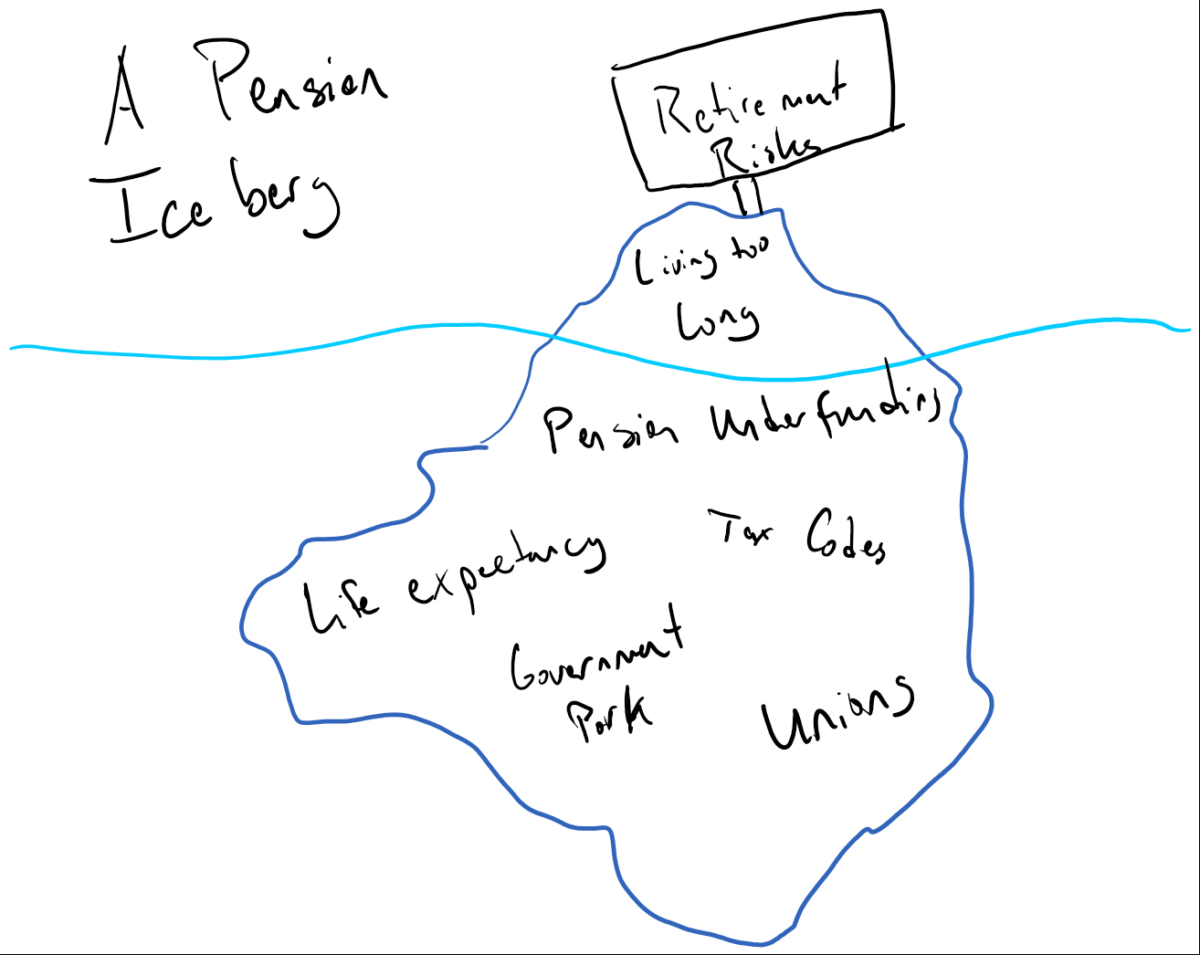

In the United States, we have a national pension and disability insurance system called Social Security; you may have heard of it. Originally established in 1935, social security started as a safety net to provide the elderly, widows, and orphans with some form of supplemental income. At the time and since that time as the program has developed, the concern …

This Time It’s Different – Why I’m a Boring Investor

It was exactly one year ago when my phone rang. It was a client out in California, and the S&P 500 index had just shown a slide of over 11% in the proceeding five days. “Dan, don’t you think we should get out now? It’s getting kinda scary.” He said. “No; this is what asset allocation is for. We have …

Death and Taxes

There’s an old saying from Benjamin Franklin: “…nothing is certain but death and taxes.” Charmingly dour as the sentiment is, he’s not wrong about that when it comes to your financial affairs and the handling of your assets when it comes to moving on from this life. As a nation, we’ve experienced a disproportionate amount of loss in the past …

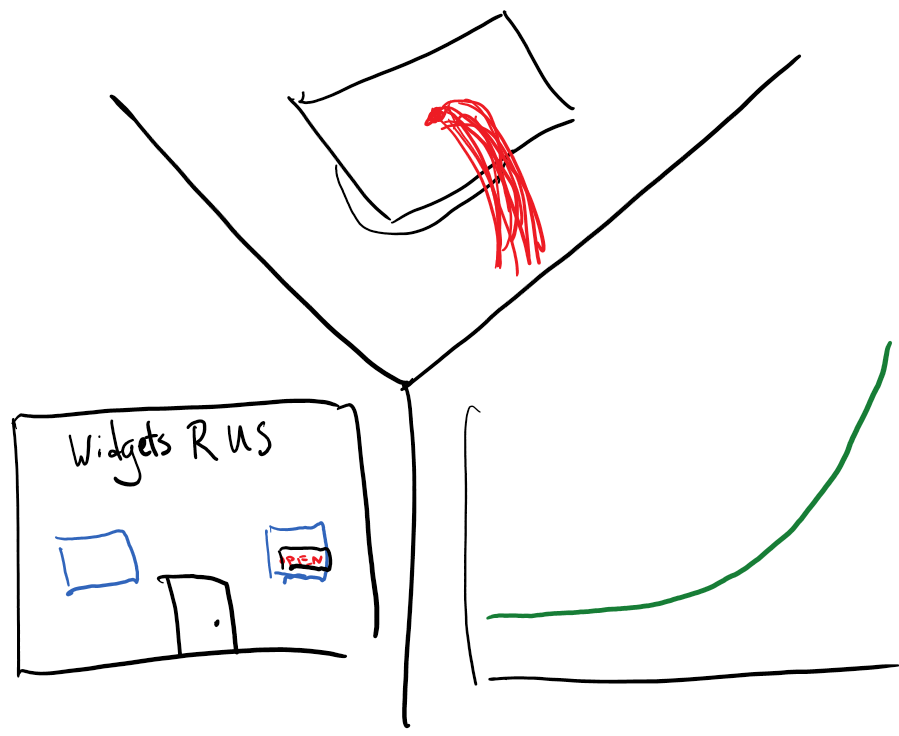

Becoming a Millionaire Next Door

According to a fair bit of research and just plain anecdotal evidence, there are three controllable paths to becoming a millionaire in the United States: work in a high-paying profession, save and invest consistently over time, and own a successful business. While some smart aleck is likely to come along at this point and say “be born with rich parents”, …

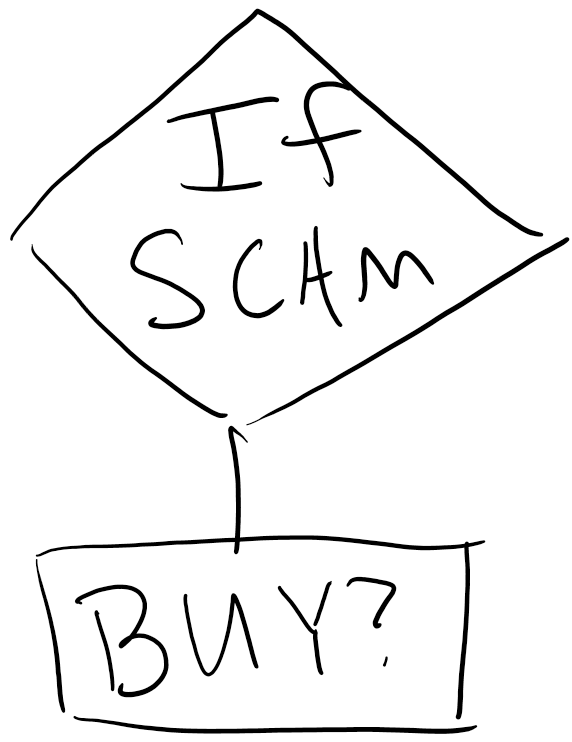

The Making of a Ponzi Scheme

On February 4th, the SEC charged three individuals and their investment firm, GPB Capital, with running a Ponzi scheme in the amount of $1.7 billion dollars. For scale, the Bernie Madoff Ponzi scheme was $64.8 billion, so while this scheme did not reach such a significant size, it is still the largest Ponzi scheme accusation made since Madoff’s conviction in …

The Games Won’t Stop

If your experience with the markets lately has been an entertaining, if confusing one, you’re not alone. Last week, the market had another “never before seen” event, after members of the website Reddit banded together to buy as much Gamestop stock as they could afford. Reporting has been mixed regarding this, but there have been several constants. Most importantly, if …

On the Morality of Stock Buybacks

In 2020 stock buybacks came under attack, and it was no surprise. The public was outraged to learn that airlines had collectively engaged in over $25 billion dollars in stock buybacks over the past decade. “How can companies making that much money suddenly not have the cash to operate?!” Was the question of the day, and a fair one at …

A Financial Planning Safari

Greetings! Today we’re going on a safari of the assorted beasts and brokers that often can be confused by a layperson for financial planning. Financial planning is a rare and special beast that is still offered by the minority of those calling themselves financial advisors, planners, counselors, coaches, and so on. Within this particular landscape, there are many things that …

The Financial Literacy Crisis

In the United States we have several measures of financial literacy, and to be frank, none of the numbers look good. Less than one in four Americans is literate in risk management (insurance) terms and only three in five can accurately describe how a loan works. Over half the population would struggle to pay for a five hundred dollar emergency …

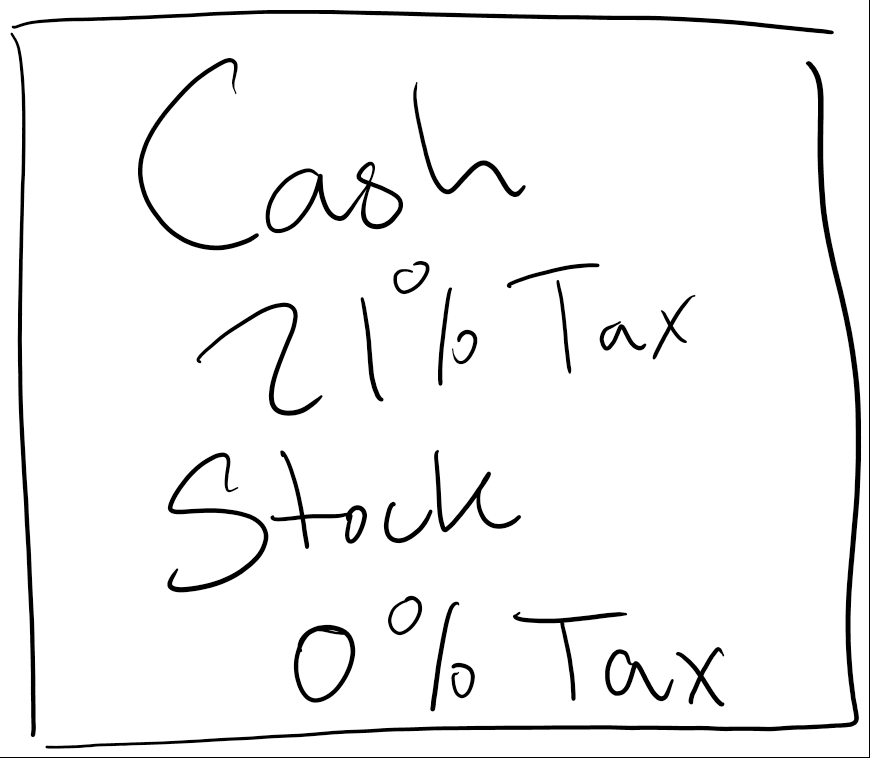

Tax Shelters and Tactics for 2021

With a new year comes many new things: resolutions, car models, and of course, tax rules. In late December, Congress passed a stimulus package that also included a number of tax provisions that apply to many people in 2021. As financial planners, “Tax Alpha” is one of the most powerful tools at our disposal, and when providing financial planning, it …