Like most obsessions, my obsession with saving didn’t start with saving or as an obsession. In fact, to go back in time a few years, you’d think I had an issue with money avoidance. Today I wanted to take some time to trot down the personal path and share how it came to be that I effectively deploy over 40% …

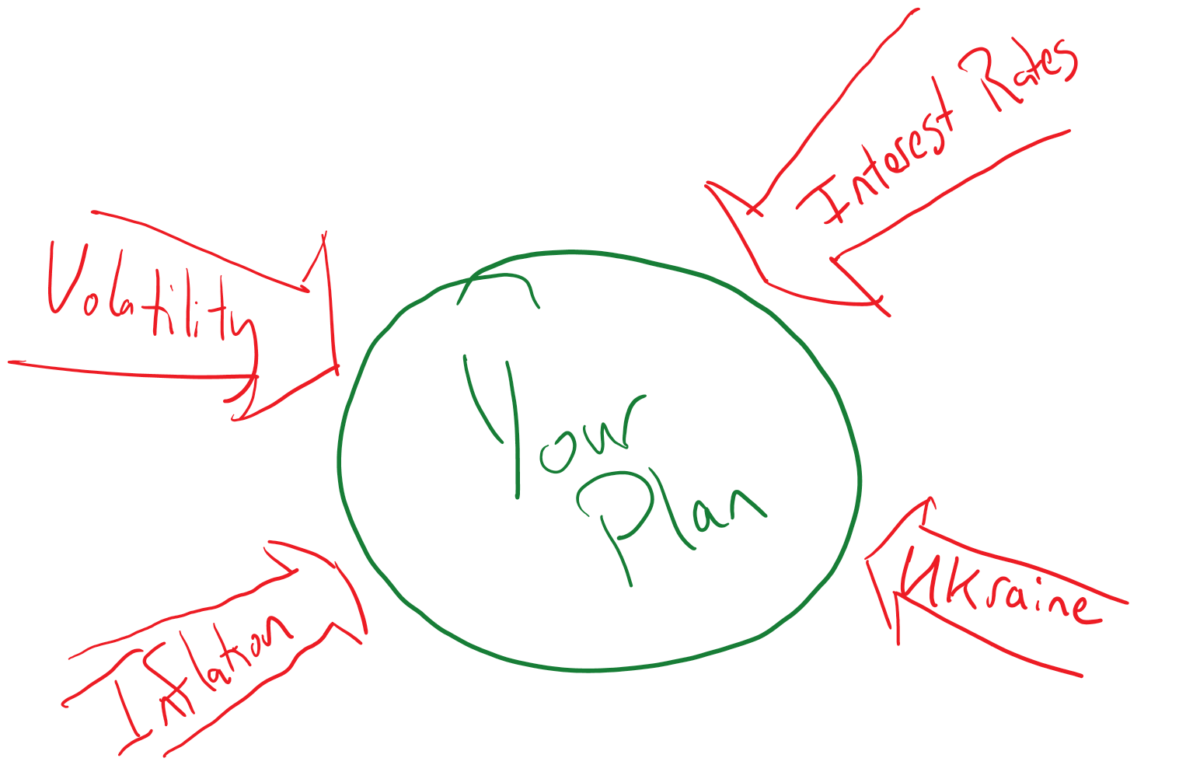

Thriving During a Market Correction

At the battle of the Chosin Reservoir in the Korean War, the Chinese and North Korean armies surrounded the United States Army X Corps and First Marine Division with over 120,000 troops. The winter conditions and a cold front out of Siberia sent temperature plunging as low as -36F, causing blood and plasma supplies to freeze, and injuring thousands of …

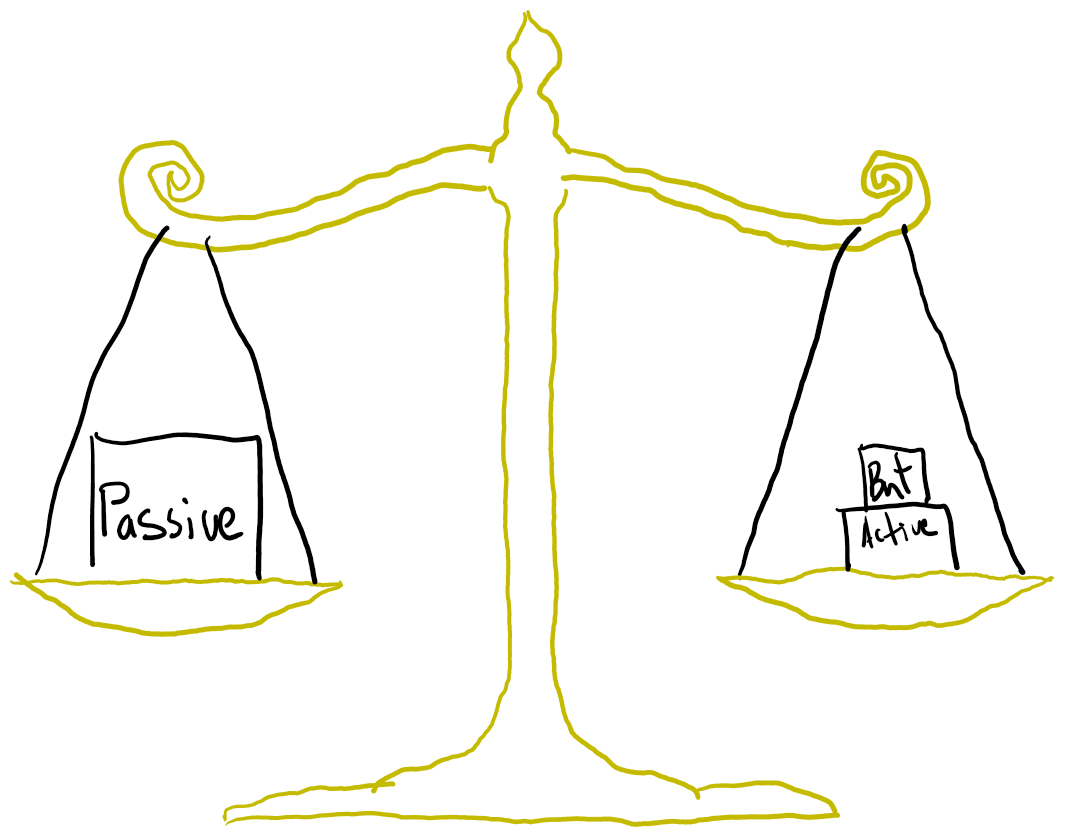

Compromising Active vs. Passive

Our firm is a passive investment management firm. Literally, every investment we select for clients is an index-based exchange traded fund that tracks a benchmark such as the S&P 500 or a bond index. We do this for a number of reasons: first, the research shows that the majority of actively managed investment products fail to outperform their benchmarks over …

Stepping Off the Tracks

A common question many clients have had over the years as they’ve asked us to take on managing their investments is “how do you manage my money?” Our answer to this for many years has been that we use a long-term focused strategy, accomplished through the use of low-cost passive index funds. A caution we give on a regular basis …

Protecting Your Castle

On New Year’s Eve we saw an enormous fire that destroyed over a thousand homes and businesses in Superior and Louisville. Concurrently, every insurance agent I know is working around the clock to process claims and get their clients taken care of in the face of such an awful catastrophe. While I can’t go back and coach anyone who suffered …

Square Pegs and Round Holes

Compensation by its nature is one of the most important and yet most taboo topics in our society. Despite the well-accepted fact that if everyone talked about money more, we’d likely all be doing a bit better by the simple merit of having more information in our salary negotiations and price discovery, we tend to keep our numbers close to …

Education, Public Markets, and Private Markets

As paradoxical as it seems, the wealth gap is not increasing in the United States. Not in any meaningful way, at least. While not a month passes that we don’t hear about a billionaire who barely paid any taxes, or another that has accrued billions in a tax-free account, the fact of the matter is that wealth in the United …

Sick Leave and Backdoor Roth Closures

This week we’re taking a break from our normal business of writing about one issue at length to talk about two issues in shorter form. Two things come into effect on the 1st of the year, and it’s noteworthy that while one is already law, the other is making its way through Congress at the moment. We’re talking about Colorado’s …

The Best Interest Trap

Last week, investment giant Vanguard announced they would begin offering personal advisor services (“PAS”) clients their proprietary actively managed funds. This was a major shock across the financial industry where Vanguard is famous for their passive index investment options and a founding philosophy focused on the low-cost capture of the market’s movements. The stated rationale for this default selection is …

The Difficulty of an Investment Process

Speculation is in vogue right now and it’s the dearth of realistic thinking that drives it. Whether it be calls to invest in dog-based cryptocurrencies or special purpose acquisition companies (SPACs) being used to dodge SEC disclosure requirements for initial public stock offerings, you can’t take a single step in the financial world without bumping into someone who is excited …