In the United States we have several measures of financial literacy, and to be frank, none of the numbers look good. Less than one in four Americans is literate in risk management (insurance) terms and only three in five can accurately describe how a loan works. Over half the population would struggle to pay for a five hundred dollar emergency …

Tax Shelters and Tactics for 2021

With a new year comes many new things: resolutions, car models, and of course, tax rules. In late December, Congress passed a stimulus package that also included a number of tax provisions that apply to many people in 2021. As financial planners, “Tax Alpha” is one of the most powerful tools at our disposal, and when providing financial planning, it …

A Few Good Policies

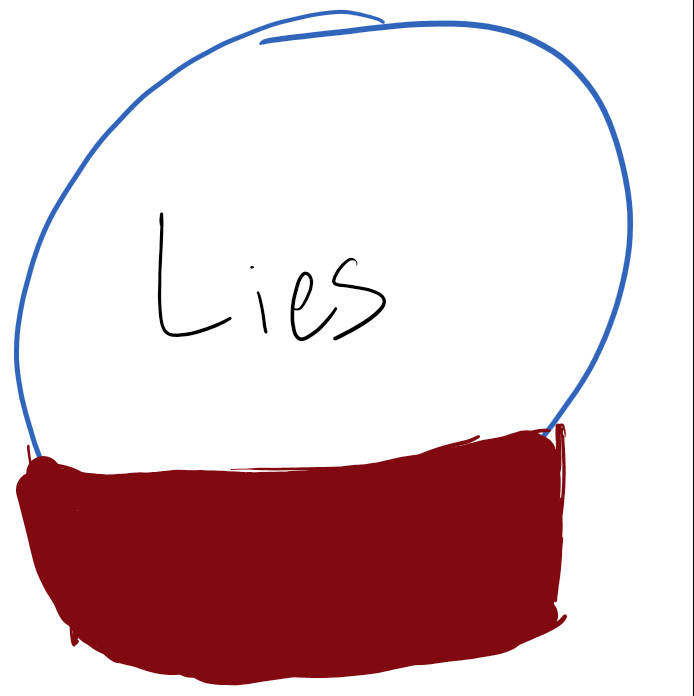

As promised, I come with post-Christmas-pre-new-years good tidings of the few decent use cases for permanent life insurance. Let me just get the facts out of the way: These conditions are rare and are unlikely to apply to you. If they do happen to apply to you, terrific, you should approach the purchase of life insurance with great skepticism and …

The False Promise of Life Insurance

I have a permanent variable universal life insurance policy. I had it written and issued on my life in December of 2018 for two specific purposes: To protect my partner against the financial loss of my death. To fund my potential need for assisted living in my later years. Respectively, the life insurance policy provides a significant death benefit that …

The Cryptocurrency Mirage

Not a week has gone by in my professional career as a financial planner that someone hasn’t asked me about bitcoin or another cryptocurrency. “Dan, what do you think about doesn’t-actually-exist-coin*? I hear people are making millions.” And it’s true. Some big names have come out to celebrate their investment in cryptocurrencies, some well known, some far off the radar. …

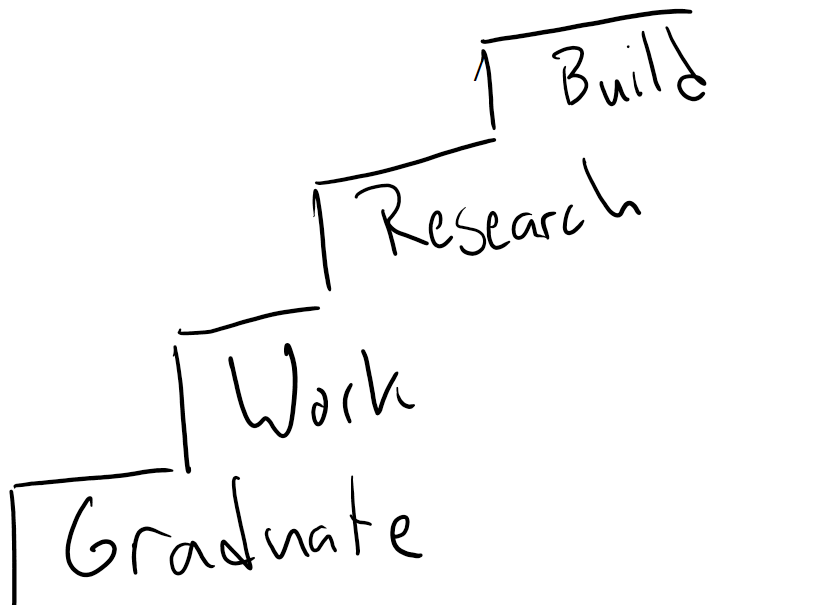

Simple Steps to Building Wealth

At the heart of the financial planning process is a philosophy and belief that, with enough time and the application of the right tools, financial independence and the accomplishment of life goals are accomplishable by anyone. However, financial planning is often a service engaged in by people who’ve already demonstrated significant financial capability: adults with careers, decent savings, and accumulated …

I Didn’t Need a Crystal Ball

Back in June, I wrote a piece called “Best Interest Root Canals”. Effective on June 30th, Regulation BI (“Best Interest”) became effective law in the United States, requiring that all registered brokers and investment adviser representatives in the United States make recommendations “in the best interest of the client”, despite entirely failing to define the term best interest or put …

Transparent Compensation

All too often, when you read job posts they look like a list from a hostage-taker, where the demands of the role are laid out in long bullet-pointed lists of ideal qualifications and the tradeoff is a vague reference to the career tier the position is intended for. “Must have 5 years experience, skills including X, Y, and Z, and …

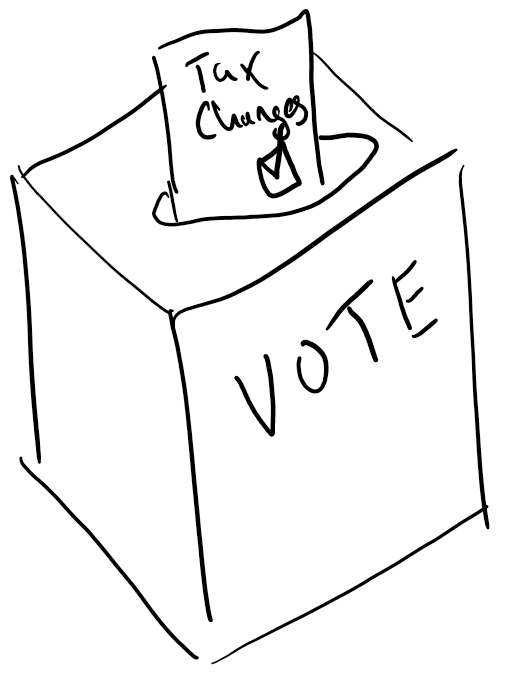

Colorado Election Results

While the presidential election is still yet to be decided, Colorado has finalized several ballot measures based on voting proportion while others remain undetermined. Based on where things sit, today, we’ll address the impact of measures that have passed (or are very likely to) and how that will affect your finances in the future. This is important for financial planning, …

You Get What You Don’t Think You Pay For

“If you’re not paying for it, you’re the product.” -Unattributed This expression has come up in popularity over the past several years as the public has become more aware of the business model of popular social media platforms such as Facebook and Twitter. As the public learns that these companies are effectively large advertising platforms designed to target them directly, …