I’ve opined multiple times over the past few years that there’s a bright future of collaboration and possibly integration between financial planners and tax professionals. After all, both frequently are on other sides of the same coin, and the divide between them often boils down to whether work is being done in arrears (e.g., tax professionals taking what’s already been …

Never Discount

It has been observed in one form or another that the only store in which people will run screaming when a sale starts is the “stock market.” Yet, despite the strange inclination of consumers to flee deep discounts when they present themselves in the world of investments and to only be tempted to buy when prices go up, today we …

Avoiding Career Bottlenecks

It is not uncommon for a financial planner to find that many clients have hit a proverbial “ceiling” in their career trajectory. As we’d observe it, this is seldom because of any limitation in their capabilities or capacity but because of a classic problem: The person on the next rung of the career ladder is happy where they are, or …

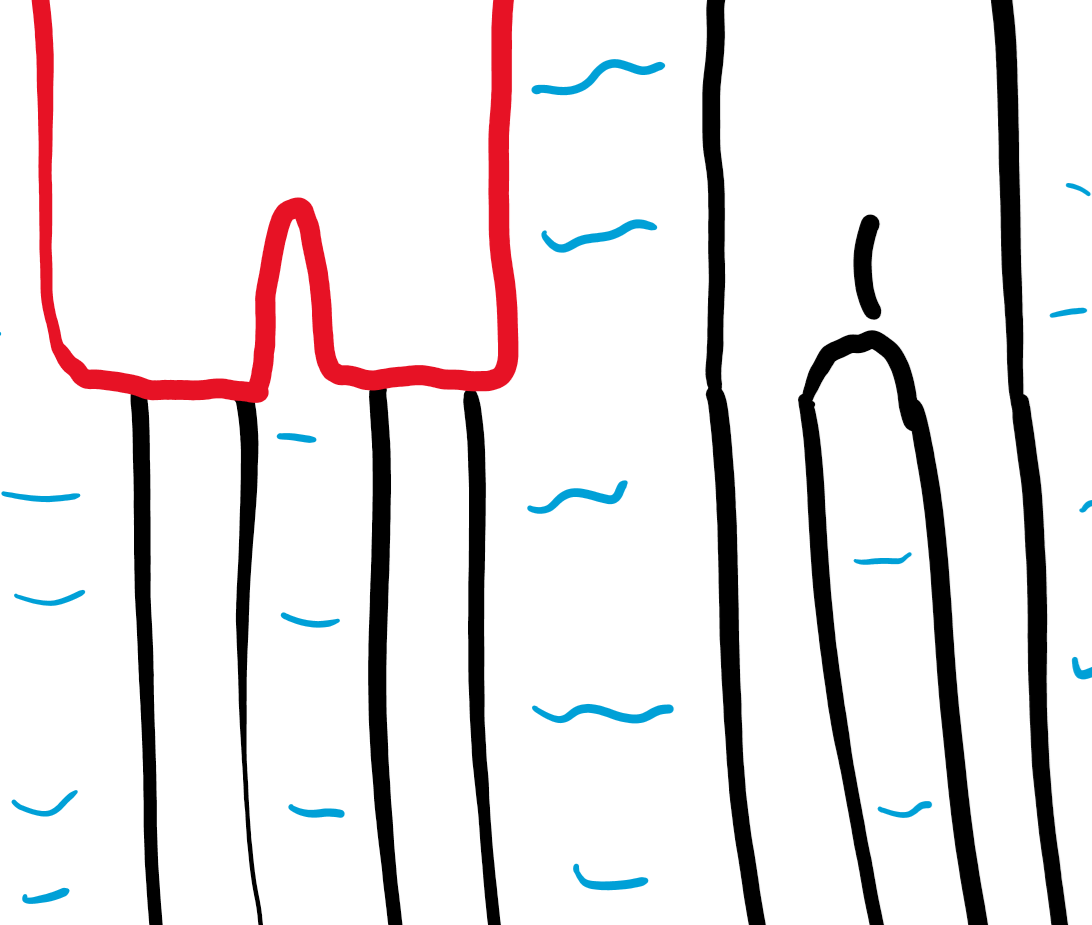

Boulder County Minimum Wage Research

For several months, an economic analysis has explored the possibility of installing a “regional” minimum wage in the Boulder county area, which would technically be implemented as a county-level and city-by-city level minimum wage, including the cities of Boulder, Erie, Lafayette, Longmont, and Louisville. Curiously, as this study got off the ground, a video produced by the research task force …

Who’s Paying Your Planner?

For those who wondered, “What happened to the blog last week? Heck, where was the blog yesterday?” The answer is as fun as it is mundane. Rather than writing a blog for July 30th, I was in Chicago attending the summer leadership meeting for the National Association of Personal Financial Advisors, or “NAPFA,” for which I sit on the west …

The Age of AI?

In 1961, during an Antarctic expedition, Leonid Rogozov came down with appendicitis. While this condition is typically solved with relatively minor surgery, there was just one problem: there was only one doctor on the expedition, Leonid Rogozov. Faced with a choice between certain death or an insane attempt at performing his own appendectomy, Dr. Rogozov chose to live. With a …

The Necessity of Fiduciary Financial Planning

Last week, WSJ reporter Jason Zweig broke the story of Powerball winners who were exploited for millions of dollars in commissions and fees. For those without the time to read the full article, succinctly, a couple won a $180.1 million dollar lottery in 2008 and walked away with $59.6 million after taxes. Shortly thereafter, they started a charitable foundation to …

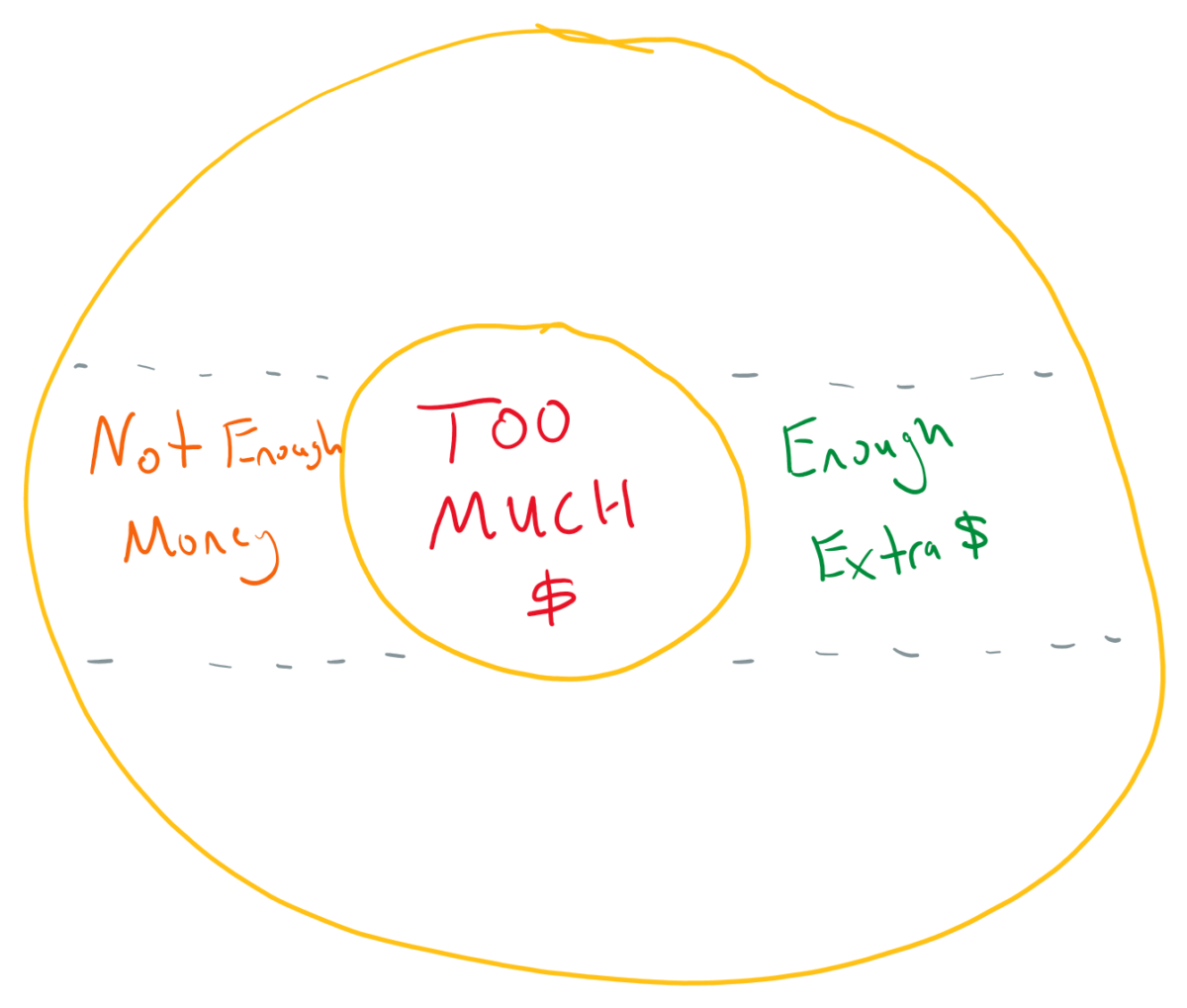

Donut Holes

A common misperception by many about taxes is that if they make too much money, they’ll end up having less money than if they hadn’t made the money. This often arises from a misunderstanding of the marginal tax system, in which incrementally, your taxes increase as your income rises. The misunderstanding then is that if you’re in the 22% bracket, …

The Business End of Fun

There’s a funny thing about entrepreneurship: many people who have successful businesses never thought of themselves as, and to this day may not think of themselves as, entrepreneurs. While this can apply to many common examples, such as those working in the trades as independent contractors, the same thing can often happen to those in more creative businesses. What might …

When the tide goes out

The Oracle of Omaha once said, “Only when the tide goes out do you discover who has been swimming naked.” While the meaning of this colloquialism varies based on who’s quoting it and the circumstances thereof, today we’re thinking about leveraged portfolios. Specifically, the risks of leveraged portfolios and where it’s often considered risky or safe, despite the risks being …