulators that be, I have to take the fun out of this by saying that this is satire, intended to make a point. You absolutely should invest your money as appropriate to help fund long term goals, preserve the value of capital, and to compliment a broader financial plan. With that out of the way… Invest …

The Hidden Cost of College

It is regularly observed in our public discourse that the cost of higher education has risen astronomically over the past several decades, outpacing inflation by a factor of three. Yet, with the increase in cost to higher education has come an increase in access to higher education. Approximately one in three Americans hold a college degree, and while it’s argued …

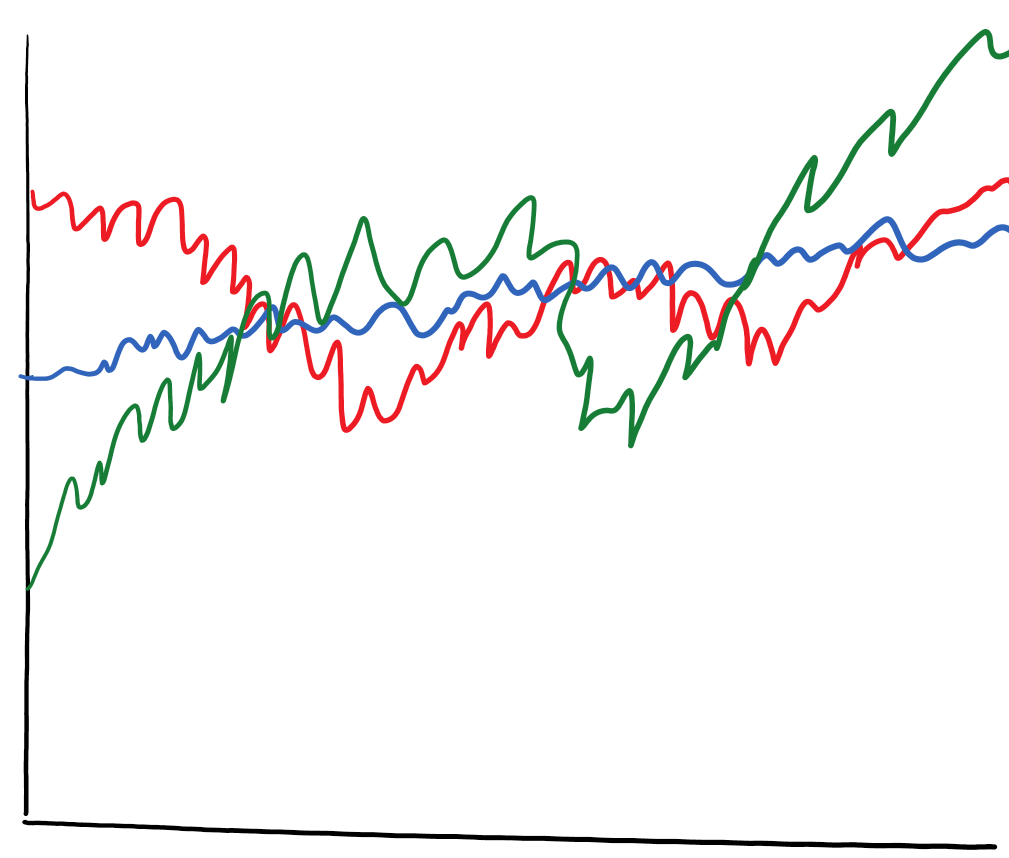

Understanding Indices

As a financial planner, I’m essentially bound to watch the news on a day-to-day basis. Tongue in cheek, the writer, Carl Richards, likes to call financial news “financial pornography.” This largely derives from the fair observation that most financial news is engineered to drive clicks and eyeballs for advertising revenue, rather than to provide any realistic or valuable insights about …

Why I Wrote the Book

If you read our email over the weekend, you know that I published a book, that was ranked as the #1 New Release in Wealth Management on Amazon! That said, the book is not targeted at our clients, nor is it an investing or personal finance book. So why did I write the book? First and foremost, the reason is …

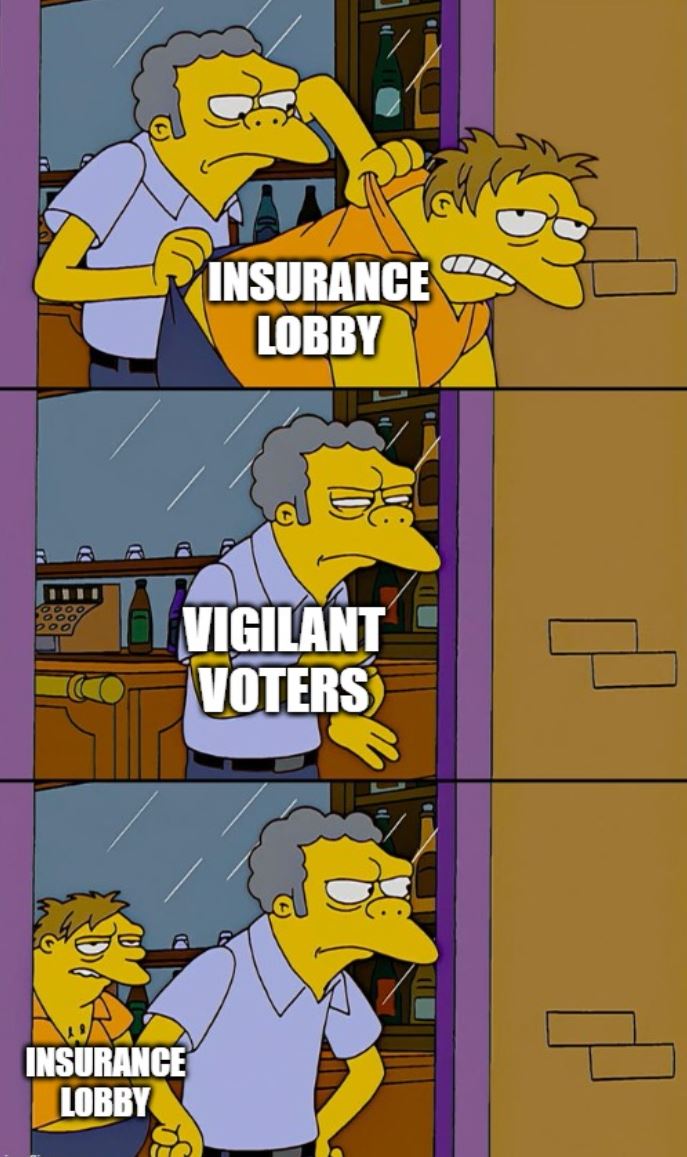

The Insurance Lobby Strikes Again

The LIFE Act has nothing to do with life. In fact, the acronym for the act is supposed to stand for “Lifetime Income for Employees Act.” H.R. 8990 was introduced by Congressmen Norcross (D) and Walberg (R). The bill is simple, less than five double-spaced, 2-inch margined pages that propose to amend the Employee Retirement Income Security Act of 1974 …